Earnout structures determine how much of your SaaS sale price you’ll actually receive. You sold your company. The champagne’s on ice. But a chunk of your money hinges on future performance. This structure bridges valuation gaps in software acquisitions.

Our team sees these deals weekly. They create alignment but also real tension. This guide unpacks the mechanics for founders. We cover the concrete pros and cons. You will learn critical valuation tactics. The goal is simple: secure your financial future without regret.

What Is an Earnout in a SaaS Acquisition?

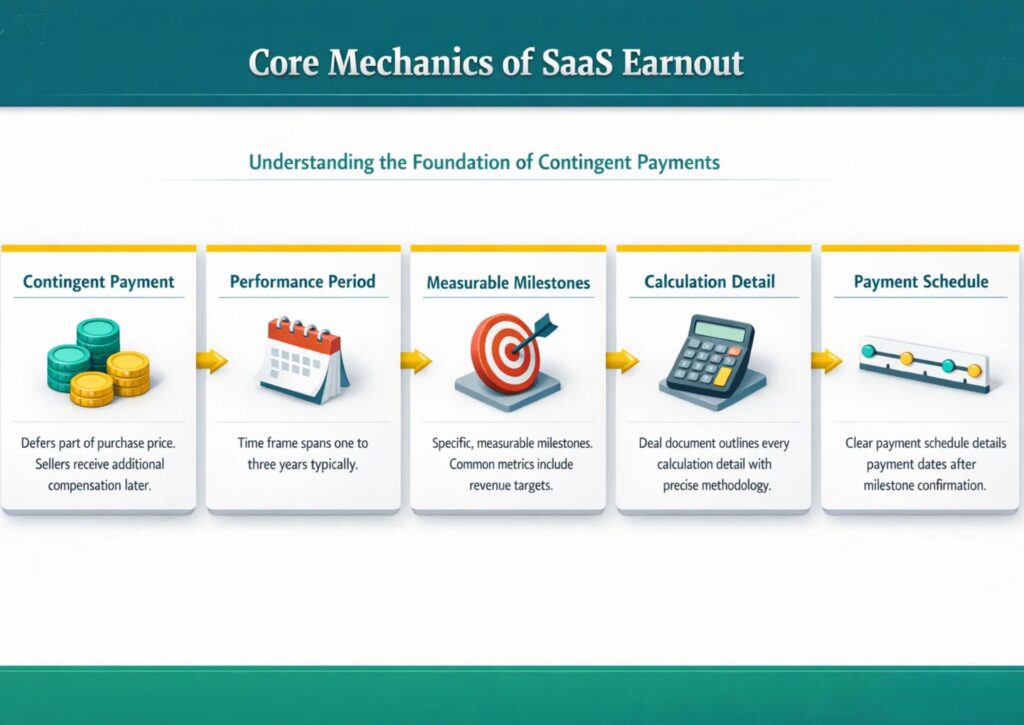

An earnout is a contingent payment provision, meaning you get paid later if you hit certain goals. Part of your sale price gets held back until the future. You receive this additional money only when the business reaches key milestones. These are usually financial or operational metrics like annual recurring revenue or net revenue retention. The earnout period typically lasts one to three years.

Acquirers use earnouts to manage risk. They protect against overpaying for future growth. Sellers use them to justify a higher total valuation. Both parties negotiate the specific milestones. The deal document outlines every calculation detail.

Core Mechanics of a Typical SaaS Earnout

All earnouts share common components. The structure defines the contingent payment amount. This is often a percentage of the total deal value. The arrangement establishes a precise performance period.

Earnouts use specific, measurable milestones. Common metrics include revenue targets and gross margin goals. Some deals use product integration timelines or customer retention rates. The agreement includes a clear payment schedule. It details payment dates after milestone confirmation.

Understanding the Financial Impact on Your Exit

The earnout percentage matters significantly. Deals typically allocate between 20% and 40% of the total purchase price to earnout provisions. A $10 million acquisition might include $6 million at close and $4 million contingent on performance. This split directly affects your financial planning and risk exposure.

Your tax treatment also changes with earnouts. Upfront payments are taxed immediately at capital gains rates. Earnout payments might be treated as ordinary income or capital gains, depending on the structure. Always consult with your tax advisor to understand the full implications before signing.

The Inevitable Challenges and Risks

Earnouts introduce complexity and potential conflict. The seller loses control after the acquisition closes. The buyer makes all operational decisions. These decisions can directly impact earnout targets.

Integration often changes customer segments or product focus. These shifts might hurt the metrics that trigger payments.

Disputes over calculation methods are frequent. The definition of “revenue” or “ARR” can become a battleground. Legal costs from disagreements eat into the earned money. The psychological strain on the selling team is heavy. It feels like working for a boss to earn your own sale proceeds.

Common Pitfalls That Derail Earnout Payments

Many founders discover problems too late. The buyer redirects your best engineers to other projects. Marketing budgets get slashed during integration. Pricing changes erode your customer base. Sales teams prioritize other products in the portfolio.

Another trap is metric manipulation through accounting choices. Revenue recognition policies can shift. Cost allocations change your gross margin calculations. The buyer controls the books and the definitions. Without protective clauses, you have limited recourse when numbers don’t match your expectations.

The Clear Advantages of Earnout Structures

Earnouts make deals happen when opinions differ. They align incentives between buyer and seller post-close. Sellers often stay on to run the business. This continuity helps maintain company culture and customer relationships. Earnouts can significantly increase the total sale price. Sellers receive premium compensation for delivered growth.

For Sellers:

- Higher Total Price: Achieve a valuation matching your growth forecast.

- Prove Your Case: Demonstrate that your projections are accurate and achievable.

- Earn Your Premium: Get paid extra for the growth you actually deliver.

For Buyers:

- Risk Mitigation: Pay a premium only for realized performance, not just promises.

- Seller Retention: Keep the founder engaged to ensure a smooth transition.

- Alignment: Ensure the seller’s goals directly support the business’s post-acquisition success.

Key Valuation Considerations for Your SaaS Business

Earnouts directly affect your company’s valuation math. You must separate guaranteed money from contingent money. The present value of an earnout is less than its face value. Future money is riskier than cash at close. Discount future payments for time and risk in your analysis.

The earnout’s design changes your effective valuation. Short performance periods with easy metrics are more valuable. Long periods with stretch goals carry more risk. Your negotiation position defines the terms. Strong, consistent growth metrics give you leverage. Consider your true willingness to stay and work under the new owner.

A Quick Comparison: Earnout vs. All-Cash Deals

| Consideration | Earnout Deal | All-Cash Deal |

| Upfront Payment | Lower | Entire purchase price |

| Total Potential Price | Higher | Fixed at closing |

| Seller Risk | High (performance-based) | None after close |

| Post-Close Control | Seller loses control | The seller has no control |

| Deal Complexity | High (legal, metrics) | Low |

| Ideal For | Bridging valuation gaps | Clean, fast exits |

Designing a Smart, Enforceable Earnout Agreement

Precision in the legal documents is non-negotiable. You must define every performance metric with accounting-level detail. Specify the exact calculation methodology. Use terms consistent with your historic financials. Assign clear responsibility for the calculation. Detail the review and dispute resolution process.

Protective Clauses Every Seller Needs

Your earnout agreement needs defensive provisions. These clauses protect your ability to hit the targets you negotiated.

Operational Controls Worth Fighting For

Negotiate for approval rights over major decisions. This includes pricing changes, sales team reductions, and product discontinuations. Request a minimum marketing budget commitment. Secure guaranteed access to engineering resources. These controls prevent the buyer from sabotaging your earnout through neglect or strategic shifts.

Additional Protective Clauses for Sellers:

- Resource Commitment: Get the buyer to commit specific marketing spend or developer headcount.

- Good Faith Obligation: Include a clause requiring the buyer not to hinder your earnout success.

- Audit Rights: Ensure you can review the financial calculations independently.

Common Earnout Metrics in SaaS

Different metrics serve different strategic purposes. Your choice reveals what the buyer values most.

Standard Performance Measurements:

- Annual Recurring Revenue (ARR): The most direct measure of growth.

- Gross Revenue Retention (GRR): Tracks your ability to keep existing customers.

- Net Revenue Retention (NRR): Measures expansion within your current customer base.

- Gross Profit: Shifts focus to the quality and profitability of revenue.

- Product Milestones: Tied to launching a new feature or integrating platforms.

The Bottom Line for SaaS Founders

Earnouts are powerful but double-edged tools. They unlock deal value that doesn’t exist today. They also create a risky employment contract with your buyer. Your success depends on the precise wording of the agreement. Assume nothing. Verify everything. Define all terms.

You need advisors who have done this before. They will spot the loopholes that cost you money. They will fight for the controls you need to hit your targets. A well-structured earnout rewards your company’s real growth. A poorly drafted one guarantees a costly dispute.

Need an expert review of your acquisition offer? The earnout clause could define your next few years. Our team at Bookman Capital analyzes these structures daily. We help SaaS founders understand the real value and risk. We ensure your deal aligns with your financial goals.

Contact Bookman Capital for a straightforward consultation. Let’s secure the full value of what you built.

Sources: