Picture two software companies sitting across the negotiation table. The first grows revenue by 60% annually but operates at negative EBITDA. The second expands at a modest 20% while generating millions in profit. Which business commands the higher price tag?

The answer depends entirely on which valuation lens you apply. The SaaS business valuation landscape has transformed dramatically since the 2021 peak. Investors no longer throw money at growth stories without scrutinizing the fundamentals underneath.

Today’s market demands substance over hype. Choosing between an ARR multiple and an EBITDA multiple can swing your valuation by millions of dollars. This guide cuts through the noise to show you exactly when each multiple applies, what the current benchmarks reveal, and how to position your business for the strongest possible outcome.

Understanding the Fundamentals: ARR and EBITDA Multiples Explained

What ARR Means for SaaS Businesses

Annual Recurring Revenue represents the subscription revenue your business expects to generate over twelve months. This metric captures the predictable, renewable income stream that makes SaaS companies so attractive to investors.

SaaS businesses built on ARR demonstrate scalability without proportional cost increases. A company can double its customer base while maintaining relatively stable operational expenses. This dynamic creates powerful unit economics that traditional businesses cannot match.

The ARR multiple calculation divides enterprise value by annual recurring revenue. A SaaS company valued at $35 million with $5 million in ARR trades at 7 times ARR. This ratio provides a quick snapshot of how much buyers will pay for each dollar of recurring revenue.

Why EBITDA Matters in SaaS Valuation

Earnings Before Interest, Taxes, Depreciation and Amortization measures operational profitability before accounting adjustments and financing decisions. EBITDA strips away the noise to reveal how much cash the core business actually generates.

Mature SaaS companies emphasize EBITDA because investors shift focus from growth potential to cash flow reliability. A business generating consistent profits proves it can sustain operations, reinvest in product development, and deliver returns to shareholders without external capital.

The EBITDA multiple calculation divides enterprise value by trailing twelve month EBITDA. This approach works best for businesses that have crossed the profitability threshold and operate with predictable margins.

Current Market Reality: 2025 SaaS Multiple Benchmarks

Private Market Valuations vs Public Company Metrics

Private SaaS companies have a long-term median near 4.7× EV/Revenue in merger and acquisition transactions. These multiples reflect the risk premium buyers demand when acquiring privately held businesses with less transparent financials.

Public SaaS companies command higher multiples due to liquidity and disclosure standards. The median enterprise value to revenue ratio for publicly traded SaaS businesses sits around 6.1× as of September 2025. These companies benefit from market visibility and regulatory oversight that reduces perceived risk. Public multiples vary by category, with dispersion across horizontal, vertical, and infrastructure cohorts.

The multiple compression from 2021 peak levels tells an important story. ARR multiples that reached 15 to 25× in 2021 have normalized to roughly 6 to 10× in 2025. This correction reflects a fundamental shift in investor psychology from growth at any cost to sustainable business models.

EBITDA Multiple Benchmarks for SaaS

The median SaaS business valuation using EBITDA multiples stands at approximately 22.4 times EBITDA in 2025. Upper-quartile performers command about 46.5× EBITDA based on stronger growth and operating efficiency.

These EBITDA multiples apply primarily to mature SaaS firms that generate consistent positive earnings. The spread between median and top quartile reflects the premium investors pay for businesses demonstrating exceptional retention, expansion revenue, and market position.

Significant variation exists across segments within the SaaS business valuation landscape. Vertical SaaS serving specific industries may trade differently than horizontal platforms. Company size, growth trajectory, and competitive positioning all influence where a business falls within the multiple range.

(Figures current as of September 2025)

Choosing Your Valuation Framework: When to Use Each Multiple

The Case for ARR Multiples

Early stage SaaS companies prioritizing growth over profitability should emphasize ARR multiple valuations. These businesses invest heavily in customer acquisition, product development, and market expansion. Current EBITDA provides limited insight into future value creation potential.

High growth companies expanding at 50% or more annually justify ARR focused valuations. Investors pay for the trajectory and addressable market opportunity rather than present day cash flows. Strong subscription revenue with high retention signals future profitability even when current margins remain negative.

The ARR multiple approach works when recurring contract models demonstrate clear unit economics. Businesses showing defined paths to profitability while capturing market share rapidly deserve valuations based on revenue multiples rather than earnings multiples.

The Case for EBITDA Multiples

Mature SaaS businesses with established customer bases and positive profit margins benefit from EBITDA multiple valuations. These companies have proven their business models work at scale. Investors prioritize cash generation and operational efficiency over pure growth velocity.

Companies generating $10 million or more in EBITDA with moderate but steady growth rates command premium EBITDA multiples. A business achieving 20% annual growth with 25% EBITDA margins demonstrates mature operations that deserve valuation based on earnings power.

The EBITDA approach makes sense when buyers focus on near term cash flows and return on investment timelines. Private equity firms acquiring profitable SaaS businesses typically anchor valuations on EBITDA multiples between 15 to 25 times depending on growth and retention characteristics.

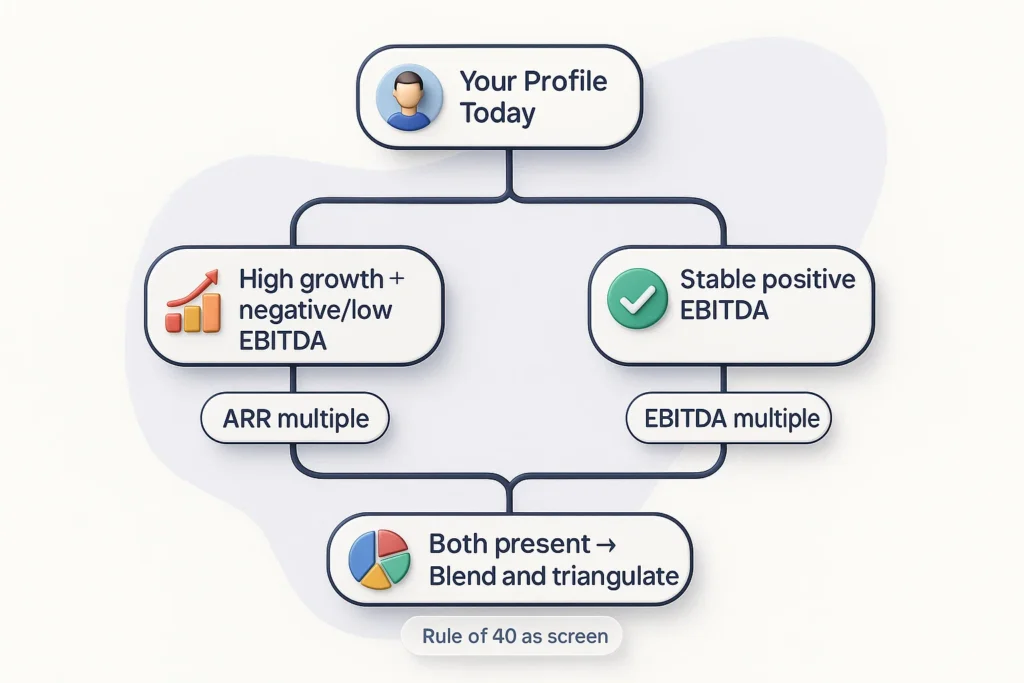

The Hybrid Valuation Approach

Sophisticated valuations incorporate both ARR and EBITDA multiples to triangulate fair value. This dual lens approach captures both growth potential and profitability validation. The resulting valuation range provides negotiation boundaries for buyers and sellers.

Many valuation professionals calculate both metrics then weight them based on company stage. A business transitioning from growth to profitability might apply 70% weight to ARR multiple and 30% to EBITDA multiple. The weights shift as the business matures and profit margins expand.

The Rule of 40 framework integrates both concepts by requiring growth rate plus EBITDA margin to exceed 40%. Companies meeting this threshold demonstrate balanced performance worthy of premium valuations regardless of which multiple framework applies.

ARR vs EBITDA Multiples: Comparison and Typical Benchmarks (2025)

| Metric | Typical Use Case | 2025 Benchmark Range | Key Advantages | Key Limitations |

| ARR Multiple | High growth SaaS emphasizing recurring revenue | Private: 3 to 10× ARR; Public: 7 to 12× EV/Revenue | Simple calculation focused on predictable revenue streams | Ignores profitability and can overvalue businesses with weak unit economics |

| EBITDA Multiple | Mature SaaS with stable profits and cash flows | Median 22.4× EBITDA; Upper quartile ≈ 46.5× | Captures profitability and actual cash generation capacity | Not suitable for loss making growth stage firms; sensitive to accounting choices |

Benchmarks vary significantly by company size, growth rate, vertical market focus, and geographic location.

Value Drivers That Move Your Multiple Up or Down

Growth Velocity and Customer Economics

Revenue growth rate directly correlates with SaaS business valuation multiples. High growth companies expanding 50% annually command ARR multiples between 10 to 15 times. Mature businesses growing 20% typically trade at 5 to 8 times ARR.

Net Revenue Retention above 110% signals powerful expansion economics within the existing customer base and is often associated with premium outcomes. This metric demonstrates customers increase spending over time through upsells, cross sells, and volume expansion. NRR exceeding 120% justifies premium multiples regardless of new customer acquisition rates.

Customer Acquisition Cost payback period under 12 months indicates efficient go to market execution and is often associated with premium outcomes. Businesses recovering acquisition costs quickly generate more cash to fuel growth. Long payback periods above 24 months raise concerns about sustainable unit economics even with strong revenue growth.

Profitability Standards and the Rule of 40

The Rule of 40 provides a quick health check for SaaS business valuations. Companies achieving growth rate plus EBITDA margin equal to or exceeding 40% demonstrate balanced performance. A business growing 30% with 15% margins or growing 20% with 25% margins both meet this standard.

Businesses exceeding Rule of 40 thresholds command premium valuations across both ARR and EBITDA multiple frameworks. This metric signals operational discipline combined with market opportunity capture. Buyers pay more for companies proving they can grow efficiently rather than burning capital indiscriminately.

Gross margins above 75% indicate scalable business models with strong pricing power. SaaS companies maintaining high gross margins demonstrate they deliver value customers willingly pay for. Lower gross margins below 60% raise questions about competitive positioning and long term profitability potential.

Market Position and Risk Factors

Company size influences SaaS business valuation multiples significantly. Businesses generating over $50 million in ARR typically command higher multiples than smaller counterparts. Larger companies demonstrate market validation, operational maturity, and reduced execution risk.

Customer concentration represents a major risk factor that reduces multiples. Companies deriving over 20% of revenue from any single customer face vulnerability if that relationship ends. Diversified customer bases with no single client exceeding 5% to 10% of revenue deserve higher valuations.

Market dynamics impact sector specific multiples within the SaaS business valuation landscape. AI enabled SaaS products currently command premium multiples due to technological advantages. Vertical SaaS serving regulated industries may trade at different multiples than horizontal productivity tools.

Practical Implementation: Steps for Founders, Buyers, and Investors

Preparing Your SaaS Business for Valuation

Founders preparing for exit or investment rounds must clean financial records and strengthen operational metrics. Revenue recognition practices should follow accounting standards consistently. Customer retention data needs documentation across multiple cohorts to demonstrate stability.

Choose which multiple to emphasize based on your current business stage. Companies growing above 50% with negative margins should highlight ARR multiple valuations. Businesses achieving profitability with moderate growth benefit from emphasizing EBITDA multiples instead.

Benchmark your metrics against industry standards to set realistic expectations. Private SaaS companies have a long-term median near 4.7× EV/Revenue. Understanding where your business falls within the range prevents disappointment during negotiations and helps you address weaknesses proactively.

Evaluating Acquisition Opportunities

Buyers and investors must look beyond headline multiples to understand underlying business quality. Unit economics including CAC, LTV, and churn rates reveal sustainability. Customer concentration analysis identifies revenue risks that might not appear in aggregate financial statements.

Apply the appropriate valuation framework based on business maturity and growth profile. Use ARR multiples for high growth opportunities where profitability remains a future milestone. Apply EBITDA multiples for cash flowing businesses where near term returns matter most.

Conduct sensitivity analysis on key assumptions to understand valuation ranges. Model scenarios where growth slows 10% or customer churn increases 5%. Understanding how these changes affect valuation helps you negotiate from an informed position and set appropriate risk reserves.

Action Checklist for SaaS Valuation

Top 5 SaaS Metrics Beyond ARR and EBITDA

- Net Revenue Retention (NRR) measures expansion revenue from existing customers and indicates product market fit strength

- Customer Acquisition Cost (CAC) Payback Period shows how quickly you recover the cost of acquiring each new customer

- Gross Margin reveals operational efficiency and pricing power independent of sales and marketing investments

- Annual Contract Value (ACV) demonstrates average customer size and helps predict revenue scaling patterns

- Logo Retention Rate tracks how many customers renew regardless of revenue changes and signals product stickiness

Calculate your current ARR by annualizing monthly recurring revenue and removing one time fees. Track trailing twelve month EBITDA by adding back interest, taxes, depreciation, and amortization to net income. These baseline metrics form the foundation for any SaaS business valuation discussion.

Identify which benchmark segment matches your business characteristics. Consider growth rate, company size, vertical market focus, and profitability profile. Comparing yourself to relevant peers produces more accurate valuation expectations than using broad market averages.

Determine which multiple framework provides the most defensible valuation for your situation. Fast growing companies with strong retention but negative earnings should lean toward ARR multiples. Profitable businesses with moderate growth rates benefit from EBITDA multiple frameworks instead.

Prepare adjustments for non recurring items that distort ongoing performance. Strip out one time implementation fees, founder salaries above market rates, or unusual legal expenses. Clean EBITDA calculations produce more accurate valuations and reduce negotiation friction with sophisticated buyers.

Develop a compelling narrative explaining your valuation position. A business transitioning from growth to profitability might say they justify an EBITDA multiple of 20 times based on 25% margins and 30% growth. The story supporting your numbers matters as much as the calculations themselves.

Top 5 Pitfalls in SaaS Valuation to Avoid

- Ignoring customer churn trends that steadily erode the revenue base and threaten long term sustainability

- Overlooking concentration risk when a handful of customers represent most revenue and create vulnerability

- Applying public company multiples to private businesses without adjusting for liquidity and transparency differences

- Focusing solely on growth while neglecting unit economics that determine eventual profitability potential

- Using outdated benchmark data from 2021 peak multiples that no longer reflect current market conditions

Common Questions About SaaS Business Valuation

When should a SaaS company shift from ARR to EBITDA multiples?

The transition occurs when businesses move from rapid growth with minimal profitability into stable recurring revenue with consistent positive EBITDA margins. Investors shift focus from growth potential to cash flow reliability at this stage. Companies make this transition once ARR is established, margins are consistently positive, and retention is stable.

Can you use both ARR and EBITDA in a single valuation?

Yes, the best practice combines both approaches to triangulate a reasonable value range. Start with an ARR multiple reflecting growth potential then apply an EBITDA multiple capturing profitability. Adjust each calculation for company specific risks related to size, customer concentration, and market position. The overlap between both methods often reveals fair value.

What metrics matter most for SaaS multiples in 2025?

Year over year ARR growth rate drives valuations for expanding companies. Net Revenue Retention above 110% proves expansion economics within the customer base. Gross margins exceeding 75% demonstrate scalability. CAC payback under 12 months shows efficient growth. Rule of 40 compliance combining growth and EBITDA margin signals balanced performance worthy of premium valuations.

Does a higher multiple always mean better value?

No, high multiples applied to weak fundamentals create overvaluation risk. Poor retention rates, high customer churn, or severe concentration issues undermine long term value regardless of the multiple applied. The market has grown more discerning in 2025. Being a SaaS company no longer guarantees premium ARR multiples without demonstrating strong operational metrics and sustainable unit economics.

How do you adjust valuations when performance declines?

Apply lower multiples or incorporate valuation discounts when key metrics deteriorate. If year over year growth drops from 50% to 30% and NRR falls from 120% to 100%, an 8 times ARR multiple might drop to 5 times or less. Similarly, declining EBITDA margins from 25% to 15% would reduce EBITDA multiples proportionally. Risk adjustments protect buyers from overpaying for deteriorating assets.

Get a Defensible SaaS Valuation With Bookman Capital

Understanding the difference between ARR multiples and EBITDA multiples gives you negotiating power whether you sit on the buy side or sell side of the table. The right valuation framework depends on your growth stage, profitability profile, and strategic positioning.

Founders preparing for exit need to emphasize the metrics that showcase their strengths. Investors evaluating deals must look beyond surface level multiples to understand true business quality. Buyers sizing opportunities should apply the appropriate framework based on investment thesis and return requirements.

Partner with experts who understand how to benchmark your business, position your strengths, and negotiate from an informed position. The SaaS business valuation landscape continues evolving as market conditions shift and investor preferences change.

Contact Bookman Capital today at bookmancapital.io/ and let our team help you navigate ARR versus EBITDA valuations with confidence. We bring deep expertise in SaaS metrics, market benchmarks, and transaction dynamics to maximize your outcome whether you are buying, selling, or raising capital.

Sources: