Building a SaaS startup is like piloting a high-speed aircraft through turbulent skies. Lose control of the stick, and what started as a smooth ascent quickly becomes a devastating nosedive.

Too many SaaS founders watch their companies crash and burn after surrendering too much control too early. They accept unfavorable investment terms, dilute their equity beyond recognition, or sell at rock-bottom prices when desperation strikes.

The wreckage tells the same story repeatedly. Promising startups with solid revenue streams end up in the hands of investors who strip away the founder’s vision, fire key team members, and pivot the product into unrecognizable territory.

But 2025 presents a different flight path for prepared pilots.

The New SaaS Reality: What Every Founder Needs to Know

The software-as-a-service market tells a story of both opportunity and challenge. According to Gartner, end‑user spending on Cloud Application Services (SaaS) is forecast to reach $299.1B in 2025.

SaaS Valuations Show Signs of Recovery

As of early to mid 2025, the SaaS Capital Index implies approximately 7.0x median EV/Run-Rate Revenue for public pure-play B2B SaaS, which many buyers use as an anchor when valuing private companies. Recent SaaS Capital modeling pegs bootstrapped private SaaS at approximately 4.8x and equity-backed peers at 5.3x, on average.

Multiples rebounded from 2022 to 2023 lows and remain well below 2021 peaks when many public SaaS names traded above 15x EV/Revenue at the top.

In 2025, high-quality private SaaS still clears approximately 8x to 10x in select cases. Many deals cluster around 4x to 7x, with slower growth and risk factors pulling valuations lower.

Sectors tied to AI/data infrastructure and some cybersecurity categories trade toward the high end of public comps. Recent banker decks show Analytics/BI/Data Management around ~11× NTM revenue—use this only as an upper reference when framing private deals.

Market Timing Creates Strategic Advantages

Investors now prioritize profitability over growth at any cost. SaaS startup teams with strong unit economics and sustainable customer acquisition receive premium attention from buyers.

The shift toward profitability favors bootstrap-minded founders who built efficient operations from the start. For a SaaS startup, this often translates into better valuations than heavily funded competitors burning cash for growth.

Building Value While Preserving Founder Control

Smart capital strategies allow founders to scale without surrendering ownership. Revenue-based financing and growth debt provide expansion capital while preserving equity stakes.

Bootstrapping Delivers Competitive Valuations

Recent SaaS Capital modeling shows bootstrapped companies achieve approximately 4.8x multiples while equity-backed peers reach 5.3x predicted private multiples on average. For a SaaS startup, this small valuation gap proves that external funding does not automatically create superior returns.

Founders who maintain control often negotiate better exit terms since they face less pressure from outside investors. Revenue-based financing offers an alternative path for growth capital without requiring equity dilution or board seats.

Revenue-based financing terms vary and can be costlier than debt at scale. These arrangements work best for a SaaS startup with predictable monthly recurring revenue and moderate customer acquisition cost payback periods.

Key Metrics Drive Premium Valuations

Annual recurring revenue growth rates directly impact valuation multiples. Companies maintaining strong growth rates while optimizing the Rule of 40 achieve the highest premiums from buyers.

Net revenue retention shows whether customers stay and expand. For 2025, a healthy profile means NRR a bit above break-even growth, CAC payback around twenty months (or faster), and strong margins—about three-quarters on subscription, a bit lower overall.

Customer acquisition cost to lifetime value ratios should target 3:1 or higher. Ratios of 5:1 can be excellent but may indicate under-investing in growth opportunities.

EBITDA margins above 20% earn approximately 32% premium versus the 5.9x median. However, growth and Rule of 40 performance generally drive bigger valuation uplifts than margin alone.

Monthly churn rates around 0.3% to 1% for B2B SaaS companies indicate strong product-market fit. This translates to approximately 3.5% to 5% annual churn rates, with SMB-focused companies typically seeing higher churn.

Strategic Scaling That Protects Your Equity

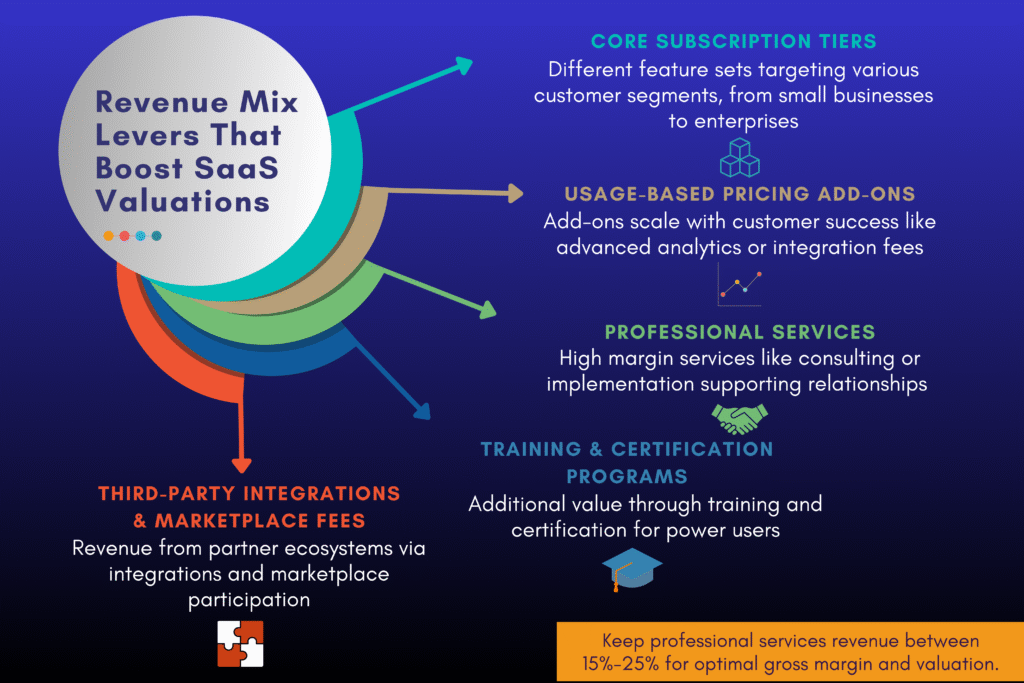

For a Saas startup, revenue diversification strengthens valuations without adding operational complexity. Multiple revenue streams reduce buyer concerns about customer concentration and market risks.

Building Multiple Revenue Streams

Tiered pricing models capture value across different customer segments. For a SaaS startup, basic plans attract small businesses while enterprise packages serve large organizations with premium features.

Usage-based pricing add-ons generate additional revenue from existing customers. Features like advanced analytics, integrations, or additional user seats create natural upselling opportunities.

Professional services provide high-margin revenue while strengthening customer relationships. Keep professional services at approximately 15% to 25% of total revenue following industry guidance. Above 30% may signal excessive customization and hurt gross margin.

High services mix can drag total gross margin below typical totals in the low-70s (with subscription margins in the high-70s).

Note: Monitor overall gross margins to ensure revenue mix optimization doesn’t compromise profitability.

Customer Acquisition That Scales Profitably

Product-led growth reduces customer acquisition costs while improving conversion rates. In a SaaS startup, free trials, freemium models, and viral features drive organic adoption without expensive sales teams.

Multi-channel acquisition strategies prevent over-dependence on single traffic sources. Combining content marketing, paid advertising, partnerships, and direct sales creates sustainable growth engines.

At scale, referrals can become a material new-logo source. Instrument referral programs and report them as key performance indicators for tracking growth efficiency.

Customer success initiatives reduce churn while driving account expansion. Proactive support and regular check-ins increase customer lifetime value significantly.

Many B2B SaaS teams target 12–18 months for CAC payback, but the current median is closer to ~20 months (top performers nearer ~14 months), with enterprise deals often justified longer. For a SaaS startup pursuing enterprise customers, longer payback periods can be reasonable given the higher lifetime values.

Perfect Timing: When to Make Your Move

For a SaaS startup, market signals indicate optimal exit timing better than financial metrics alone. Industry consolidation trends, valuation cycles, and competitive pressures all influence sale success.

Reading the Market Tea Leaves

Acquirer activity in your specific SaaS vertical provides timing insights. When strategic buyers complete similar acquisitions, they often seek additional targets to build market dominance.

Valuation multiple trends cycle predictably over 3 to 5 year periods. Selling during multiple expansion phases captures maximum value for equivalent financial performance.

Personal readiness matters as much as market conditions. Founders experiencing burnout or seeking new challenges should prioritize exit timing over perfect market conditions.

Preparation Strategies for Maximum Value

Financial documentation requirements start 18 months before any sale process. For a SaaS startup, clean bookkeeping, regular audits, and organized customer data significantly impact buyer confidence.

Customer concentration risks must be addressed before marketing your business. No single customer should represent more than 15% of annual recurring revenue to achieve premium valuations.

Buyers expect to sample billing data, logo retention, NRR cohorts, and GAAP revenue tie-outs covering 18 months of historical performance. Clean data hygiene becomes critical during this process.

Intellectual property portfolios strengthen competitive positioning during due diligence. Patents, trademarks, and proprietary technology create barriers that justify higher multiples.

Key employee retention becomes critical during sale processes. In a SaaS startup, employment agreements, equity incentives, and clear transition plans reduce buyer concerns about team departure.

Remember to maintain professional services revenue below 30% of total revenue to avoid margin compression concerns during due diligence.

| ARR Growth Rate (Guideline) | Typical Private Range (2025) | Notes |

| Under 20% growth: ~3×–5× | Approximately 3x to 5x | Heavier discounts with churn, high CAC payback |

| 20%–40% growth: ~4×–7× | Approximately 4x to 7x | Middle of market |

| 40%+ growth: ~6×–9× | Approximately 6x to 9x | Quality, efficiency, retention push to top end |

| Elite profiles (strong Rule of 40, NRR ~120%+, clear category tailwind): ~8×–10×+ in select cases | 8x to 10x+ (select cases) | Outliers only in 2025 market |

Negotiation Strategies That Preserve Your Influence

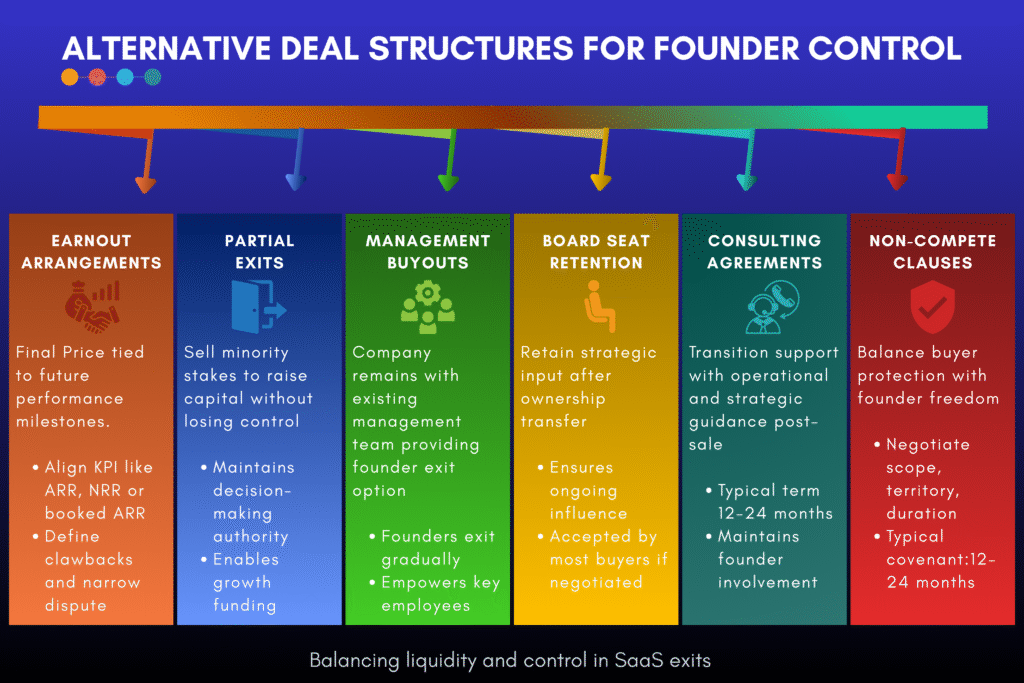

Deal structures beyond traditional sales allow founders to maintain involvement while capturing value. Creative arrangements balance immediate returns with ongoing participation.

Alternative Deal Structures

Earnout arrangements tie final purchase prices to future performance milestones. For a SaaS startup, these structures work well when expansion plans are ambitious and founders remain confident. Define objective earnout KPIs such as GAAP ARR, NRR, or booked ARR with clawbacks and narrow dispute windows.

Partial exits allow founders to capture liquidity while maintaining operational control. Selling minority stakes to strategic investors provides capital for growth while preserving decision-making authority.

In a SaaS startup, management buyouts keep companies within existing teams while providing founder exits. Employee stock ownership plans create similar outcomes while distributing ownership across key team members.

Maintaining Post-Sale Influence

For a SaaS startup, board seat retention ensures ongoing strategic input after ownership transfer. Most buyers accept founder board participation when structured properly during negotiations.

Consulting agreements provide transition support while maintaining founder involvement. These arrangements typically last 12 to 24 months and include both operational guidance and strategic planning.

Non-compete clause negotiations require careful balance between buyer protection and founder freedom. Negotiate scope, territory, and duration carefully. Typical tech covenants range from 12 to 24 months.

Life After Your SaaS Startup Success Story

Successful exits create new opportunities beyond immediate financial gains for a SaaS startup. Strategic planning for post-sale activities maximizes long-term satisfaction and continued wealth building.

Managing New Wealth Strategically

Following a SaaS startup exit, tax optimization strategies require professional guidance. Proper planning can save millions in taxes while preserving capital for future investments.

For SaaS startup founders, investment diversification beyond technology reduces portfolio risk after concentrated SaaS wealth creation. Real estate, public markets, and alternative investments balance overall exposure.

Your Next Chapter Possibilities

Serial entrepreneurship appeals to founders energized by building new companies. Previous SaaS experience provides valuable insights for identifying opportunities and avoiding common mistakes.

Angel investing allows successful founders to support other entrepreneurs while generating returns. Many SaaS founders become active investors in their areas of expertise.

Board positions with other growing companies provide ongoing involvement without full-time commitment. These roles combine strategic guidance with equity participation in promising ventures.

Frequently Asked Questions

What minimum ARR do I need for revenue-based valuations?

There isn’t a universal cutoff. Buyers look at ARR, growth, retention, margin, and concentration together. Revenue-multiple deals are common from low single-digit millions of ARR upward; stronger profiles command better multiples.

How can I raise growth capital while maintaining control?

Revenue-based financing, growth debt, and structured earnout deals provide expansion capital with minimal equity dilution compared to traditional venture capital funding.

When should I consider selling my SaaS business?

Optimal timing combines strong financial performance with favorable market conditions. Currently, 2025 shows SaaS valuation recovery with premium multiples for AI and cybersecurity companies.

What mistakes do founders make when selling?

Common errors include inadequate financial documentation, over-concentration in key customers, poor competitive positioning, and failing to optimize key metrics before going to market.

How do I know if my valuation offer is fair?

Compare offers against industry benchmarks for your growth rate, revenue size, and market sector. High-growth SaaS companies typically achieve 7x to 10x ARR multiples in current market conditions.

Your Next Strategic Move

Scaling and selling your SaaS startup without losing control requires expert guidance and strategic planning. The difference between a good exit and a great exit often comes down to preparation, timing, and negotiation expertise.

Market conditions in 2025 favor well-prepared founders who understand how to maximize valuations while preserving their vision and operational influence. The recovery in SaaS multiples creates opportunities for founders ready to make their move.

Ready to maximize your SaaS valuation while maintaining control? The experienced team at Bookman Capital specializes in helping SaaS founders navigate complex exit strategies that preserve your vision and maximize your return. Our proven approach has helped dozens of founders achieve premium valuations without sacrificing operational control.

Contact Bookman Capital today at bookmancapital.io/ to schedule your confidential valuation consultation and discover how to position your SaaS for a successful exit on your terms.

Additional Sources:

• KBCM/Sapphire 2024 Private SaaS Survey (NRR, CAC payback, total & subscription GM) Key.com+2Key.com+2

• Cantor Winter 2025 (Analytics/BI ~11.4× NTM) Cantor