Building a company means making smart decisions about equity. When does a company need a 409A valuation matters more than most founders realize. Stock options can turn into tax nightmares without proper pricing. The IRS created Section 409A in 2004 after the Enron scandal, specifically to prevent companies from issuing artificially cheap stock options.

Getting this right protects your employees from unexpected tax bills. Getting it wrong triggers immediate taxation, a 20% penalty tax, and interest charges that stack up from the grant date.

What Is a 409A Valuation?

A 409A valuation measures the fair market value of your private company’s common stock. An independent third party performs this appraisal using accepted financial methods.

Section 409A of the Internal Revenue Code governs how private companies value equity compensation. The law requires companies to determine fair market value before granting stock options to employees, advisors, or contractors.

Think of it like a home appraisal. Just as a bank needs an independent assessment before approving your mortgage, the IRS requires an independent valuation before you can safely issue stock options. This protects everyone involved.

Why Safe Harbor Matters

A proper 409A valuation creates safe harbor protection. This shifts the burden of proof to the IRS.

With safe harbor, the IRS must prove your valuation was “grossly unreasonable” to challenge it. Without safe harbor, you must prove your valuation was reasonable. That difference is huge during an audit.

Safe harbor status requires specific elements. Your valuation must come from a qualified independent appraiser with at least five years of relevant experience. The report must use generally accepted valuation methods. The valuation must be less than 12 months old at the time of each stock option grant.

The Real Cost of Getting It Wrong

Employees face immediate income tax on the difference between the exercise price and fair market value. The IRS adds a 20% penalty tax on top of regular income tax. Interest charges accrue from the original grant date at the underpayment rate plus 1%.

These penalties apply to all vested options across all years. A single mispriced grant can create tax problems that compound over time.

Your company suffers too. Investors spot missing or questionable valuations during due diligence. Fundraising slows down. Acquisition negotiations get complicated. Your cap table becomes a liability instead of an asset.

When Does a Company Need a 409A Valuation: Primary Triggers

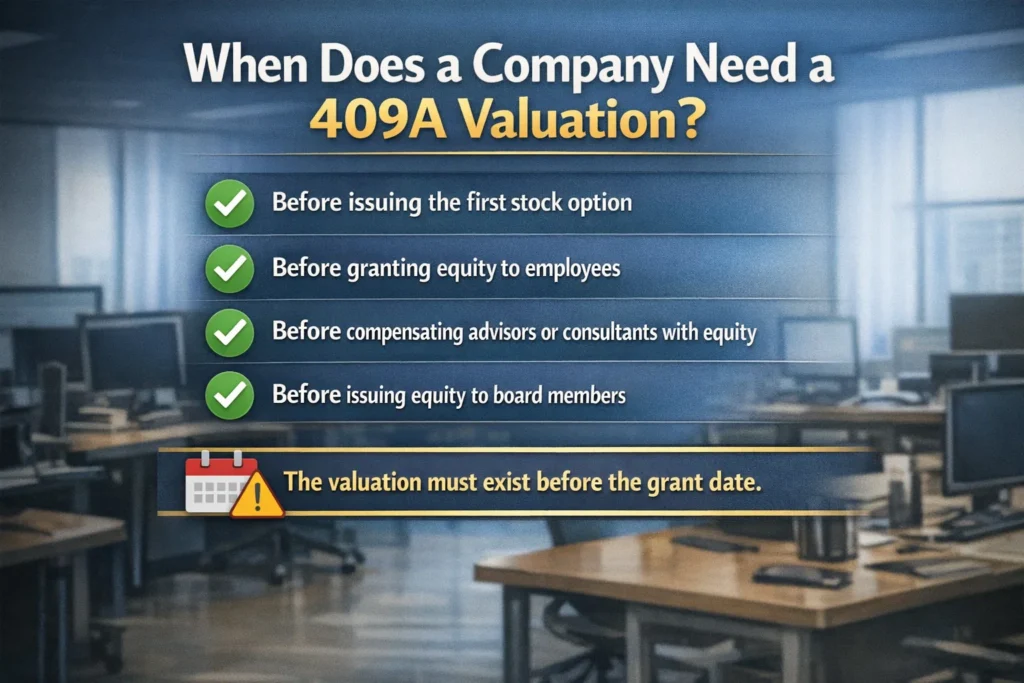

Companies need a 409A valuation before issuing the first stock option. This applies whether you grant options to employees, advisors, consultants, or board members.

You cannot legally grant equity compensation without knowing the fair market value. Planning to bring on your first hire with stock options? Get the 409A first. Bringing advisors on board for equity? Get the 409A first.

The sequence matters. The valuation must exist before the grant date. Doing it backwards creates compliance problems you cannot fix retroactively.

Material Events That Reset the Clock

A 409A valuation expires after 12 months. Certain company events invalidate your current valuation immediately, even if 12 months have not passed.

Material events change your company value enough that the old number no longer reflects reality. You need a fresh valuation before making new grants.

New Equity Financing

Raising capital establishes a new market price for your company. Every priced round, convertible note, or SAFE financing round counts. The new money changes your cap table structure and company value.

Major Customer Contracts

Landing a transformative deal shifts your financial outlook. Revenue projections change. Growth trajectory accelerates. The old valuation becomes outdated.

Significant Product Traction

User growth that exceeds expectations changes everything. Revenue jumps matter. Product market fit moments matter. These milestones increase company value materially.

Key Executive Hires

Bringing in proven industry leaders changes how investors view your potential. A rockstar CTO or experienced CFO shifts institutional perception of your company.

Important Patents Granted

Securing key intellectual property creates measurable new asset value. Patents protect your competitive position and increase company’s worth.

Company Stage Determines Timing

Your startup phase tells you when to act. Early-stage companies face different triggers than growth-stage companies.

Early-Stage Action Items

You need a 409A immediately if any of these describe your situation:

- Preparing to hire your first team member with equity compensation

- Negotiating with advisors who want stock options instead of cash

- Closing friends and family funding and setting up your option pool

- Joining an accelerator that requires documented equity structures

- Creating an employee stock option plan for the first time

Growth Stage Refresh Moments

Your existing 409A needs updating at these checkpoints:

- Ten months have passed since your last valuation or material event

- Planning your Series A, B, or later funding round

- Making regular hires but using outdated strike prices

- Starting acquisition or merger discussions

- Approaching annual board meetings where governance matters

The Valuation Process Explained

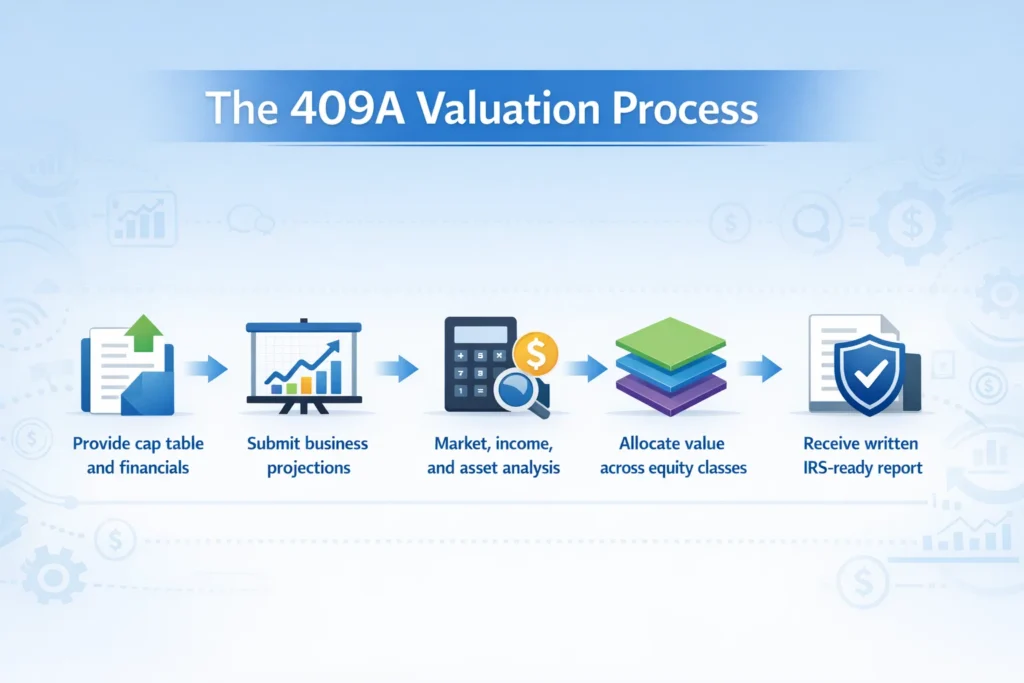

Valuation firms follow IRS-approved methodologies. The timeline typically takes two to four weeks from start to finish.

You provide core financial documents first. This package includes your cap table showing all equity holders and ownership percentages. Financial statements covering at least the past two years go in. Business projections for the next three to five years help analysts understand your trajectory.

The firm analyzes your complete financial picture. They examine assets, liabilities, revenue, burn rate, and cash position. Market analysis compares your company to similar businesses in your industry.

Three primary valuation methods are applied. The Market Approach compares your company to similar public companies and recent private transactions. The Income Approach estimates value based on the future cash flows your company will generate. The Asset Approach calculates value based on your company’s net assets.

Analysts then allocate enterprise value across your equity classes. Preferred stock includes special rights like liquidation preferences that common stock lacks. This discount calculation determines the fair market value of your common stock.

You receive a detailed written report. This document justifies every assumption and calculation. The report becomes your official IRS documentation. Quality reports include sensitivity analysis showing how different assumptions affect value.

Choosing the Right Valuation Provider

Low-cost options look tempting. They create expensive problems later.

Cheap valuations cut corners on analysis. They use simplified assumptions that do not withstand IRS scrutiny. The provider might lack proper credentials or relevant experience. Weak methodology falls apart during audits.

Quality providers cost more upfront because they do the work properly. They employ CPAs and analysts with business valuation credentials. They follow the Uniform Standards of Professional Appraisal Practice. Their reports hold up under audit.

Bookman Capital specializes in business valuations for startups and private companies, including 409A valuations. Our team understands the specific challenges founders face. We deliver defensible, audit-ready reports without unnecessary delays. We treat valuations as essential infrastructure for your equity program.

Common Questions About 409A Valuations

Founders ask similar questions about the valuation process. Here are the answers to the most common concerns:

How Much Does This Cost?

It depends on your company’s specific situation. Early stage companies with simple cap tables typically pay between $2,500 and $4,000 for their first valuation. More complex companies with multiple financing rounds, complicated equity structures, or significant revenue pay between $5,000 and $15,000.

Late stage pre IPO companies face higher costs due to increased complexity and frequency requirements. The investment protects you from penalties that vastly exceed the service fee.

Can We Use Our Funding Round Price?

No. Your preferred stock price does not equal your common stock price.

Preferred shares include investor protections like liquidation preferences, anti-dilution rights, and voting rights. Common stock lacks these features. Its value is always lower than preferred stock value.

The 409A calculation determines this specific discount. Using your preferred price for common stock options creates an illegal discount under IRS rules. This mistake triggers all the penalties we discussed earlier.

What Happens After 12 Months?

Your safe harbor protection expires completely. The old valuation loses its defensive power against IRS challenges.

Any stock option grants you make after expiration lack safe harbor coverage. This exposes your employees to 409A tax penalties immediately. You must obtain a new valuation before granting more options.

Smart companies refresh valuations at the 11-month mark. This prevents any gap in coverage.

Do We Need One for Every Hire?

No. One fair market value applies to all grants during the safe harbor period.

You use the same strike price for every option grant until either 12 months pass or a material event occurs. Then you commission a new valuation. The new fair market value applies to all future grants until the next refresh cycle.

Take Action Before You Grant Options

Most startups hiring employees need a 409A valuation now, not later. When does a company need a 409A valuation stops being a question once you plan your first equity grant.

Delay creates real tax exposure for the people you want to reward. The risk is not theoretical. Section 409A violations happen regularly to companies that skip this step.

Companies that take equity seriously treat valuations seriously. Your cap table is financial infrastructure. It deserves the same attention as your legal entity structure or banking relationships.

A proper 409A transforms equity from a compliance headache into a growth tool. Clean option grants attract top talent. Organized equity documentation speeds up fundraising. Your team receives stock options they can trust.

Get your 409A valuation right the first time. Bookman Capital delivers straightforward, secure valuations for growing startups. Visit https://bookmancapital.io/ to start your valuation today. Build your company on foundations that last.

Sources:

IRS Internal Revenue Bulletin 2007-19

Carta 409A Valuation Guide

Morgan Stanley 409A Valuation FAQ