When you’re preparing to sell your company, your 409A valuation history becomes one of the most scrutinized documents in the data room.

Understanding 409A in M&A is essential because buyers don’t just review your financials and customer contracts. They examine every valuation you’ve commissioned to assess potential risks that could affect the deal price or derail the transaction entirely.

Your fair market value history tells the story of how you’ve managed equity compensation. Buyers read this story carefully, looking for compliance gaps that create liability or accounting issues they’ll inherit after closing.

What Is a 409A Valuation?

A 409A valuation determines the fair market value of your company’s common stock. This valuation is required under Section 409A of the Internal Revenue Code for private companies that issue stock options.

The regulation requires stock options be granted at or above fair market value of the underlying common stock. When priced correctly, employees can exercise them without triggering immediate tax consequences.

If options are priced below fair market value, employees face a 20% additional tax on the spread, plus interest and potential penalties. The company may also face penalties for noncompliance.

How safe harbor protection works

The IRS provides safe harbor protection when you follow specific procedures. You must use a qualified independent appraiser, update your valuation annually or after material events, and obtain formal board approval.

Safe harbor means the IRS presumes your valuation is reasonable unless it can prove otherwise. Without this protection, you bear the burden of proving your valuations were appropriate if questioned.

This protection becomes critical in 409A in M&A transactions because buyers want assurance that your historical valuations will withstand IRS scrutiny.

Why Buyers Review Your 409A Valuation History During Due Diligence

Acquisition teams request complete 409A documentation as standard practice in 409A in M&A due diligence. They’re evaluating three specific financial and legal risks.

Compensation expense on their books

Outstanding stock options create post-closing accounting obligations. Each option has a spread between the exercise price (determined by your historical 409A valuations) and the acquisition price.

Under ASC 718 accounting standards, buyers must recognize compensation expense for this spread. Higher spreads mean larger expenses that reduce reported earnings.

Public company acquirers are particularly sensitive because the expenses directly impact their financial statements and purchase price calculations.

Legal liability they inherit

Options granted below fair market value expose both the company and buyer to legal risk. Employees who face unexpected tax penalties may bring claims for damages.

Your 409A documentation demonstrates whether you followed proper procedures. Complete documentation with qualified appraisers and board approval reduces risk, while missing or inadequate documentation increases it.

Buyers often require purchase price adjustments or escrow holdbacks to offset potential claims when they identify compliance gaps in 409A in M&A transactions.

Tax audit exposure

The IRS may audit companies with questionable valuation practices. Red flags include infrequent updates, methodology that doesn’t match your capital structure, or patterns suggesting manipulation.

Buyers prefer to avoid inheriting tax controversies or heightened audit risk during 409A in M&A deals. They view clean 409A practices as evidence of sound financial governance across your organization.

Common 409A Issues That Affect Deal Value

During due diligence for 409A in M&A transactions, buyers look for specific patterns that indicate compliance problems.

Infrequent valuation updates

Companies sometimes delay updating their 409A valuations beyond the 12-month safe harbor period. Material events like fundraising rounds require immediate updates, but some companies continue using outdated valuations.

This creates compliance risk for all options granted during the gap period. Buyers must assess the potential tax liability for affected employees.

Low-cost valuation providers

Some companies use inexpensive online services that provide template reports with minimal analysis. These reports often lack the detailed methodology and supporting documentation that buyers expect.

During due diligence, buyers verify the credentials of your valuation providers. Reports from unqualified or low-credibility providers raise concerns about whether the valuations will withstand scrutiny.

Changing valuation firms frequently

Switching providers multiple times in a short period can suggest you were seeking lower valuations rather than accurate ones. Buyers plot your fair market value progression against your business metrics to identify inconsistencies.

If your revenue grew significantly, but your common stock value barely increased, and you changed providers during this period, buyers will question the reliability of your valuations.

Missing board documentation

Proper governance requires that your board review and formally approve each 409A valuation. This approval should be documented in board minutes with specific reference to the valuation date and approved fair market value.

Missing documentation eliminates safe harbor protection even if the valuation itself was appropriate. Buyers interpret this as weak governance that may affect other areas of your business.

Grant timing issues

Options must be granted after you obtain a current valuation, not before. Some companies backdate grants or use older valuations for convenience.

This violates Section 409A requirements and creates immediate tax liability for employees. Buyers view backdating as a serious compliance failure that could trigger IRS penalties or litigation.

Methodology mismatches

Your valuation methodology should match your capital structure complexity. Simple market multiples work for early-stage companies with straightforward cap tables.

Companies with multiple preferred share classes, liquidation preferences, or complex terms need sophisticated methods like the Option Pricing Model or Probability-Weighted Expected Return Method.

Using an overly simple approach when your structure is complex suggests the valuation may not accurately reflect fair market value.

How Professional 409A Practices Support M&A Success

Well-maintained 409A records create several advantages during acquisition transactions.

| Practice Area | Benefit | Impact on Deal |

| Annual updates with credentialed providers | Demonstrates regulatory compliance | Reduces due diligence time |

| Comprehensive documentation | Supports valuation conclusions | Minimizes purchase price adjustments |

| Consistent methodology | Shows reliable FMV progression | Builds buyer confidence |

| Formal board approval | Proves governance quality | Reduces escrow requirements |

Faster due diligence

Buyers can verify compliance quickly when your documentation is complete and well-organized. This reduces the time your management team spends responding to requests and allows the deal to proceed on schedule.

Stronger negotiating position

Clean 409A records eliminate a common source of purchase price reductions. Buyers cannot justify discounts for risks that don’t exist.

Credibility across other areas

Buyers view equity compensation management as an indicator of your overall financial practices. Strong 409A compliance suggests your other representations are equally reliable.

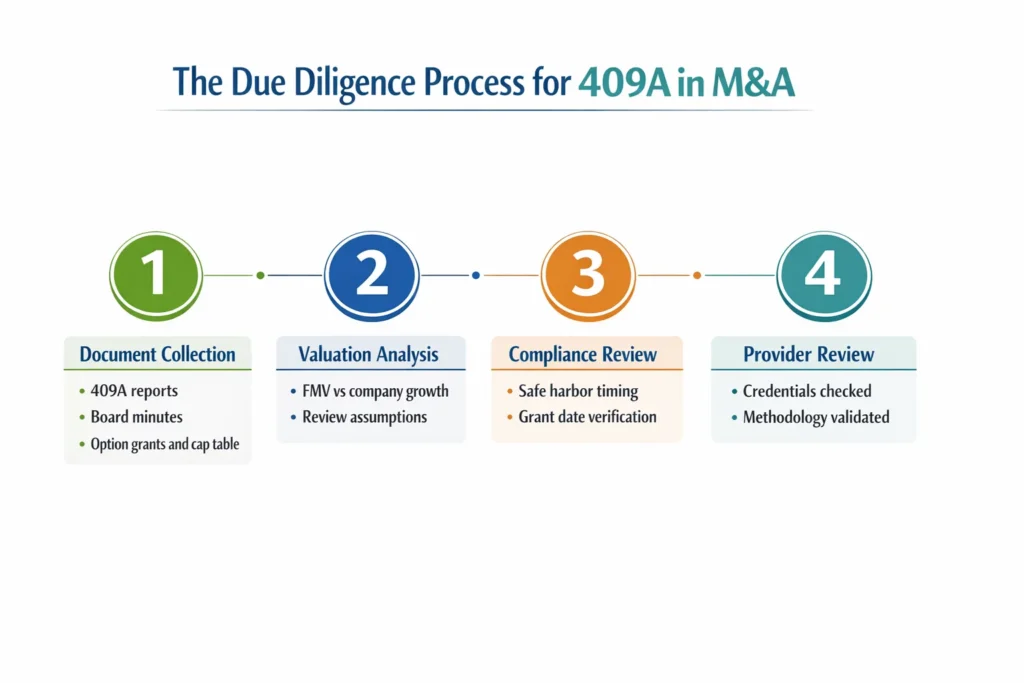

The Due Diligence Process for 409A in M&A

Buyers follow a systematic approach when reviewing your equity compensation history.

Document collection

Within days of signing a letter of intent, the buyer’s counsel requests all historical 409A reports, board minutes approving valuations, option grant records, and your current capitalization table from formation forward.

Valuation analysis

The buyer’s finance team compares your fair market value progression to business performance, verifying that values increased appropriately with revenue growth, funding rounds, and milestones. They also verify your methodology matches your capital structure and that key assumptions are well-supported.

Compliance verification

Legal counsel checks that grants occurred after valuation dates, updates happened within safe harbor periods, and material events triggered timely revaluations. They calculate potential IRS penalty exposure for any compliance gaps.

Provider assessment

During 409A in M&A due diligence, buyers contact your valuation providers to verify credentials and discuss methodology. Providers without appropriate credentials or those who cannot clearly explain their approach create concerns about valuation reliability.

Real Examples of 409A Impact on Deals

Understanding 409A in M&A becomes clearer through actual transaction scenarios.

Example 1: Clean compliance accelerates closing

A software company maintained annual 409A updates with a certified valuation firm. They updated within 30 days of each funding round and documented board approval in detailed minutes.

During due diligence, the buyer’s team completed its equity compensation review in under a week. They found no compliance issues and made no adjustments to the purchase price.

The transaction closed on schedule with standard terms.

Example 2: Compliance gaps reduce proceeds (Illustrative scenario)

In a hypothetical scenario, a retail company used an inexpensive online service for 409A valuations and updated irregularly. Several option grants used valuations that were 16 to 18 months old.

The buyer commissioned an independent analysis showing the company should have used fair market values approximately 35% higher for certain grants.

The buyer reduced the purchase price by $900,000 to offset estimated tax liability and required a $500,000 escrow holdback for potential employee claims. The due diligence period was extended by several weeks to address these compliance concerns.

Steps to Strengthen Your 409A Practices

You can address potential issues well before any M&A transaction begins.

Review your current documentation

Gather all existing 409A reports and board minutes. Verify that you have complete documentation for every period since you began granting options.

Identify any gaps in reports, missing board approvals, or grants that may have timing issues.

Assess your provider

Verify that your current valuation firm has appropriate credentials such as ASA, CPA/ABV, or CVA designations. Confirm they provide comprehensive written reports with detailed methodology.

If you’ve been using a template service, consider engaging a more qualified provider going forward.

Establish update triggers

Set calendar reminders for annual updates even when no material events occur. Define what constitutes a material event in your equity administration policy.

Common material events include fundraising rounds, significant revenue milestones, major customer wins or losses, and leadership changes.

Improve board documentation

Ensure your board agenda includes 409A review as a standing item. Have your valuation provider present their findings when possible.

Board minutes should specifically state the date of the valuation report, the approved fair market value, and that the board reviewed the methodology.

Organize your records

Create a centralized repository for all equity compensation documents. You’ll need to produce these quickly during any future due diligence process.

Well-organized records demonstrate professionalism and make the buyer’s review more efficient.

Frequently Asked Questions About 409A in M&A

Do all buyers review 409A valuations?

Yes, virtually all professional buyers include equity compensation in their due diligence. The depth of review varies by deal size and buyer type, with public companies conducting the most thorough reviews due to accounting requirements.

How far back do buyers typically look?

Buyers generally request your complete 409A history from formation forward. They focus most attention on the past three to five years, when the most outstanding options were likely granted. However, patterns of noncompliance in earlier periods can still raise concerns about your governance practices.

Can you correct 409A issues during the sale process?

Technical corrections are possible through IRS voluntary compliance programs, which involve filing amended documents and paying back taxes with interest. For guidance on establishing strong practices before issues arise, read our guide on when to get a software valuation, which covers 409A compliance as part of a comprehensive valuation strategy for equity compensation and M&A readiness.

What happens if buyers identify serious violations?

Material violations typically result in purchase price reductions to offset the buyer’s estimated liability exposure. The specific reduction varies significantly by deal based on the severity of violations, the number of affected options, and the overall transaction size. In cases involving systematic backdating or active IRS controversies, buyers may terminate the transaction.

Planning Ahead for Future Transactions

Strong 409A in M&A practices protect the value you’re building today.

Most founders focus on 409A compliance from a tax and regulatory perspective. The M&A implications often come as a surprise during their first serious acquisition discussion.

By maintaining professional valuation practices now, you eliminate a source of risk and negotiation leverage that buyers routinely use. The investment in proper valuations is modest compared to the deal value they protect.

Clean documentation also signals to buyers that you manage other aspects of your business with equal care and attention. This credibility can influence how they evaluate risk across all due diligence areas.

Ready to establish acquisition-ready equity practices? Bookman Capital work with companies well before transactions begin to identify and address equity compensation issues. Contact Bookman Capital to learn how proper 409A practices support your long-term M&A readiness.

Additional Source(s):

IRS Section 409A Final Regulations