When you’re building a software business, one question dominates every strategic decision. Are you selling to businesses or consumers? This single choice reshapes your entire valuation story. The revenue multiples for B2B SaaS companies reached 5.8 times in 2023, while B2C platforms face different market dynamics that impact how investors price their future.

The valuation gap between these two models isn’t about luck or timing. It stems from fundamental differences in how customers behave, how revenue flows, and how investors calculate risk. Understanding these distinctions can help you build a more valuable company from day one.

What Are B2B and B2C SaaS?

B2B stands for Business-to-Business. These are software companies that sell to other businesses. Think of tools that help companies run their operations. Salesforce helps businesses manage customer relationships. Slack keeps teams connected. These platforms solve operational problems that organizations face daily.

B2C stands for Business-to-Consumer. These platforms sell directly to individual users. Netflix streams entertainment to your living room. Spotify delivers music to your headphones. Duolingo teaches you languages on your phone. These apps serve personal needs rather than business objectives.

The difference goes deeper than just who signs the check.

B2B customers need software that integrates with existing systems and serves multiple team members. B2C users want something simple that works immediately. No training manuals. No IT support required.

Why Investors Value These Models Differently

Your business model determines how investors see your future cash flows. B2B SaaS companies typically command higher valuations because they solve mission-critical business problems.

Bootstrapped companies yield a predicted private SaaS company valuation multiple of 4.8 times. Equity-backed companies yield a predicted valuation multiple of 5.3 times.

B2B companies often build longer-term contracts with enterprises. This creates predictable revenue streams.

Consumer-facing platforms must constantly fight for attention in crowded markets. Users can switch providers with a single click. This fundamental difference reshapes risk calculations and drives valuation gaps.

Revenue Stability Creates Valuation Premiums

Annual contracts form the backbone of B2B SaaS valuation. When customers commit to yearly payments, your business gains financial predictability. Investors reward this with premium multiples. Enterprise SaaS companies often have more considerable profitability potential due to the stability of subscriptions and the value of subscriptions.

B2C platforms usually rely on monthly subscriptions. Revenue fluctuates more dramatically as consumers react to economic changes or competitor offers.

The median multiple among the top 10 SCI constituents by ARR multiple is 14.2 times as of year-end 2024. B2B companies dominate these premium positions.

Customer Retention Rates Tell Different Stories

Churn represents the silent killer of SaaS valuations. B2B churn averages around 5.00 percent compared to B2C churn at 7.05 percent. This difference compounds dramatically over time. It reshapes the lifetime value of each customer and fundamentally alters valuation calculations.

Business customers rarely cancel software that powers critical operations. Once integrated into workflows and approved by multiple stakeholders, B2B software becomes embedded in organizational infrastructure.

B2C markets are typically larger than B2B markets. But this larger addressable market comes with more mercurial customers. They switch products based on price, features, or simply because they are bored.

Monthly Churn Benchmarks by Business Type

| Customer Type | Good Monthly Churn | Great Monthly Churn | Annual Impact |

| B2C SaaS | 3-5% | Under 2% | 31-46% loss |

| B2B SMB | 2.5-5% | Under 1.5% | 26-46% loss |

| B2B Enterprise | 1-2% | Under 0.5% | 11-21% loss |

Companies with net revenue retention above 120 percent achieved a median 11.7 times multiple in 2024. That’s more than double the industry median of 5.6 times.

This metric matters more than raw growth. It demonstrates your ability to expand revenue within existing accounts.

Acquisition Costs Shape Profitability Paths

Getting new customers costs money. Free trial consumers typically convert at 60 percent. Freemium consumers convert at 10 to 20 percent.

B2C companies often rely on digital marketing campaigns that cast wide nets. They hope to capture enough volume to offset high customer acquisition costs.

B2B sales cycles take longer but yield more valuable customers. Enterprise deals involve multiple decision-makers, proof-of-concept trials, and complex negotiations. The upfront investment is substantial. But the payback delivers a higher lifetime value that justifies the initial expense.

Growth Metrics That Investors Actually Care About

The SaaS industry is valued at approximately 273 billion dollars in 2024. The Rule of 40 combines growth rate and profit margin. It creates a benchmark that separates strong performers from struggling companies. A company growing at 30 percent with a 10 percent profit margin meets this threshold.

Net revenue retention separates mediocre businesses from exceptional ones. For SaaS companies selling into small and medium-sized businesses, a good NRR is around 90 percent. For enterprise SaaS, 125 percent is a good NRR. This difference reflects the expansion potential within enterprise accounts.

Key Valuation Drivers Comparison

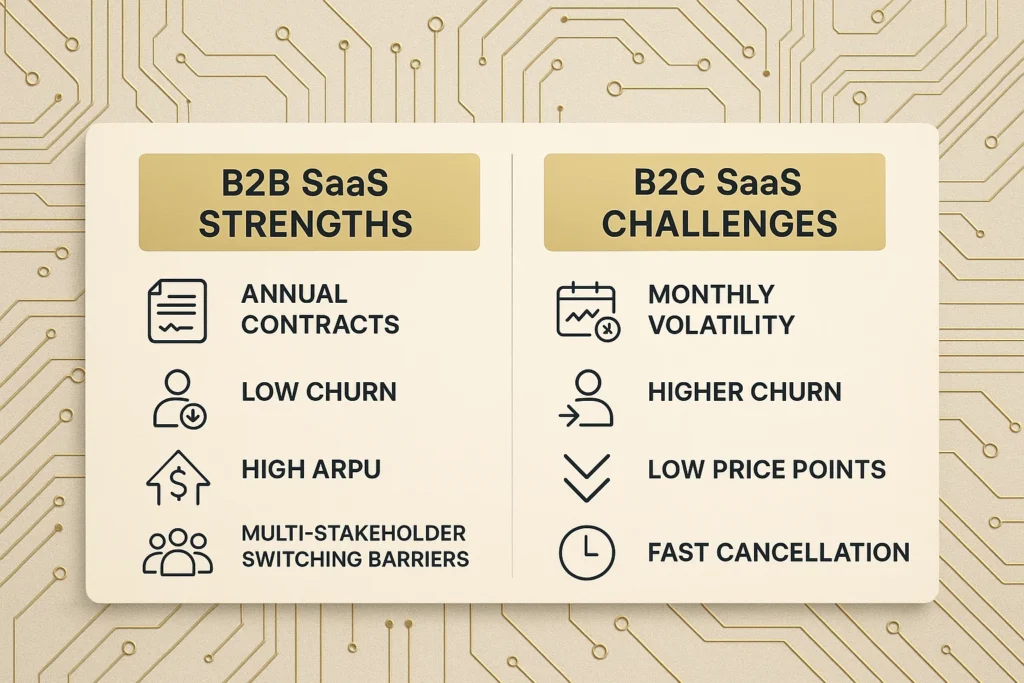

B2B SaaS Strengths:

- Annual contracts create revenue predictability

- Lower churn rates extend customer lifetime value

- Higher average revenue per user justifies sales investment

- Multiple stakeholders create switching barriers

- Mission-critical functionality drives retention

B2C SaaS Challenges:

- Monthly subscriptions increase revenue volatility

- Higher churn rates reduce lifetime value

- Lower price points require volume scale

- Single-user decisions enable quick cancellations

- Entertainment value competes with necessity

Strategic Positioning for Maximum Value

The SCI median valuation multiple is down 60 percent from its peak in 2021. It’s stabilizing in the 6 to 7 times range.

Companies with gross margins above 80 percent had a median multiple of 7.6 times. Companies below 80 percent gross margins earned a median of 5.5 times.

In 2024, 44 percent of all SaaS deals involved vertically focused companies. Buyers value purpose-built solutions that address specific industry challenges. These products become deeply embedded in customer operations. Healthcare software, real estate platforms, and financial services tools command premium valuations due to specialized expertise.

2025 Valuation Multiple Ranges

| Company Stage | Revenue Multiple | Key Considerations |

| Under $2M ARR | 3-7x | Model validation critical |

| $2-8M ARR | 3-7x | Scale economics emerge |

| Over $8M ARR | 4.8-5.3x | Proven fundamentals |

| Public Companies | 6-7x | Market sentiment drives price |

B2B companies should focus on expanding within existing accounts. Retention remains a top differentiator. Companies with net revenue retention above 120 percent achieve median multiples more than double the industry median.

B2C platforms must achieve significant scale to justify their valuations. Buyers strongly prefer SaaS businesses with churn below 6 percent.

Ready to Maximize Your SaaS Valuation?

Understanding the differences between B2B and B2C SaaS valuation is just the beginning. The right guidance can help you position your company for the most favorable exit possible. Whether you’re considering a sale or exploring growth capital, expert advisors make the difference between good outcomes and exceptional ones.

At Bookman Capital, we specialize in helping SaaS founders navigate complex valuation landscapes and identify optimal timing for liquidity events. Our team brings deep industry expertise and proven track records in maximizing exit values for software companies. Connect with us at bookmancapital.io/ to discuss how we can help you achieve your exit goals.

Frequently Asked Questions

What is the average valuation multiple for B2B SaaS companies in 2025?

The median valuation multiple for B2B SaaS companies stands at 7.0 times current run-rate annualized revenue. Bootstrapped companies sit at 4.8 times and equity-backed companies at 5.3 times. These multiples reflect a stabilization after the dramatic correction from the 2021 peaks.

Why do B2B SaaS companies have lower churn than B2C platforms?

B2B companies help other businesses solve problems. Lapsed interest isn’t a strong churn factor. Business software becomes integrated into critical workflows and requires approval from multiple stakeholders to remove. This creates natural retention barriers that consumer products lack.

How does pricing structure affect SaaS valuation?

Enterprise SaaS companies often have more considerable profitability potential due to more stability of subscriptions and the value of subscriptions. Annual contracts provide revenue predictability that investors reward with higher multiples. Monthly subscriptions create more volatility and uncertainty.

What churn rate is acceptable for B2B versus B2C SaaS?

B2B churn averages around 5.00 percent compared to B2C churn at 7.05 percent. For monthly rates, B2C SaaS between 3 and 5 percent is good. B2B SMB between 2.5 and 5 percent is good. Enterprise B2B companies with churn between 1 and 2 percent monthly demonstrate excellent performance.

How important is net revenue retention for valuation?

Companies with net revenue retention above 120 percent achieved a median 11.7 times multiple in 2024. That’s more than double the industry median of 5.6 times. This metric proves your ability to expand revenue within existing customers. Investors value this more highly than constant new customer acquisition.

How can Bookman Capital help maximize my SaaS valuation?

Bookman Capital specializes in helping SaaS founders navigate valuations and time liquidity events optimally. Their team brings deep expertise in both B2B and B2C models, with proven track records in maximizing exit values for software companies.

Sources: