Ready to turn your AI business into serious money? You’re in the right place.

Building an AI business that sells for $200K or more isn’t just about having cool technology—it’s about understanding what buyers actually want and positioning yourself to get it. And here’s the thing: 2025 is shaping up to be one of the best years ever to sell an AI business.

Whether you’re running a scrappy AI startup from your garage or you’ve built something more substantial, the fundamentals remain the same. You need a plan, you need to understand the market, and you need to avoid the mistakes that kill most AI business sales before they even begin.

Let’s dive into exactly how to make this happen for you.

Why 2025 is THE Year for AI Business Exits

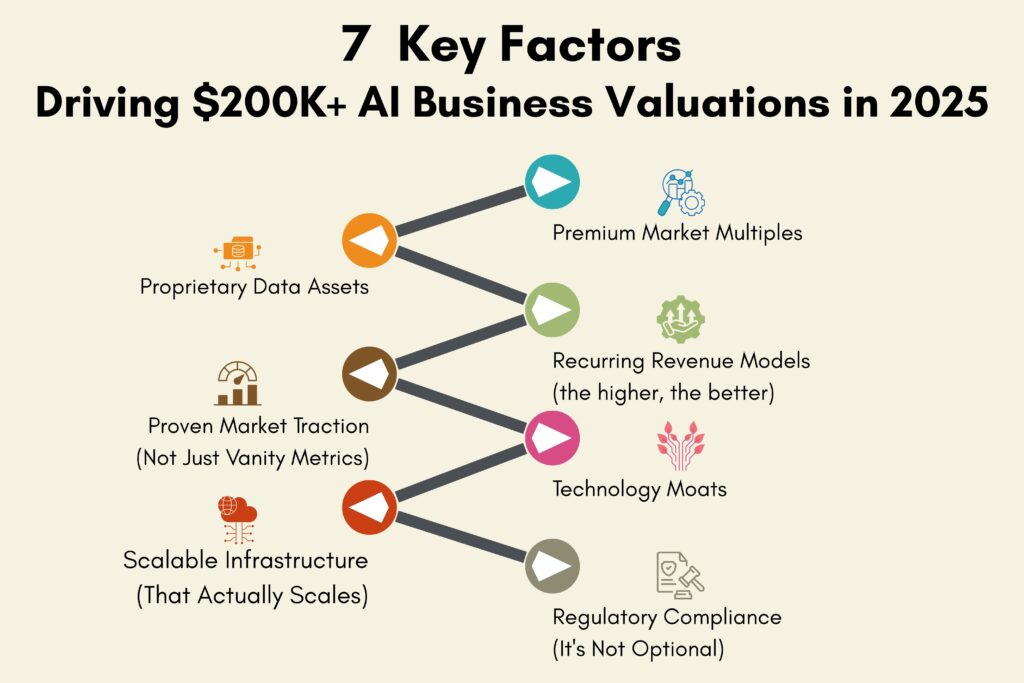

The numbers don’t lie. AI businesses are commanding premium valuations that would have been unthinkable just a few years ago. We’re talking about revenue multiples of 24-30x for top-tier AI companies in fundraising rounds and standout M&A deals. Now, before you get too excited, those are the cream-of-the-crop numbers from curated datasets—most private exits are lower. But even “typical” private AI businesses are seeing 4-10x revenue multiples, which beats traditional software by a wide margin.

Compare that to regular SaaS companies (4-7x revenue) or IT services (around 1.5-1.6x revenue), and you can see why everyone’s talking about AI exits right now.

But here’s what most people miss: it’s not just about the technology. The buyers paying these premium multiples are looking for specific things, and if you don’t have them, you’ll be disappointed with your offers.

6 Essential Steps to Prepare Your AI Business for Sale

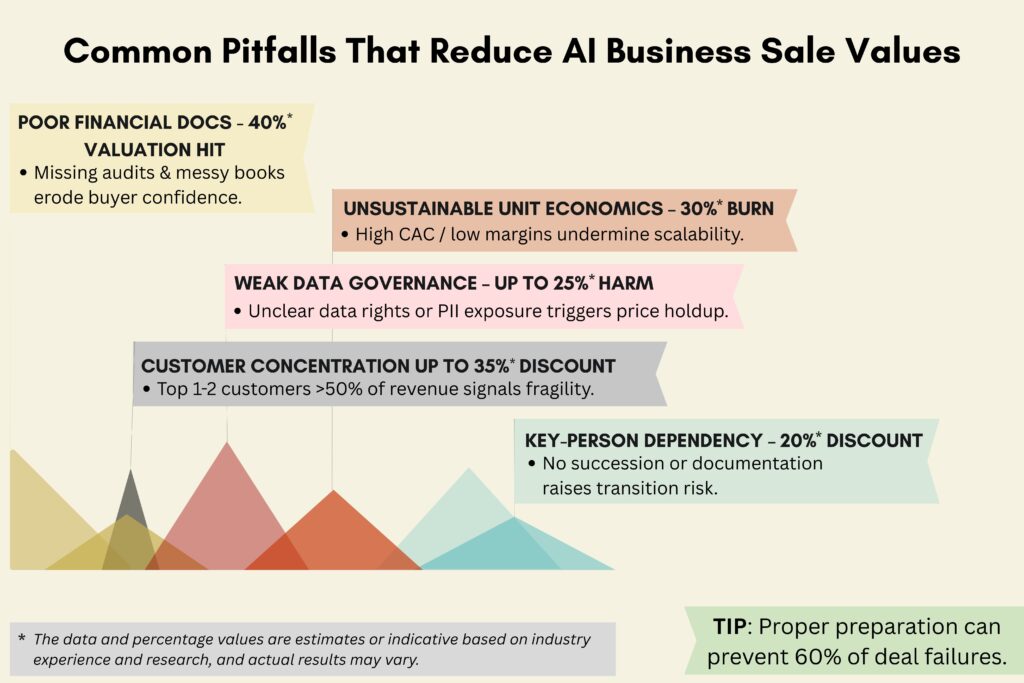

Business valuations are significantly influenced by pre-sale preparation, which ultimately determines the success of the final transaction and the achievement of the desired valuation. Systematic preparation creates measurable advantages in sale processes. Professional preparation separates successful exits from failed attempts.

1. Financial Documentation Audit – Your Foundation for Success

This is where most AI business sales die. Buyers will scrutinize every number, and if your financials are a mess, the deal’s over before it starts. Transparency and accuracy are non-negotiable.

Essential Financial Documents You Must Prepare:

• Provide GAAP-compliant financials and a Quality of Earnings; audits help and may be required in larger or regulated contexts, but aren’t universal

• Monthly recurring revenue (MRR) calculations with clear methodology

• Detailed profit and loss statements showing operational strengths

• Cash flow statements demonstrating operational efficiency

• Revenue recognition methods aligned with industry standards

• KPI tracking systems providing buyers with performance insights

Revenue Stream Documentation:

• Document all income sources to prove diversification

• Show that no single customer represents more than 20% of revenue

• Calculate customer lifetime values and acquisition costs

• Demonstrate growth trajectories with month-over-month metrics

• Provide evidence of predictable, recurring income streams

2. Technical Due Diligence Package

Code documentation standards ensure smooth technology transfers. Architecture diagrams explain system designs clearly. Performance metrics demonstrate technical capabilities objectively.

AI models require comprehensive performance documentation. Training data sources need clear documentation. Model accuracy metrics prove technical competence.

Security protocols documentation reassures buyers about data protection. Technical documentation packages reduce buyer concerns significantly. Comprehensive technical records expedite sale processes.

3. Legal and IP Portfolio Review

Patent applications protect proprietary AI technologies effectively. Trademark registrations secure brand assets permanently. Copyright protections cover software code and documentation.

Customer contracts require legal review before sale processes. Terms and conditions affect business valuations directly. Contract stability influences buyer confidence levels.

Compliance documentation proves regulatory adherence across jurisdictions. Legal reviews identify potential deal-breaking issues early. Proper legal preparation prevents transaction delays.

4. Operational Excellence Assessment

Buyers want to know they’re getting a business, not just a technology project.

Operational documentation needed:

- Team structure and organizational charts

- Key personnel retention agreements

- Standard operating procedures for all business processes

- Customer support systems and satisfaction metrics

- Process documentation that proves you can scale efficiently

5. Customer Base Analysis

Customer concentration risks require careful evaluation and mitigation. Diverse customer bases reduce single-client dependencies. Customer contract terms affect valuation calculations directly.

Retention metrics demonstrate customer satisfaction and loyalty. Net Promoter Scores quantify customer advocacy levels. Customer lifetime values prove business sustainability.

Growth potential analysis shows expansion opportunities clearly. Market penetration rates indicate future possibilities. Customer base quality affects long-term valuations.

6. Competitive Positioning Strengthening

Market differentiation strategies separate successful businesses from competitors. Unique value propositions justify premium pricing models. Clear positioning attracts strategic buyers.

Competitive advantages documentation proves sustainable market positions. Barrier-to-entry analysis demonstrates market protection. Strong positioning supports higher valuation discussions.

Brand recognition metrics quantify market presence effectively. Marketing effectiveness measures prove customer acquisition capabilities. Strong positioning reduces buyer acquisition risks.

AI Business Valuation Comparison Table

| Business Type | Revenue Multiple | Growth Rate | Market Premium |

| AI Businesses (Top Tier) | 24-30x* | 45-60% | High |

| AI Businesses (Typical Private) | 4-10x | 25-45% | Medium-High |

| Private SaaS Companies | 4-7x | 25-40% | Medium |

| Traditional Software | 3-8x | 15-25% | Low-Medium |

| IT Services | ~1.5–1.6x | 8-15% | Low |

*Fundraising and select M&A samples; median private exits are materially lower

8 Proven Strategies to Maximize Your AI Business Sale Price

Selling an AI business isn’t like selling traditional software. Buyers are more sophisticated, valuations swing dramatically based on positioning, and the difference between a decent exit and an exceptional one comes down to strategic preparation.

Smart founders build valuation drivers into their business from day one, creating a foundation that attracts premium buyers. Here’s what actually moves the needle based on what buyers consistently pay premiums for.

- Revenue Diversification

Revenue diversification isn’t just financial stability—it’s risk mitigation that buyers pay premiums for. When 60% of your revenue comes from one customer, you’re selling a dependency. When you’ve built multiple complementary revenue streams, you’re selling a resilient asset.

Subscription models provide predictable monthly recurring revenue that buyers can model with confidence. Layer consulting services on top of your core AI product, and suddenly you’re not just a software vendor—you’re a strategic partner with deep customer relationships and higher switching costs.

Geographic diversification proves your AI solution solves universal problems, not regional ones. It demonstrates that your business model adapts to different markets and regulatory environments, exactly what strategic buyers need for global expansion.

- Growth Trajectory Documentation

Growth documentation isn’t about pretty charts—it’s about building an undeniable momentum narrative that justifies premium valuations. Buyers who pay top dollar want evidence you’re creating waves, not just riding them.

Your historical performance data must tell a coherent story. Month-over-month metrics should reveal underlying growth drivers: improving customer acquisition efficiency, better AI model performance leading to superior customer outcomes, or expansion into new use cases within existing accounts.

Conservative projections actually increase buyer confidence. Projections grounded in historical trends and supported by market research demonstrate business maturity. Buyers have seen too many AI companies with hockey stick projections that never materialize.

Connect milestone achievements to measurable business outcomes. Show how that new AI feature reduced churn or how that enterprise integration drove average contract values up 40%.

- Strategic Partnerships – Building Valuable Alliances

Strategic partnerships create competitive moats that drive significant valuation premiums. The partnerships that matter most create genuine switching costs while reducing customer acquisition expenses.

Here’s what actually drives partnership value in AI businesses:

Technology Integration Partnerships:

- API partnerships that handle critical business processes and increase customer switching costs

- Platform integrations that expand your addressable market and become part of daily operations

- Technology stack partnerships that enhance your core AI offering in ways competitors can’t replicate

- White-label partnerships that scale distribution through established channels without direct investment

Distribution and Channel Partners:

- Reseller agreements that accelerate market penetration with proven sales networks

- Marketplace presence on major platforms like AWS, Azure, and Google Cloud for credibility

- Industry-specific channel partners that provide vertical market expertise and relationships

- International distributors that enable global expansion without building local operations

The real magic happens through partnership value creation. Each integration makes your platform more useful to existing customers while making it more attractive to potential new ones. Shared development costs with partners allow you to enhance offerings without proportionally increasing expenses, improving margins that directly impact valuation multiples.

- Intellectual Property Enhancement

Patent portfolios protect proprietary technologies permanently. Trademark registrations secure brand assets effectively. Copyright protections cover software implementations.

Trade secrets create defensible competitive positions. Proprietary algorithms generate sustainable advantages. IP documentation increases buyer confidence levels.

Licensing opportunities create additional revenue streams consistently. Technology licensing expands market reach without direct investment. IP assets support premium valuation discussions.

- Customer Success Metrics

Gross retention rates around 90% represent solid B2B SaaS performance, with Net Revenue Retention commonly evaluated alongside. Customer satisfaction scores quantify service quality levels. Success metrics prove value delivery consistently.

Net Promoter Scores measure customer advocacy effectively. Customer testimonials provide social proof clearly. Reference customers validate market acceptance.

Case studies demonstrate measurable customer outcomes. ROI calculations prove value propositions objectively. Success stories attract strategic buyers consistently.

- Market Opportunity Sizing

Total addressable market calculations justify growth potential. Market research validates expansion opportunities objectively. TAM analysis supports valuation assumptions clearly.

Serviceable addressable market defines realistic growth targets. Market penetration rates show expansion possibilities. SAM calculations ground valuation expectations.

Market growth rates indicate industry expansion potential. Trending markets attract premium buyer interest. Growth markets support higher valuation multiples.

- Cost Structure Optimization

Operating margins improvement increases profitability directly. Cost reduction strategies boost cash flows. Efficient operations attract buyer interest consistently.

Scalability metrics prove growth without proportional cost increases. Variable cost structures enable profitable scaling. Optimized operations support premium valuations.

Automation implementation reduces manual intervention requirements. Efficient processes lower operational risks significantly. Streamlined operations increase buyer confidence.

- Buyer Competition Creation

Multiple interested parties create competitive bidding situations where strategic buyers often pay premiums. Research shows higher initial premiums in auctions versus one-on-one negotiations.

Professional intermediaries manage competitive processes effectively. Multiple offers increase negotiating power significantly, and timing optimization leverages favorable market conditions.

The key is creating genuine competition among qualified buyers who see strategic value in your AI capabilities, not just financial returns. When buyers know they’re competing against other strategic acquirers, they’re more likely to put their best offer forward quickly.

Maximizing Your AI Business Exit Value

Professional preparation increases sale success rates substantially. Expert guidance navigates complex transaction processes effectively. Strategic positioning commands premium valuations consistently.

Market timing affects valuations significantly. Current conditions favor AI business sellers. The 2025 market window provides exceptional opportunities.

Buyer identification determines final sale prices substantially. Strategic buyers pay higher premiums than financial buyers. Industry expertise attracts competitive offers consistently.

Ready to maximize your AI business exit value? Contact the artificial intelligence M&A specialists at Bookman Capital for confidential valuation consultation and strategic exit planning. Visit bookmancapital.io/ to schedule your free assessment today.

AI entrepreneurs can achieve $200K+ valuations through proper preparation and strategic execution. Market conditions create significant opportunities for prepared sellers. Professional guidance transforms potential into profitable reality.

Sources:

Pre-sale preparation / Quality of Earnings boosts sale outcomes