You spent $15,000 on ads this month. Twenty new customers sign up. Success, right? Not quite. The real question is simpler and scarier: how long before those customers actually pay you back?

Every dollar you spend acquiring customers sits in limbo until that customer generates enough profit to cover the cost. That waiting period determines whether you’re building sustainable growth or just burning cash with a fancy business plan attached.

This is what the CAC Payback Period measures. It’s the metric that separates thriving SaaS companies from those struggling to stay afloat.

The Metric Every SaaS Founder Needs to Master

Customer Acquisition Cost (CAC) represents every dollar your business spends on sales and marketing to win a single customer. This includes advertising spend, sales team salaries, marketing tools, and related expenses. CAC Payback Period measures the months required to recover these acquisition costs through the profit each customer generates.

The calculation divides your total CAC by the monthly gross margin each customer produces. Here’s the basic formula: Customer Acquisition Cost divided by Monthly Recurring Revenue multiplied by Gross Margin percentage.

Monthly Recurring Revenue represents the predictable income from each new customer. Gross Margin shows what percentage of that revenue becomes actual profit after covering direct costs like hosting and support.

A simple example makes this clear. You spend $1,200 acquiring a customer. That customer pays $100 monthly, and your gross margin sits at 75%. Your CAC Payback Period equals 16 months because $1,200 divided by $75 equals 16.

Most SaaS companies target gross margins between 70% and 80%. Industry data shows that 63% of public SaaS companies maintain gross margins above 70%, with 23% exceeding 80%. Lower margins extend your payback period and signal problems with your cost structure.

How This Differs From Customer Lifetime Value

Customer Lifetime Value looks at all the money a customer will spend with you over their entire time as a customer. CAC Payback Period focuses only on when you get your initial investment back.

Think of LTV as running a marathon and CAC Payback Period as running a sprint. Both are important races, but they measure different things about your business health.

LTV tells you if a customer is worth the money you spend getting them. CAC Payback Period tells you if you have enough cash right now to afford getting them.

Why Twelve Months Became the Industry Gold Standard

The 12-month benchmark separates healthy businesses from those burning through cash too quickly. Venture capitalists established this standard after watching thousands of SaaS companies succeed and fail over decades.

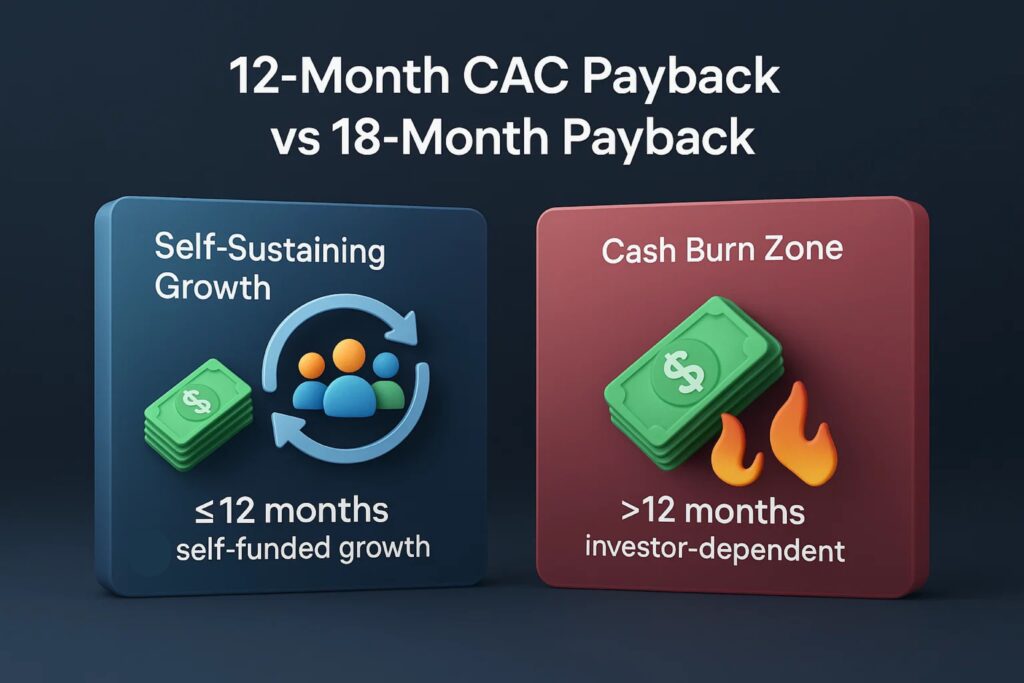

Here’s why this number matters so much. When you recover your acquisition costs within 12 months, you can use profits from existing customers to pay for new ones. This creates a self-sustaining growth engine that doesn’t need constant funding from investors.

Think of it this way. If it takes you 12 months to earn back what you spent on a customer, your business generates positive cash flow before running out of money. Customer profits naturally fund more customer acquisition, creating compounding growth.

On the other hand, companies that take longer than 12 months face serious problems. Every dollar spent acquiring customers sits locked up for over a year, which means you need outside money to keep growing. This limitation makes scaling expensive and risky.

The Reality Check: Where Most Companies Actually Stand

Here’s the truth that makes the 12-month standard so important. The median CAC Payback Period across all SaaS companies reached 18 months in 2024, according to the Benchmarkit 2025 SaaS Performance Metrics Report.

This means most companies fail to meet the 12-month benchmark. The standard exists not because companies typically achieve it, but because hitting this target separates efficient operators from those burning capital inefficiently.

The gap between the 12-month standard and the 18-month reality explains why investors focus intensely on this metric. Companies meeting the benchmark demonstrate superior capital efficiency that translates directly into competitive advantages.

Top-performing SaaS companies achieve payback periods between 5 and 7 months consistently. These organizations convert every acquisition dollar into profit twice as fast as the industry median, enabling faster scaling and commanding premium valuations.

How Company Stage and Deal Size Change the Equation

The 12-month standard applies most directly to early-stage and mid-market SaaS companies with average contract values under $25,000 annually. Enterprise SaaS companies selling to large organizations operate under different dynamics.

| Annual Recurring Revenue | Typical CAC Payback Period | Why It’s Different |

| Under $1M | 2-12 months | Lower ACV, faster sales cycles, lean acquisition costs |

| $1M – $10M | 11-15 months | Growing sales team, expanding channels, mid-market focus |

| $10M – $100M | 21-24 months | Enterprise deals, longer sales cycles, higher-touch sales |

| $100M+ | 30+ months | Complex enterprise contracts, strategic accounts, high LTV |

This progression happens because enterprise deals involve longer sales cycles, higher customer acquisition costs, and larger contract values. A $500,000 annual contract justifies a 24-month payback period that would sink a company selling $5,000 contracts.

The 12-month standard remains the benchmark for evaluating efficiency relative to your market segment and deal size. Enterprise companies get measured against different expectations, but the principle of capital efficiency stays constant.

When Longer Payback Periods Make Strategic Sense

Not every business needs to hit the 12-month mark. Enterprise customers who sign big multi-year contracts are worth the wait because they end up spending way more money over time.

Here’s another exception. When a customer pays $12,000 upfront on day one, you get your money back immediately. The math shows 12 months, but the cash is already in your bank account.

Companies flush with investor cash can also play the long game. If you’ve got millions in the bank and you’re racing to dominate a massive market before competitors catch up, waiting 18 or 24 months becomes acceptable.

Your existing customers matter too. When they keep buying more from you each year, growing their spending by 30% or more, that extra revenue helps recover your initial investment faster than you expected.

The Cash Flow Reality Nobody Discusses

Here’s what most founders miss. A 6-month payback needs half the cash of a 12-month payback to grow at the same speed.

Let’s say you’re spending $100,000 monthly to acquire customers. With a 12-month payback, you need $1.2 million sitting in limbo waiting to come back. Cut that to 6 months, and you only need $600,000 tied up. That frees up $600,000 to invest in more growth.

This difference gets bigger as you scale. Companies with faster payback periods can grow without constantly asking investors for more money. They use customer profits to fund new customer acquisition, creating a cycle that feeds itself.

This is exactly why the 12-month standard matters so much. Hit this benchmark and you can scale without needing huge cash injections just to keep growing.

Five Ways Extended Payback Periods Destroy Value

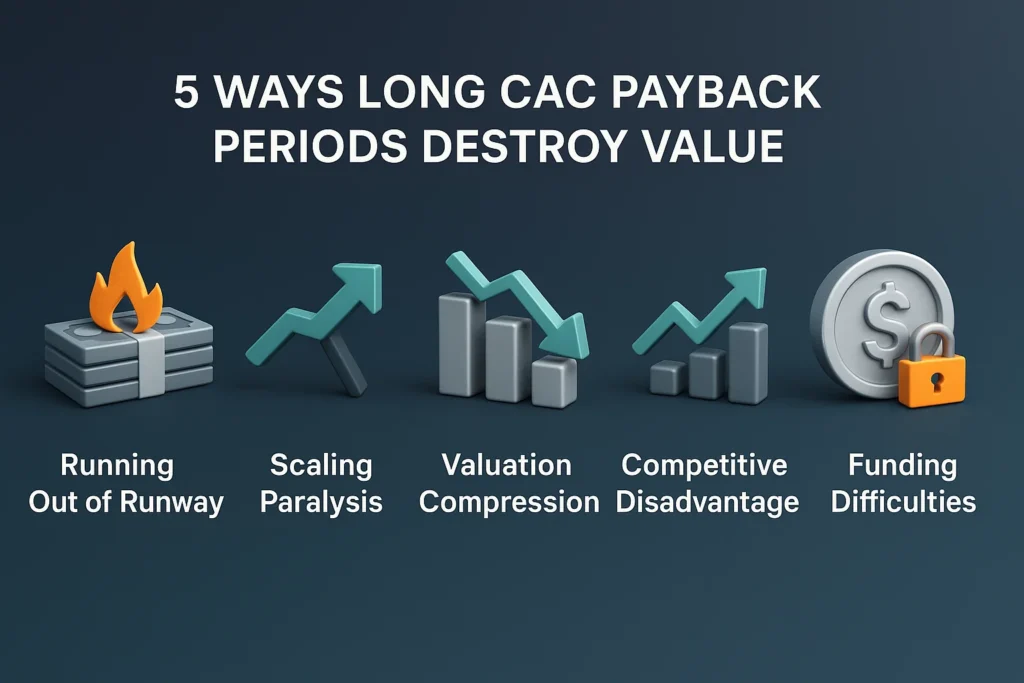

Running out of Runway happens when acquisition spending exceeds the ability to recover costs before cash depletes. Companies misjudge burn rates and face unexpected shortfalls.

Scaling Paralysis emerges when long payback periods prevent increasing acquisition spending. Growth stalls because the business cannot afford more customers at current efficiency levels.

Valuation Compression occurs when investors perceive higher risk in companies with inefficient unit economics. Extended CAC Payback Periods signal capital inefficiency that negatively impacts valuation multiples during fundraising or exit discussions.

Competitive Disadvantage develops as rivals with better metrics acquire customers faster. Market share shifts to companies that can outspend less efficient competitors.

Funding Difficulties arise when seeking additional capital with weak unit economics. Investors demand higher dilution or impose restrictive terms when the CAC Payback Period signals inefficiency.

Reading Warning Signs in Your Numbers

Several red flags indicate CAC Payback Period problems. A steadily increasing payback period over multiple quarters signals deteriorating efficiency. Marketing channels losing effectiveness or rising competition typically cause this trend.

Wide variance between customer segments reveals targeting problems. If enterprise customers show 8 8-month payback while small business customers need 18 months, your acquisition strategy needs refinement.

High churn rates before payback completion invalidate the entire metric. Customers churning at month 10 of a 12-month payback period represent a total loss of acquisition investment plus opportunity cost.

Misalignment with customer lifetime value creates sustainability problems. If your average customer churns at 18 months but payback requires 15 months, you extract only 3 months of profit per customer.

Eight Proven Moves to Hit the 12 Month Standard

Companies reduce CAC Payback Period toward the 12-month benchmark by attacking three variables: lowering acquisition costs, increasing monthly revenue, and improving gross margins. Here are eight proven moves that consistently work:

1. Conduct Channel ROI Analysis: Cut the bottom 20% of channels by efficiency and reallocate budget to high performers. Most companies discover that 2 or 3 channels drive 80% of quality customers.

2. Offer Annual Billing Incentives: Offer 15% to 20% discounts for annual prepayment. Customers perceive value while you accelerate cash receipt and improve your working capital position.

3. Deliver Onboarding Excellence: Reduce time to value with faster activation. Customers reaching milestones within 30 days show 60% better retention than slower adopters.

4. Launch Expansion Revenue Programs: Launch cross-sell and upsell campaigns to boost average revenue per account. A 20% increase in ARPA cuts the payback period proportionally without additional acquisition spending.

5. Implement Referral Incentives: Turn customers into acquisition channels. Referrals typically convert at 3x to 5x rates of paid channels while costing 50% less.

6. Optimize Free Trials: Shorten trials from 30 to 14 days to improve conversion through urgency while reducing free service delivery costs.

7. Prioritize High-Return Segments: Focus spending on customer profiles showing the fastest payback. Identify which verticals, company sizes, or use cases enable targeted acquisition investment.

8. Enhance Gross Margins: Automate customer support, optimize infrastructure spending, and remove unnecessary product features to improve profitability per customer.

How Leading Companies Track and Optimize

Successful SaaS companies treat CAC Payback Period as a board-level metric. Monthly reporting includes cohort analysis by acquisition channel, customer segment, and time period.

Integration with other SaaS metrics provides complete performance visibility. Tracking CAC Payback Period alongside net revenue retention, gross margin, and the Rule of 40 creates comprehensive business health monitoring.

Cohort-based tracking reveals performance trends before they impact aggregate numbers. Analyzing May 2024 cohorts separately from June 2024 cohorts shows whether improvements persist or represent one-time events.

Attribution modeling ensures accurate CAC calculation. Multi-touch attribution gives appropriate credit to marketing activities throughout the customer journey rather than only crediting the final interaction.

The Valuation Connection

Investors assign higher revenue multiples to companies demonstrating capital efficiency through metrics like CAC Payback Period. The connection between efficient unit economics and valuation remains clear across market conditions.

The 2024 SaaS market shows median private valuations around 5x ARR for healthy companies, according to SaaS Capital. Public market multiples range from 4x to 12x, depending on growth rates and efficiency metrics. Companies meeting the 12-month payback standard typically position themselves in the upper ranges of these valuation bands.

Efficient unit economics become table stakes during due diligence. Buyers scrutinize CAC Payback Period to validate sustainable growth models and assess working capital requirements post acquisition.

Strategic acquirers pay premium multiples for companies showing improving CAC trends. A business reducing payback from 15 months to 9 months over 12 months demonstrates operational excellence that commands higher valuations.

Frequently Asked Questions

What is the CAC Payback Period in simple terms?

CAC Payback Period shows how many months pass before customers generate enough profit to cover their acquisition costs. Calculate it by dividing the customer acquisition cost by the monthly gross margin per customer. A $1,000 CAC with $100 monthly gross margin equals a 10-month payback period.

Is 12 months actually a good benchmark?

Yes, the 12-month CAC Payback Period represents the established industry standard for evaluating SaaS capital efficiency. This benchmark separates efficient operators from those requiring external capital to sustain growth. The median SaaS company reaches 18 months, making the 12-month standard an aspirational but achievable target that signals healthy unit economics.

How do I reduce my CAC Payback Period quickly?

Focus on three improvement areas simultaneously. Reduce acquisition costs by optimizing marketing channels and cutting underperformers. Increase monthly revenue through pricing adjustments, annual billing incentives, and expansion selling. Improve gross margins by automating costs and removing inefficient service delivery.

What happens if my payback period exceeds 18 months?

Extended payback periods create serious cash flow problems that limit growth. You need more working capital to acquire each customer, face difficulty raising funding, and risk losing investment if customers churn early. Payback periods beyond 18 months require immediate investigation and corrective action unless justified by high-value enterprise contracts.

How does this metric affect company valuation?

CAC Payback Period serves as a key indicator of capital efficiency that investors evaluate during funding and acquisition discussions. Companies demonstrating payback periods at or below the 12-month standard typically position themselves for stronger valuations. Efficient unit economics reduce perceived risk and demonstrate sustainable growth potential that translates into higher revenue multiples.

Turn Your Metrics Into Growth Momentum

Understanding the CAC Payback Period is just the starting point. Converting that knowledge into a competitive advantage requires expertise and proven strategies.

Bookman Capital specializes in helping SaaS companies optimize unit economics and position for maximum valuation. Our team brings deep expertise in the metrics that drive business value and investor confidence.

Whether you’re preparing for fundraising, planning an exit, or scaling efficiently, the right guidance separates good outcomes from exceptional ones.

Visit Bookman Capital at bookmancapital.io/ today. Turn your CAC Payback Period into your biggest competitive weapon and build the capital-efficient growth engine your business deserves.

Sources:

- Software Equity Group (SEG) – SEG — “How to Calculate Cost of Goods Sold (COGS) for SaaS Companies”– SEG — “SaaS M&A and Public Market Report”

- Benchmarkit (RevOps Squared) – 2025 SaaS Performance Metrics Report

- Geckoboard / Stats for Startups

- David Skok (Matrix Partners) – SaaStr Presentations & Interviews

- Point Nine Capital – “The Art and Science of Figuring Out Your CAC Payback Time”