Picture this: You walk into a SaaS M&A meeting confident about your target company’s metrics. Revenue looks solid at $2 million ARR with 25% growth. Customer churn sits at ~0.6% monthly (~7% annual). The seller wants an 8x revenue multiple.

Then you dig deeper. Half the revenue comes from one enterprise client. Customer acquisition costs doubled in six months. The technical infrastructure runs on outdated servers. Your dream acquisition just became a nightmare.

This scenario plays out across boardrooms nationwide. SaaS M&A deals face re-trades because buyers overlook critical warning signs. Smart acquirers master the fundamentals before writing checks.

Today’s SaaS market demands precision. Interest rates remain elevated despite recent cuts. Buyers scrutinize every metric. Sellers face realistic valuations. Success requires understanding the complete acquisition playbook.

2025 SaaS Acquisition Trends and Market Outlook

In SaaS M&A, success hinges on rigorous preparation and disciplined execution. Clear investment criteria and tight target screening filter out misfits early, while standardized scorecards keep comparisons consistent across deals in SaaS M&A. Cross-functional alignment (finance, product, security) ensures risks surface quickly and decisions stay objective.

Market Valuation Trends and Multiples

SaaS valuations reflect a cautious but active market. In public comps, the median EV/Revenue was ~5.1x in Q2-2025, after ~5.6x in 4Q-2024. In private SaaS M&A, median deal multiples were ~4.2x EV/TTM revenue in Q2-2025 (with averages near 6.1x for top-tier assets). Growth, retention, and margin quality are driving the spread between median and top-quartile outcomes.

Why the spread? Targets with >80% gross margins and durable NRR tend to see higher multiples (e.g., in 4Q-2024, >80% GM names traded around 7.6x vs 5.5x). In public comps, companies with NRR >120% were associated with double-digit EV/Revenue medians (~11.7x in the 2024 dataset).

Growth alone no longer drives premium pricing. Efficient growth beats rapid expansion in current market conditions. Revenue retention metrics heavily influence buyer interest.

The Flight to Quality Phenomenon

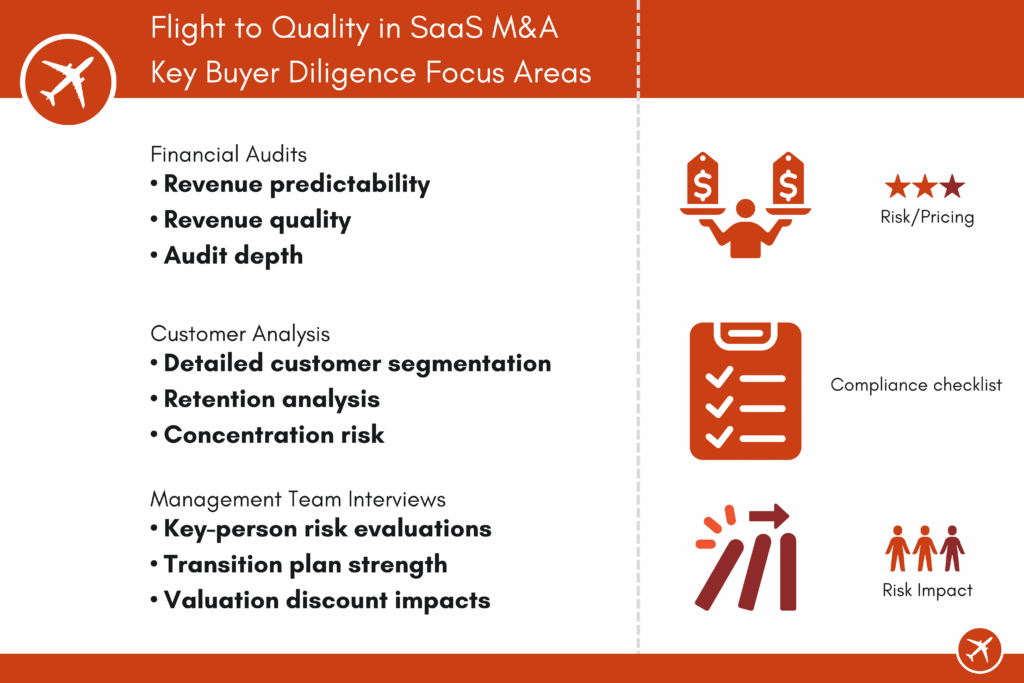

Buyers conduct exhaustive financial audits before closing deals. Investment committees require detailed customer analysis. Revenue predictability ranks as the primary valuation driver.

Technology and security diligence is deeper than ever. Enterprise buyers frequently require SOC 2 in vendor risk programs, and gaps can delay or reprice deals.

Management teams face extended interview processes. Key-person risk often results in valuation haircuts and/or structural protections (escrows, earnouts). Magnitude varies by transition plan and team depth.

Essential SaaS M&A Valuation Methodologies and Metrics

Valuation approaches vary significantly based on company maturity and market segment. EBITDA multiples work best for profitable SaaS businesses. Revenue multiples suit high-growth companies with clear paths to profitability.

Critical SaaS Metrics That Drive Value

- Annual Recurring Revenue (ARR) and month-over-month growth rates

- Customer Acquisition Cost (CAC) to Lifetime Value (LTV) ratio above 3:1 (though investors increasingly triangulate with payback and CAC ratio)

- Net Revenue Retention exceeding 110% for expansion opportunities

- Annual gross churn in high single digits is healthy; ≤5% is top-decile for enterprise motions (median GRR ~90%)

- Unit economics showing positive contribution margins

ARR growth remains the foundation metric for SaaS valuations. Companies achieving 40% annual growth receive premium multiples. Organic growth outweighs acquisition-driven expansion in buyer evaluations.

Customer concentration materially impacts risk. Once a single customer >20–30% of revenue, buyers typically discount value and/or add structure (earnouts, escrows, holdbacks). The magnitude varies by contract length, stickiness, and switching costs.

| Company Type / Context | Median Multiple | Top-tier / Avg for Best Assets | Notes |

| Public SaaS (Q2-2025) | ~5.1x EV/Revenue | 8–12x (select leaders) | Mix depends on growth, GM, and NRR |

| Private SaaS M&A (Q2-2025) | ~4.2x EV/TTM Rev (median) | ~6.1x avg | Deal-level dispersion is high |

| Private SaaS (predictive, not comps) | ~4.8–5.3x ARR | — | SaaS Capital model; orientation only |

*Illustrative, based on recent SaaS M&A medians

Benchmarking Against Industry Standards

Vertical SaaS remains highly active (healthcare & financial services among the busiest), but premiums are deal-specific; multiples vary by sub-sector and metrics.

Geographic expansion capabilities influence international buyer interest. Multi-language platforms access broader acquirer pools. Compliance frameworks across regions determine enterprise value.

Revenue retention now dominates buyer interest. Across private SaaS, median GRR ~90% and NRR ~101% persisted through 2024. Top-quartile NRR (110–120%+) is still a premium driver, while public comps show NRR >120% associated with ~11.7x EV/Revenue medians.

Due Diligence Challenges and Best Practices

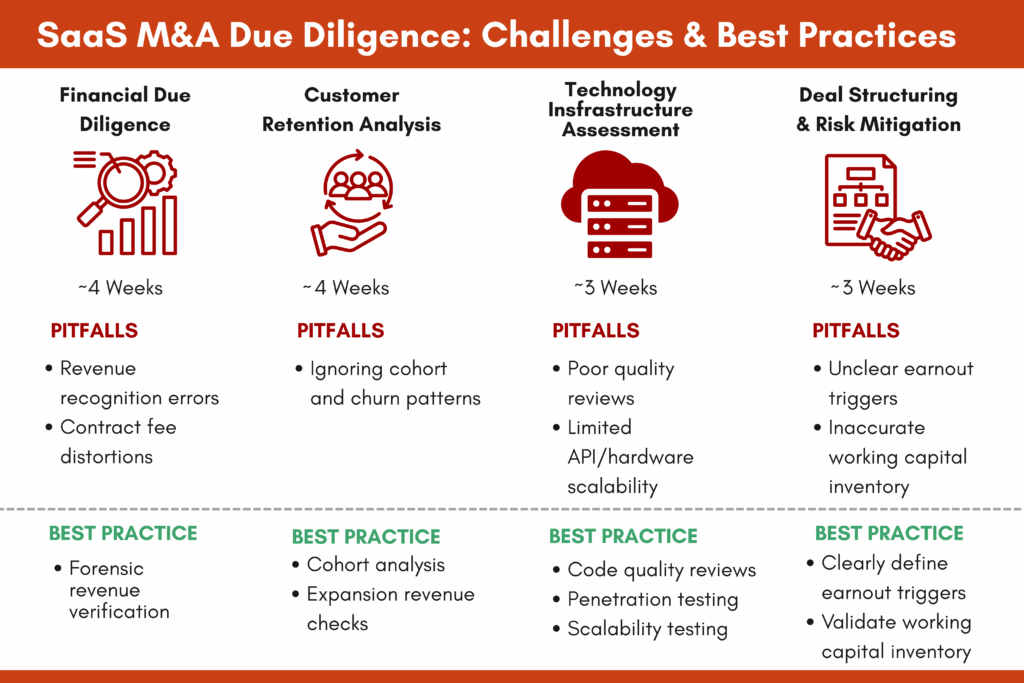

Inadequate diligence around retention, revenue quality, and security remains a leading cause of re-trades or post-close surprises; timelines are trending longer as buyers go deeper.

Financial Due Diligence Deep Dive

Revenue recognition practices require forensic analysis. Recurring revenue classifications determine actual ARR calculations. Contract modifications and one-time fees distort underlying metrics.

Customer retention patterns reveal business stability. Cohort analysis shows revenue predictability. Expansion revenue from existing customers indicates product-market fit strength.

Working capital requirements affect cash flow projections. Accounts receivable aging reports highlight collection risks. Deferred revenue balances indicate customer prepayment trends.

Technology Infrastructure Assessment

Cloud infrastructure costs scale with customer growth. Database architecture determines system performance limits. API integrations create customer switching costs.

Security frameworks meet enterprise buyer requirements. SOC 2 compliance enables enterprise sales. Data backup systems prevent catastrophic loss scenarios.

Development team productivity metrics reveal innovation capacity. Code quality assessments predict maintenance costs. Technical debt levels determine integration complexity.

Deal Structuring and Risk Mitigation Strategies

In SaaS M&A, deal structures must balance buyer protection with seller objectives while aligning incentives for both parties. Asset purchases often limit liability exposure, making them a common choice in SaaS M&A transactions. Meanwhile, stock deals can provide tax advantages for qualifying companies, though they may transfer greater risks.

Risk Mitigation Techniques

Earnouts are back as a mainstream tool, with approximately one-third of non-life sciences private deals in 2023 including an earnout. Working-capital PPAs (purchase price adjustments, not allocations) appear in >90% of private-target deals. Ensure your model reflects realistic PPA mechanics and retention-tied earnout triggers.

Representations and warranties cover financial accuracy and legal compliance. Insurance policies protect against unknown liabilities. Escrow accounts secure indemnification obligations.

Key employee retention packages prevent talent loss. Employment agreements extend beyond closing dates. Equity participation motivates continued performance excellence.

| Deal Structure | Buyer Benefits | Seller Benefits | Risk Factors |

| Asset Purchase | Limited liability | Retain corporate shell | Complex asset transfers |

| Stock Purchase | Simpler transaction | Tax deferral options | Inherit all liabilities |

| Merger | Complete integration | Immediate liquidity | Cultural challenges |

Purchase price adjustments account for working capital changes. Net cash / (debt) positions affect final consideration amounts. Transaction costs reduce seller proceeds significantly.

Navigating Market Challenges and Emerging Trends

Higher interest rates lift discount rates in DCF models and compress valuations. With the Fed’s target range at 4.25%–4.50% as of July 30, 2025, and still elevated versus 2020–21, investors are favoring quality over growth in SaaS m&a. This rate backdrop pushes acquirers in SaaS m&a to prioritize durable margins, retention, and cash efficiency when pricing deals.

AI and Technology Integration Considerations

AI can drive a premium when it demonstrably improves retention, margins, or growth efficiency (e.g., lower support costs, higher ARPU, upsell). Buyers emphasize “AI readiness tied to measurable outcomes” rather than a fixed premium band; instead, buyers cite AI readiness and proof of value as reasons to stretch on price for select assets.

Data analytics platforms generate higher customer lifetime values. Predictive algorithms improve user engagement metrics. Integration APIs create ecosystem advantages.

Technical due diligence for AI-enhanced platforms requires specialized expertise. Algorithm performance metrics determine competitive sustainability. Training data quality affects model accuracy.

Regulatory and Compliance Evolution

Data privacy regulations increase compliance costs. GDPR requirements affect international operations. Industry-specific regulations create market barriers.

Cybersecurity standards evolve rapidly across industry verticals. Penetration testing reveals security vulnerabilities. Incident response plans demonstrate operational maturity.

Expert Tips for Successful SaaS Acquisitions

Success in SaaS m&a depends on rigorous preparation and disciplined execution. Effective target screening filters out misaligned candidates early and streamlines SaaS m&a pipelines. Standardized evaluation frameworks ensure consistent analysis and faster, higher-confidence decisions.

Pre-Acquisition Preparation Strategies

Investment criteria establish clear screening parameters. Financial thresholds eliminate underperforming targets. Strategic fit requirements guide integration planning.

Internal capabilities determine integration complexity. Technology teams assess system compatibility. Sales organizations evaluate market synergies.

Professional advisors provide specialized industry expertise. Investment bankers access proprietary deal flow. Legal counsel structures optimal transactions.

Working with Professional Advisors

Due diligence teams coordinate across multiple disciplines. Financial advisors validate revenue projections. Technical consultants assess scalability requirements.

Tax specialists optimize transaction structures. Labor attorneys review employment contracts. IP lawyers protect intellectual property rights.

Integration consultants develop post-closing plans. Change management experts facilitate cultural transitions. Customer success teams retain existing relationships.

Frequently Asked Questions

Q: What are the current SaaS valuation multiples in 2025?

Public comps: ~5.1x EV/Revenue (Q2-2025); 4Q-2024 was ~5.6x. Private SaaS M&A: ~4.2x EV/TTM revenue (median) in Q2-2025, with top-tier assets averaging ~6.1x. >80% GM and high NRR command premiums; ARR-based predictive bands of ~4.8–5.3x help with orientation (not deal comps).

Q: How long should SaaS due diligence take?

Plan for ~4–6 weeks of core diligence post-LOI; total timelines can extend to 6–12 weeks for larger or regulated assets. Diligence has lengthened since 2022 as buyers scrutinize unit economics, retention, and security.

Q: What’s the biggest challenge in SaaS M&A today?

Balancing growth vs. profitability under a still-elevated rate regime. NRR, gross margin, and efficient growth move the needle more than headline ARR growth.

Q: How do AI capabilities affect SaaS valuations?

AI can support a premium when tied to measurable outcomes (expansion, lower churn, margin gains). Buyers increasingly evaluate AI in diligence, but there’s no universal premium band; substance over slogans.

Q: What deal structures work best for SaaS?

Asset purchases plus earnouts tied to retention or ARR remain common to bridge valuation gaps. Expect working-capital PPAs and special escrows as standard protections.

Ready to navigate your next SaaS acquisition with confidence?

The SaaS M&A experts at Bookman Capital bring deep industry knowledge and proven deal execution to help you identify, evaluate, and successfully acquire the right SaaS businesses.

From initial target identification through post-closing integration, our team provides the strategic guidance you need to maximize value and minimize risk. Our transaction professionals understand the unique challenges of SaaS acquisitions and deliver results that drive long-term success.

Contact Bookman Capital today at bookmancapital.io/ to discuss your SaaS acquisition strategy and discover how we can help you achieve your growth objectives.

Sources: