You open your inbox and see it: “We’d love to discuss a software valuation for your business. Are you free this week?” It feels validating and urgent.

A software valuation isn’t just a number. It is an anchor that shapes every conversation that follows. In 2025, public cloud and SaaS trade near ~6× median EV/Revenue, with the BVP Cloud Index around ~6–8× ARR. Cloud 100 averages sit near ~20×, with AI-native peers closer to ~24×. Venture AI rounds often price ~25–30×, while private SaaS M&A medians cluster near ~5×.

Saying yes to the wrong valuation at the wrong time can lock you into a low number that is hard to shake. Saying no when you should engage can mean missing capital windows or leaving money on the table. This guide shows you exactly when to take the meeting, when to pause, and how to benchmark your business against real 2025 data so you protect your leverage and maximize your outcome.

What a Valuation Does and What It Costs

A valuation unlocks real moves: exit planning, buyer targeting, and secondary liquidity. It sets fair market value for options (409A) and supports governance or debt covenants. Stock-for-stock acquisitions also need a credible basis for pricing your equity.

There are costs. Building a lean data package takes real time and judgment. Anchoring risk appears once a number circulates, especially if comps are shallow. Model-fit matters too: subscription SaaS, usage-based AI, and services-heavy revenue deserve different comps and adjustments.

If you proceed, manage the calendar. Align scope on a short call. Limit data transfer to a two-hour pack and confine Q&A to one round. Aim for a range discussion focused on assumptions, not a single “hero” number.

How Software Actually Gets Valued in 2025

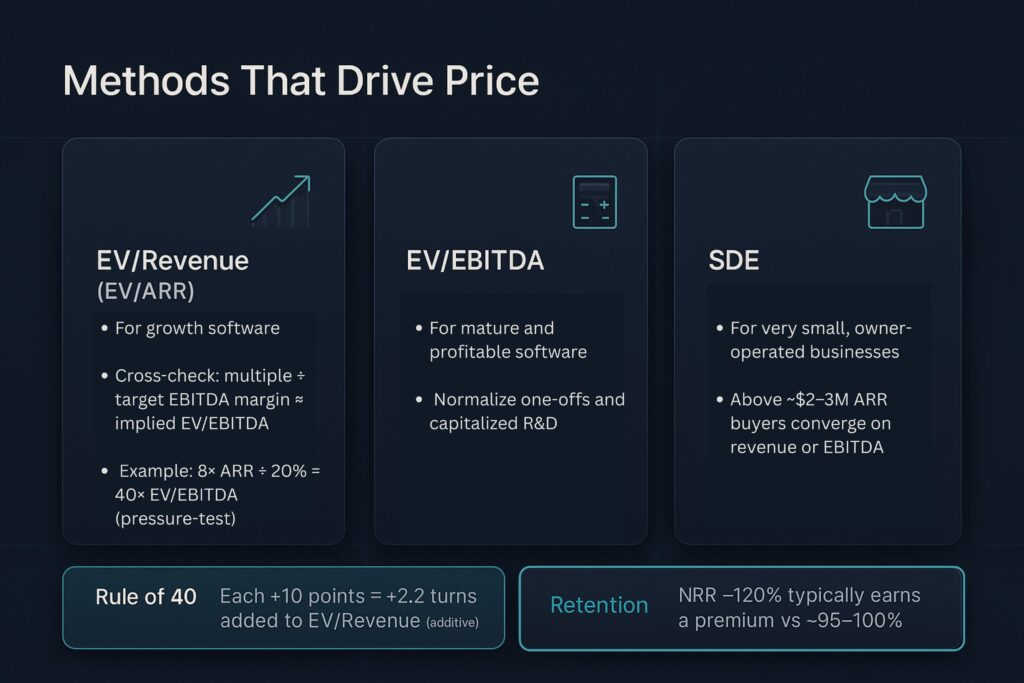

Growth software is usually priced on EV/Revenue or EV/ARR. In any software valuation, cross-check by dividing the revenue multiple by the target steady-state EBITDA margin. If 8× ARR implies about 40× EV/EBITDA at a 20% margin, ask whether growth and retention justify it.

Mature, profitable software fits EV/EBITDA after normalizing one-offs and capitalized R&D. SDE shows up mainly in small, owner-operated businesses. Beyond about $2–3M ARR, buyers converge on revenue and EBITDA frameworks.

What moves your multiple? Growth and profitability, summarized by the Rule of 40. Each +10 points is associated with approximately +2.2 turns added to EV/Revenue (additive). Retention quality matters: NRR above about 120% earns premia versus roughly 95–100%. Strong gross margins, a clean recurring mix, and contract quality help. AI adds upside when it creates moats, pricing power, or lower COGS, not just features.

Usage-based revenue needs clarity. If usage maps to clear value metrics and diversified cohorts, buyers underwrite variability. If a few whales drive spikes, expect discounts. Decompose usage by cohort and tie it to outcomes so your software valuation reads as durable rather than volatile.

Where the Market Is Right Now (2025)

Public SaaS medians sit near ~6× EV/Revenue. The BVP Cloud Index averages ~6–8× ARR, depending on timing. Private SaaS M&A runs ~4.7–4.8× long-run, with ~5.7× in 2025 and size premia for larger deals.

Cloud 100 averages hover near ~20×. AI-native peers price around ~24× versus ~19× for non-AI. Venture AI fundraising often clears ~25–30×, while M&A is lower due to diligence and integration risk. On marketplaces, SaaS commands the strongest profit multiples; search-dependent content faces softer demand; AI-related assets attract interest.

To apply those bands, consider a $5M ARR vertical SaaS growing ~55%, with 78% margins and 118% NRR. A public-anchored 5.5–7.5× range may adjust up for moats or down for noisy mix. The aim isn’t a single figure, it is an assumption-aware range you can defend.

Dispersion is reality. Infrastructure with network effects outruns generic horizontal apps. Security can command premiums given mission-critical renewals. Vertical SaaS with embedded payments may earn higher multiples for margin capture and switching costs. If a party offers a point estimate without a bridge, ask for comps and adjustments.

Six Green Lights That Mean You Should Say “Yes”

- Metrics you can defend: Clear cohorts, GRR/NRR bridges, consistent revenue recognition, and GAAP-to-management reconciliation that streamline a software valuation. Add one-page notes that explain any anomalies (seasonality, re-classifications, churn events) so reviewers do not assume risk where there is none.

- Healthy unit economics: LTV/CAC ≥ 3:1, ≤ 12-month payback, ≥ 70% software gross margins, and improving efficiency that support a stronger software valuation range. Show the trendline for the last 4–6 quarters to prove the motion is durable, not a one-off.

- Repeatable growth engine: 3–5× pipeline coverage, rising sales productivity, and expansion motions pushing NRR > ~110% that signal durability in a software valuation. Include simple win-rate and cycle-time dashboards to demonstrate operational control across segments.

- Category tailwinds: Cybersecurity, vertical SaaS with high switching costs, or infrastructure with network effects that expand the comparable set used in a software valuation. Cite credible third-party market growth estimates to underscore why buyers will pay for your lane.

- AI that moves the P&L: Data moats, pricing power, or measurable COGS leverage and not features alone, so the software valuation reflects real economics. Provide before-and-after metrics (ARPU, churn, support tickets, unit compute cost) to quantify the impact.

- Favorable timing: If buy-side activity is back or you’re planning a raise or secondary, a current range helps you enter a software valuation discussion near the right reference points. Tie the outreach to internal milestones (feature GA, new enterprise logos) to maximize perceived momentum.

When to Say “Not Yet”: Fix These Red Flags First

- Messy revenue and retention: Services-heavy mix or unexplained usage spikes; GRR < ~90% or NRR < ~110% that could anchor a software valuation low. Separate software from services, document upsell drivers, and show cohort stability before inviting third-party views.

- Negative unit economics after PMF: Long payback and weak LTV/CAC that require pricing, packaging, or funnel fixes before pursuing a software valuation. Run small pricing tests or refine ICP targeting, then return with evidence that efficiency has improved.

- Unclear AI story: No moat, rising inference costs, or cannibalization risk that investors will discount in a software valuation. Clarify the data advantage, optimize model cost paths, and position AI as margin-accretive rather than feature-parity.

- Macro mismatch: If peers trade ~1–3× NTM in a cold segment, rebuild proof points before seeking opinions so your software valuation does not set an avoidable low anchor. Consider waiting for a steadier window or amassing proof (renewals, multi-year prepaids) that offsets the sector drag.

Getting a Real Number Without Losing Leverage

Control scope first. When pursuing a software valuation, ask for an Indication of Value (IOV) or a narrow, assumption-backed range. Request 2–3 public comps and 3–5 private references, plus a one-page driver memo. Avoid commissioning a full opinion until the range makes sense.

Share only a two-hour data room. Provide 24 months of ARR/MRR by cohort, GRR/NRR math with notes, gross margin by product, CAC and payback by motion, Rule of 40, top-10 customer profiles, and a brief billing-anomalies log. This keeps the software valuation exercise focused and shows command of the numbers without turning diligence into a project.

Triangulate to avoid anchors. Start with public medians (~6×), bridge to private medians (~5×), then adjust for category, moats, and mix. If someone’s figure diverges, ask for the comp set, normalizations (deferred revenue, capitalized R&D), and retention bridges. Debating assumptions beats arguing a single number, and it strengthens your software valuation narrative.

A quick scenario helps. At $10M ARR growing 45%, with 78% margins, 92% GRR, and 114% NRR, a 5.5–7.0× start can shift ±0.5–1.0 turn with strengths or weaknesses. That yields a 5.0–8.0× assumption-aware range. If a counterparty offers 3.0× without a bridge, it is likely methodology, not the market.

FAQ

Should I get a software valuation even if I’m not selling this year?

Yes, if you need it for 409A options, debt covenants, or concrete planning. Otherwise, keep a rolling range and update as metrics and markets shift. Refresh quarterly against public medians (~6x EV/Revenue) and private benchmarks (~5x). Update after major milestones or meaningful market moves.

Which multiple should I use: ARR, revenue, or EBITDA?

Use EV/ARR or EV/Revenue for growth, and use EV/EBITDA for mature, profitable businesses. Cross-check revenue multiples against your target margin to infer EV/EBITDA. For example, 8x ARR with a 20% target margin implies roughly 40x EV/EBITDA. Ask whether that is realistic given your growth and retention profile.

Do AI features increase my multiple?

Sometimes. Investors reward AI when it creates moats, pricing power, or cost leverage, and they discount AI washing. Document before and after metrics such as COGS per unit, ARPU, churn, or win rates, so the economics carry your story.

How do growth and the Rule of 40 affect valuation?

They are central. Each +10 points of Rule of 40 is associated with ~+2.2 turns added to EV/Revenue, which is additive. For example, moving from 30 to 50 adds about 4.4 turns, although company risk and category dynamics still create dispersion.

Ready for a Defensible Valuation?

Getting a valuation right protects years of work and millions in outcome. Book a confidential consultation with Bookman Capital to get a defensible range and a clear punch list for lifting your multiple. No pressure, just expert guidance that helps you make better decisions about timing, positioning, and process.

Contact Bookman Capital at bookmancapital.io to start the conversation.

Sources: