You’ve probably used both without knowing they’re fundamentally different beasts.

Slack? Everyone uses it. Toast? Only restaurants. Both are worth billions, but here’s the kicker: one type consistently sells for 30 to 50% more than the other.

It comes down to this: horizontal SaaS tries to be everything to everyone. Vertical SaaS? It picks one industry and becomes irreplaceable.

Think of a Swiss Army knife versus a surgeon’s scalpel. Both are valuable, but you’d never use a Swiss Army knife for heart surgery.

The numbers tell a compelling story. Vertical SaaS companies don’t just sell for more. They keep customers longer, charge higher prices, and face less competition. If you’re building, buying, or selling software, understanding why this happens isn’t just interesting. It’s essential.

Let’s break down what actually separates these two worlds.

Horizontal SaaS: Built for Everyone

Horizontal SaaS solves problems that every business has, regardless of what they do. We’re talking about the basics: communication, accounting, project management, and customer tracking.

The beauty of horizontal tools is their simplicity. A yoga studio and a law firm can both use Slack in the exact same way. No customization needed.

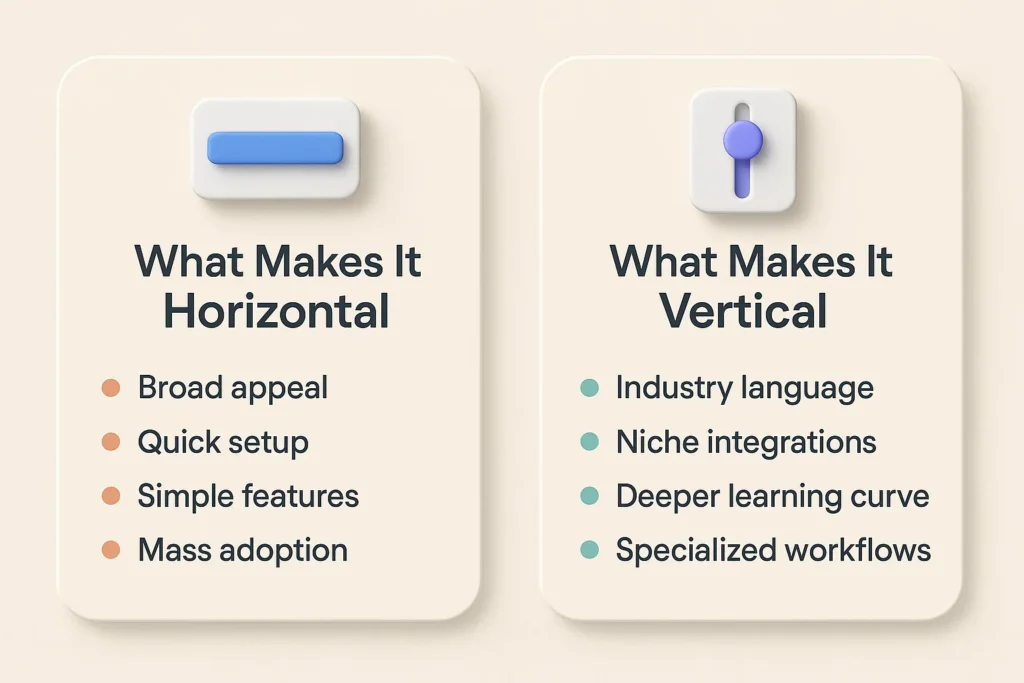

What Makes It Horizontal

These platforms chase the broadest possible appeal. They’re designed so anyone can sign up and start using them within minutes. No special training required.

The tradeoff? They can’t go deep on industry-specific features. QuickBooks handles basic accounting for everyone, but it won’t manage your restaurant’s recipe costing or your construction company’s change orders.

Volume is everything here. These companies need thousands, sometimes millions, of customers to make the math work.

The Big Names You Know

Slack changed how teams communicate everywhere. Doesn’t matter if you’re in healthcare, retail, or tech. It works the same way.

Salesforce became a CRM giant by being useful to sales teams in every industry imaginable. Same dashboard whether you’re selling software or selling cars.

QuickBooks handles the books for millions of small businesses across every sector you can think of.

Zoom became everyone’s video meeting solution overnight. Schools, hospitals, and startups all use identical features.

How They Make Money

The market size is enormous. When every business on earth is a potential customer, you’re looking at tens of millions of opportunities.

Marketing tends to be spray and pray: Google ads, content marketing, and free trials. Cast a wide net and see who bites.

Pricing usually starts low. Get people in the door cheap, then upsell them on premium features once they’re hooked. It’s the classic land and expand playbook.

Vertical SaaS: Industry Obsessed

Vertical SaaS goes all in on one industry. Every feature, every integration, and every piece of the product is built for a specific type of business.

This isn’t a tool that happens to work for restaurants. It’s a tool that couldn’t exist without deep knowledge of how restaurants actually operate.

What Makes It Vertical

These platforms speak your industry’s language. If you’re a dentist, the software knows what a CDT code is. If you run a construction company, you understand retention and lien waivers.

They integrate with the specialized tools only your industry uses. A dental practice system connects directly to X-ray equipment and insurance verification systems that other industries have never heard of.

Yes, there’s more to learn upfront. But once you’re using it, you wonder how you ever managed without it.

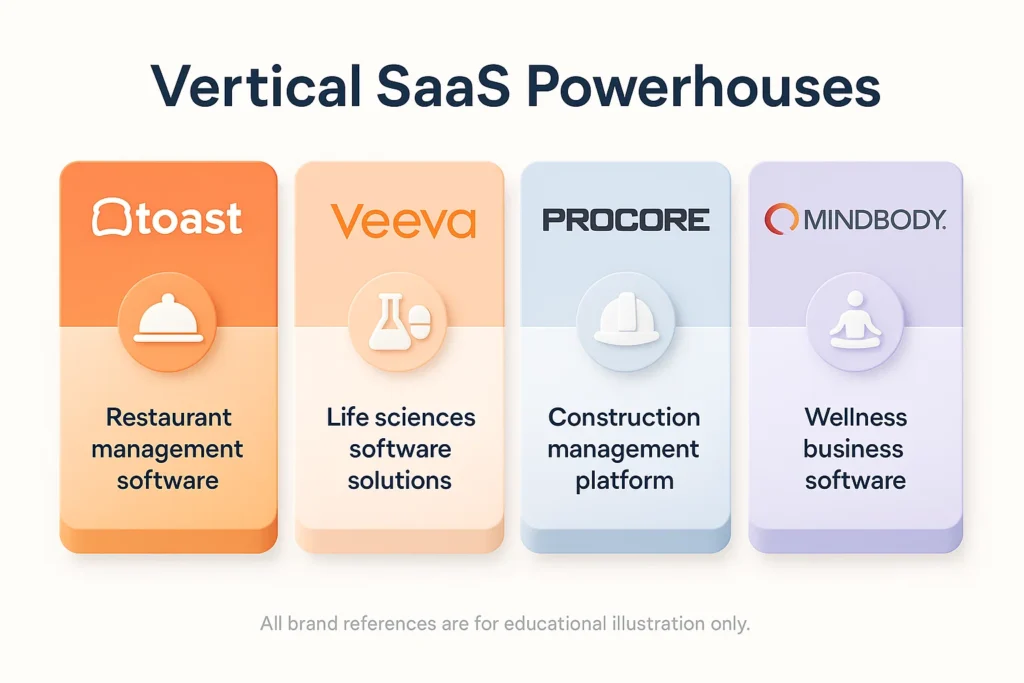

The Specialists Winning Big

Toast owns the restaurant world. Point of sale, inventory, staff scheduling, and menu engineering. Everything a restaurant needs in one place. In 2023, Toast processed $126.1 billion in payments and served over 106,000 restaurant locations. Try doing that with generic tools.

Veeva dominates pharma and life sciences. When you’re managing clinical trials and FDA compliance, you need software that gets it. Generic CRMs don’t cut it.

Procore transformed construction management. Blueprints, subcontractor coordination, and building codes. It’s built by people who understand job sites.

Mindbody runs fitness studios and wellness centers. Class scheduling, instructor payroll, and membership management are all designed specifically for the health and wellness world.

How They Make Money

The market is smaller, but they dominate it. Instead of chasing 50 million potential customers, they’re after the 100,000 restaurants or 50,000 dental practices that exist.

Sales are more targeted. Think industry conferences, trade publications, and word of mouth at association meetings. You go where your people already are.

Pricing is significantly higher because the value is undeniable. We’re talking $10,000 to $100,000 annually versus the $500 to $5,000 that horizontal tools charge. When software solves your exact problems, you pay for it.

The Big Differences That Matter

Market Size Reality Check

Horizontal players can theoretically sell to anyone with a business. That’s a massive addressable market, sometimes tens of millions of potential customers.

Vertical companies are limited by how many of businesses exist in their industry. There are only so many restaurants, dental practices, or construction firms out there.

But here’s the thing: smaller markets often mean you can actually win them. It’s better to own 60% of a niche than 2% of everything.

Depth vs Breadth

Horizontal tools stay relatively simple by design. They build features that work for 80% of users 80% of the time. Good enough for most, perfect for none.

Vertical platforms go incredibly deep. Toast doesn’t just process payments. It handles kitchen display systems, alcohol compliance, tip pooling rules, and menu profitability analysis. Try finding that in a generic POS system.

What It Costs to Win a Customer

Horizontal SaaS typically spends $500 to $3,000 to acquire each customer through digital advertising. They accept waste because volume makes up for it.

Vertical SaaS invests $3,000 to $15,000 per customer through direct sales and industry events. Sounds expensive until you realize those customers pay more and stick around longer.

Here’s the key metric: vertical companies get their money back faster. They recover acquisition costs in 12 to 18 months. Horizontal platforms take 18 to 24 months, despite spending less.

Pricing Power

Horizontal SaaS competes heavily on price because alternatives are everywhere. Monthly revenue per customer runs $50 to $500.

Vertical SaaS charges premium prices, $500 to $5,000 per month, because there simply aren’t good alternatives. When software is built for your exact workflow, you’ll pay for it.

Over time, this gap widens. Vertical platforms grow revenue per customer by 20 to 30% annually as they add features. Horizontal tools struggle to raise prices without losing customers to competitors.

Who Sticks Around

Horizontal SaaS faces higher customer turnover. Annual churn rates typically range from 10 to 15%. Switching is easy when dozens of similar tools exist and your data isn’t that complicated to move.

Vertical SaaS maintains much lower churn, often between 5 to 8% annually. Switching means retraining your entire staff, migrating years of industry-specific data, and losing integrations with equipment and systems.

That retention difference compounds. A vertical customer staying seven years generates substantially more lifetime value than a horizontal customer who churns after four.

The Competition Factor

Build a successful horizontal product and watch every tech giant on earth come after you. Google, Microsoft, and Amazon all have the resources to clone your features and undercut your price.

Vertical markets protect you through specialization. Google isn’t going to spend years learning restaurant operations to build competing software for a market of 200,000 potential customers.

Why Investors Pay More for Vertical

Customers Can’t Leave

Vertical SaaS becomes part of your daily operations in ways horizontal tools never do. When Toast runs every transaction in your restaurant, switching isn’t a decision. It’s a month-long project.

Your staff knows the system inside and out. They’ve learned industry-specific features that won’t exist anywhere else.

Years of data live in the platform. Customer histories, inventory patterns, vendor relationships. Moving all that is a nightmare nobody wants to attempt.

The Math Just Works Better

Vertical SaaS delivers superior numbers across the board. Higher prices plus better retention create exceptional lifetime value.

Most vertical platforms achieve lifetime value to acquisition cost ratios exceeding 5 to 1. Horizontal competitors struggle to maintain 3 to 1 in crowded markets.

Profit margins often exceed 80% because customers recognize the specialized value and pay accordingly.

Built In Network Effects

When most restaurants use Toast, food suppliers and delivery services build integrations with Toast. This makes Toast more valuable to the next restaurant that signs up.

Entire ecosystems form around successful vertical platforms. Third-party developers create add-ons that only work within that specific industry.

These dynamics create winner-takes-most markets. The leading vertical player often captures 40 to 60% market share, while horizontal markets fracture across dozens of competitors.

Tech Giants Stay Away

Microsoft won’t build dental practice management software. The market’s too small to move the needle on their balance sheet.

More importantly, they lack industry expertise. Building great vertical SaaS requires years of understanding niche workflows that generalist tech companies can’t justify acquiring.

This protection is real and lasting. Vertical players maintain pricing power indefinitely, while horizontal platforms constantly defend against billion-dollar competitors.

Side by Side: The Numbers

| What You’re Measuring | Vertical SaaS | Horizontal SaaS |

|---|---|---|

| Total market size | 10,000 to 500,000 customers | 10 to 50+ million customers |

| Annual customer churn | 5 to 8% | 10 to 15% |

| Monthly revenue per customer | $500 to $5,000 | $50 to $500 |

| Time to recover acquisition cost | 12 to 18 months | 18 to 24 months |

| Company sale price | 8 to 12× annual revenue | 5 to 8× annual revenue |

| Profit margins | 75 to 85% | 70 to 80% |

| Lifetime value vs acquisition cost | 5:1 or better | Around 3:1 |

| Risk from tech giants | Low | High |

Which Should You Build?

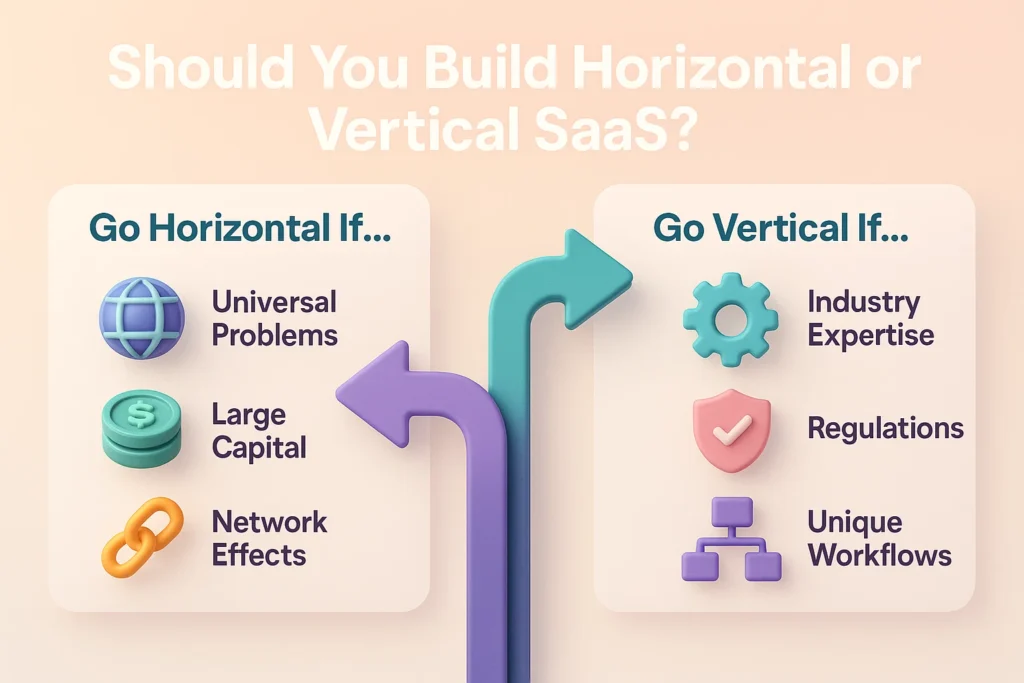

Go Horizontal If…

You’re solving genuinely universal problems. Some things, like team communication or basic accounting, really do work the same way everywhere.

You have serious capital to deploy. Horizontal success requires millions in marketing spend to reach critical mass before competitors crush you.

You can create cross-industry network effects. Slack succeeded partly because everyone your team works with also needs messaging software.

Go Vertical If…

You have deep industry expertise. Former restaurant operators build better restaurant software than talented engineers who’ve never worked a dinner rush.

Regulations create barriers. Healthcare and financial services demand specialized compliance that generic tools can’t handle.

The industry has unique workflows that horizontal tools serve poorly. Construction project management is so different from software development that generic project tools fail contractors completely.

The Middle Ground

Some companies start horizontal and go vertical over time. Salesforce began as CRM for everyone, but now offers specialized versions for healthcare, financial services, and manufacturing.

Others launch verticals and expand to adjacent industries. Toast started with full-service restaurants, then moved into quick service and catering.

This hybrid approach can work, but it’s tricky. Each vertical needs dedicated product teams and marketing resources. You can’t just rebrand the same tool.

Real-World Winners

Toast: The Vertical Playbook

Toast launched in 2013, focusing exclusively on full-service restaurants. The founders understood that restaurants didn’t just need software. They needed hardware, payment processing, and operations management working together seamlessly.

By 2023, they were processing $126.1 billion in annual payments. They’ve got over 106,000 restaurant locations as customers across the United States.

The company went public in 2021 and continues to grow. That success reflects the premium investors place on vertical SaaS economics with strong unit economics and customer retention.

Slack: Horizontal at Scale

Slack also launched in 2013, but as workplace communication for absolutely everyone. The product worked identically whether you ran a three-person startup or a 10,000-person enterprise.

They reached 12 million daily active users by serving every industry imaginable. Growth came from viral adoption, with teams bringing in other teams, with minimal customization needed.

Salesforce bought them for $27.7 billion in 2021. Massive, yes, but valued at typical horizontal multiples rather than the premium vertical companies command.

Where This Is All Heading

Vertical SaaS continues gaining market share. Investors increasingly recognize that sustainable economics beat pure growth stories.

Private equity firms especially love vertical platforms now. Predictable cash flows and sticky customers match their investment criteria perfectly.

AI is making vertical SaaS easier to build. You can now create industry-specific features faster using AI trained on sector data, lowering the expertise barrier.

New verticals keep emerging. Entrepreneurs are building specialized software for car washes, HVAC contractors, orthodontists, and industries that were underserved for years.

The market continues evolving toward solutions that combine deep industry knowledge with modern technology capabilities.

The Path Forward for Your SaaS Business

Vertical and horizontal SaaS aren’t just different strategies. They’re different businesses entirely.

Horizontal platforms chase massive markets with universal tools. Vertical solutions dominate niches through deep specialization.

That valuation premium for vertical isn’t random. It reflects lower churn, higher pricing, and better unit economics. More valuable customers make more valuable companies.

Your choice should match your expertise and resources. Vertical requires industry knowledge and patience while horizontal demands capital and competitive stamina.

Both can build great companies. The key is being honest about your advantages and the market reality you’re stepping into. This is where Bookman Capital comes in. We help SaaS founders understand their true market position before they enter exit conversations.

Ready to understand what your SaaS business is really worth? Whether you’re building vertical or horizontal, knowing your valuation drivers is critical for exit planning. Talk to the M&A team at Bookman Capital about how your business model positions you in today’s market.

Sources: