If you had to grow ARR this quarter without shipping a single feature, could your SaaS pricing models do it? If the answer isn’t a confident “yes,” you’re leaving money on the table. Below, we break down the models actually working in 2025 and how to match them to your product, buyers, and usage patterns.

The SaaS market is large and still expanding in 2025 and that scale is reshaping how teams think about pricing. Growth puts pressure on acquisition, expansion, and retention at once, so the model you choose matters as much as the features you ship. Different sources measure either provider revenue or buyer spend, but all point to massive scale and that’s reshaping how teams approach pricing. These metrics capture different aspects of the market, but both indicate massive scale. This explosive growth has changed how companies think about pricing strategies.

Your pricing model determines your company’s success or failure. The wrong approach can kill your revenue growth and customer acquisition. The right strategy can accelerate your business beyond your competitors.

This guide explores the most effective SaaS pricing models for 2025. You’ll discover which models work best for different business types and customer segments.

Why Are SaaS Pricing Strategies Evolving So Rapidly?

The SaaS landscape has transformed dramatically in recent years. Traditional pricing approaches no longer deliver the same results they did five years ago.

Market pressures are driving this change. Published U.S. market estimates vary widely by scope and methodology, so it’s best to treat any single figure cautiously. This massive growth has intensified competition across all market segments.

Customer expectations have shifted as well. Buyers now demand more value-based pricing that aligns with their actual usage and outcomes. They reject one-size-fits-all approaches that don’t match their specific needs.

Economic Factors Reshaping SaaS Pricing Models

Economic uncertainty has made buyers more selective about their SaaS subscriptions. Companies are scrutinizing every software purchase with renewed intensity, comparing SaaS pricing models side by side. This scrutiny forces providers to justify their SaaS pricing models with clear, defensible value propositions.

Inflation has also impacted pricing strategies. SaaS companies must balance cost increases with customer retention. The challenge is raising prices without losing subscribers to competitors.

Technology advancements enable more sophisticated pricing approaches. AI and analytics tools help companies optimize their pricing strategy based on real customer behavior data.

What Makes Traditional Subscription Models Still Relevant?

Subscription pricing remains the foundation for most SaaS companies. This model provides predictable revenue streams for both providers and customers.

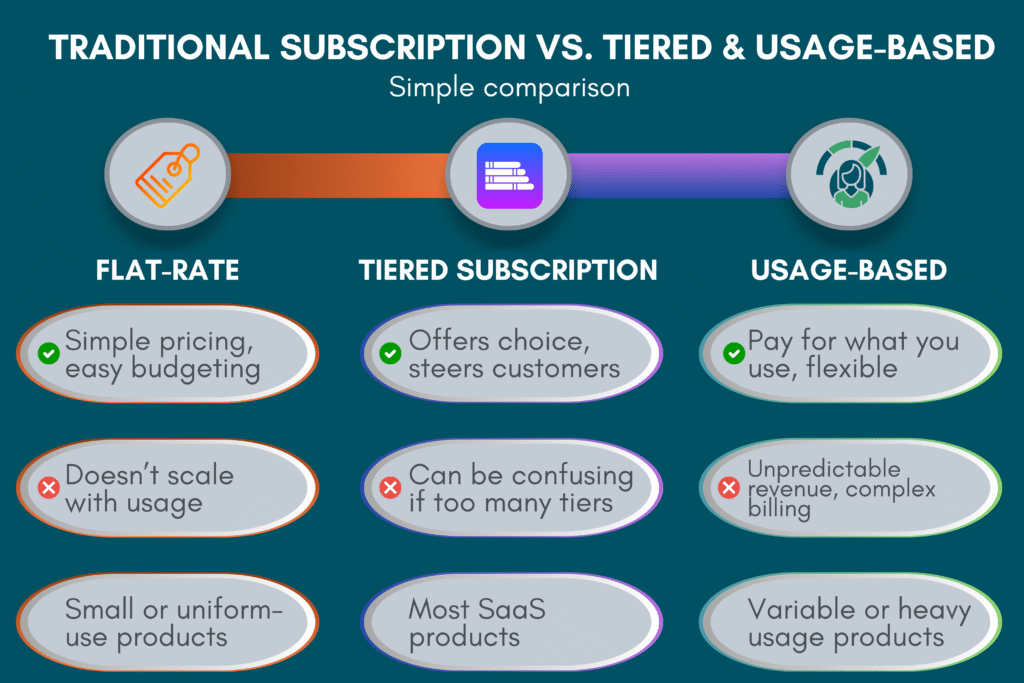

Flat-rate pricing offers the simplest approach to subscriptions. Customers pay one price for access to all features. This simplicity reduces friction in the sales process and makes budgeting straightforward.

However, flat-rate pricing has limitations. It doesn’t scale with customer growth or usage patterns. Large customers may feel overcharged while small customers might feel undercharged.

How Do Tiered Subscription Models Maximize Revenue?

Tiered pricing addresses flat-rate limitations by offering multiple subscription levels. Each tier provides different features, usage limits, or support levels.

The psychology behind tiered pricing is powerful. Customers often gravitate to a middle option (compromise effect, Simonson 1989) when plans are framed appropriately. This “goldilocks effect” allows companies to steer customers toward their preferred pricing level.

Successful tiered models follow specific principles. The basic tier should provide real value while leaving room for upgrades. The premium tier should include features that justify the higher price point.

Is Usage-Based Pricing the Future of SaaS?

A growing majority of SaaS companies now use usage- or consumption-based elements, aligning price with realized value.

Usage-based models work best for products where consumption varies significantly between customers. API services, data processing platforms, and cloud infrastructure benefit from this approach.

The model reduces barriers to adoption. New customers can start with minimal costs and scale up as they see value.

What Challenges Do Usage-Based Models Present?

Revenue predictability becomes more difficult with usage-based SaaS pricing models. Monthly recurring revenue fluctuates based on customer activity levels, which complicates financial forecasting and planning.

Billing complexity increases significantly. Companies need sophisticated systems to track usage, calculate charges, and generate invoices especially when SaaS pricing models blend subscription and consumption components. The technical infrastructure requirements are substantial.

Customer education becomes critical. Users need clear understanding of how their usage translates to costs. Without proper education, bill shock can drive customer churn.

How Effective Are Freemium Models for Customer Acquisition?

Freemium models offer basic functionality for free while charging for premium features. This approach has proven effective for customer acquisition and market penetration.

The freemium strategy works by demonstrating product value before asking for payment. Users become familiar with the software and develop usage habits that make switching costly.

Conversion from free to paid is typically low single digits and varies widely by product, audience, and freemium design. SaaS teams report diverse conversion patterns depending on how the free tier is scoped and the upgrade path is framed.

What Features Should Stay Free vs. Premium?

The line between free and premium features determines freemium success in your SaaS pricing models. Free tiers should provide enough value to be useful while creating clear upgrade incentives.

Storage limits work well as freemium boundaries. Users can accomplish meaningful work within limits but need more space as usage grows. This creates a natural upgrade path in SaaS pricing models.

Advanced features like analytics, integrations, or collaboration tools typically belong in premium tiers. These features appeal to power users who are willing to pay for enhanced functionality.

Which SaaS Pricing Models Works Best for AI-Powered SaaS?

AI and machine learning capabilities are becoming standard in SaaS products. These features often require significant computing resources that vary based on usage.

AI features lend themselves to usage-based pricing because computational costs scale with usage. Processing images, analyzing data, or generating content all consume resources proportionally.

How Should Companies Price AI Capabilities?

AI feature pricing should reflect the value delivered rather than just computational costs. Within your SaaS pricing models, a structure based purely on API calls or processing time may miss the true business value created.

Hybrid approaches work well for AI-powered SaaS. A base subscription provides access to standard features while AI capabilities use consumption-based pricing. This combines revenue predictability with usage alignment and keeps your SaaS pricing models flexible as workloads scale.

Value-based pricing for AI requires clear ROI demonstration. Companies must show how AI features improve customer outcomes in measurable ways. Time savings, accuracy improvements, or revenue increases provide concrete value metrics.

What Psychological Principles Drive Pricing Success?

Pricing psychology significantly impacts conversion rates and customer behavior. Understanding these principles helps optimize your SaaS pricing models.

Price anchoring influences customer perception of value. When you show a high-priced option first, other options within your SaaS pricing models can appear more reasonable by comparison. This effect works even when customers don’t choose the anchor price.

The decoy effect (Huber, Payne & Puto 1982) uses a strategically inferior option to make another option more attractive. A slightly cheaper plan with significantly fewer features makes the target plan appear like better value.

5 Pricing Psychology Tactics That Increase Conversions

- Position your preferred plan prominently – Use “Most Popular” or “Best Value” badges to guide customer attention

- Create artificial scarcity – Limited-time offers or limited seats per tier can accelerate purchase decisions

- Use charm pricing strategically – prices ending in 9 or 7 can lift response rates.

- Offer annual discounts – Monthly vs. annual comparisons make annual plans appear significantly cheaper

- Bundle features intelligently – Group complementary features together to increase perceived value

How Do You Choose the Right Model for Your Business?

The best SaaS pricing models depend on your product characteristics and customer base. No single model works perfectly for every SaaS business.

Product usage patterns provide the clearest guidance. If usage varies dramatically between customers, usage-based pricing aligns costs with value. If usage is consistent, subscription models offer better predictability.

Customer preferences matter significantly. Enterprise customers often prefer predictable subscription costs for budgeting purposes. Startups and small businesses may prefer usage-based models that scale with their growth.

SaaS Pricing Model Comparison

| Pricing Model | Best For | Revenue Predictability | Implementation Complexity | Customer Acquisition |

| Flat-Rate | Simple products, uniform usage | High | Low | Moderate |

| Tiered Subscription | Most SaaS products | High | Medium | Good |

| Usage-Based | Variable consumption patterns | Low | High | Excellent |

| Freemium | Viral products, large markets | Variable | Medium | Excellent |

| Hybrid | Complex products, diverse customers | Medium | High | Good |

What Trends Will Shape SaaS Pricing in 2025?

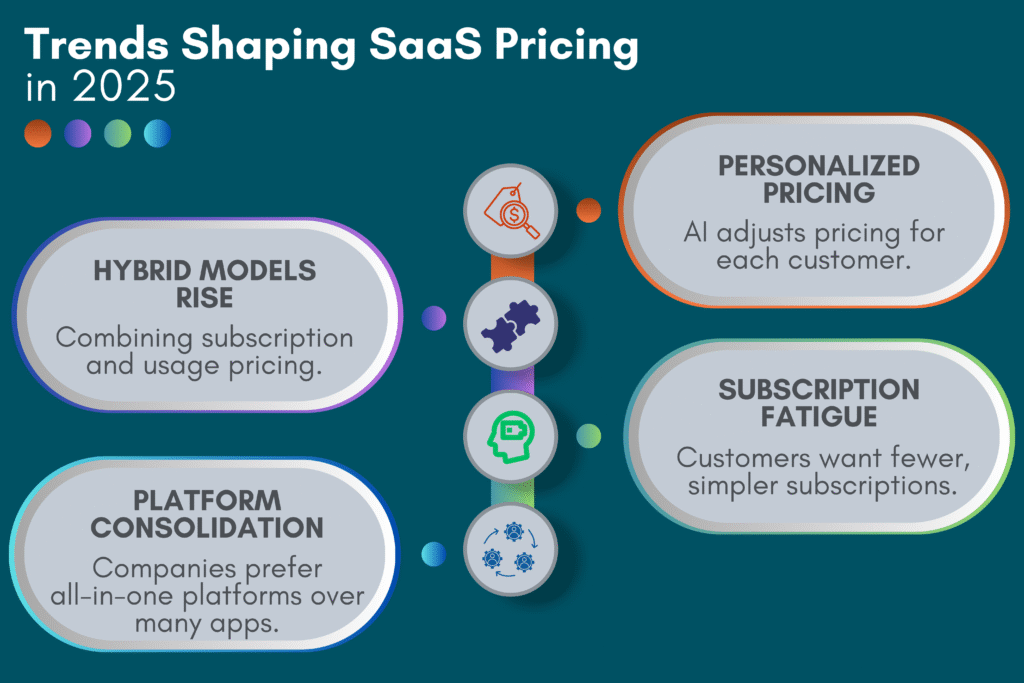

Several key trends are reshaping SaaS pricing strategies this year. Understanding these trends helps companies adapt their approaches proactively.

Personalized pricing is becoming more common. AI tools analyze customer data to suggest optimal pricing for individual accounts. This approach maximizes revenue while maintaining competitiveness.

Hybrid pricing models stand out for their adaptability and ability to cater to diverse customer needs and usage patterns. More companies are combining multiple pricing approaches within single offerings.

Subscription fatigue is real: many organizations are consolidating app portfolios to reduce cost and complexity, favoring platforms over point solutions. This trend favors comprehensive platforms over narrow tools.

How Are Market Leaders Adapting Their Strategies?

Successful SaaS companies are becoming more flexible with their SaaS pricing models. They’re testing different models for different customer segments rather than applying one-size-fits-all solutions.

Data-driven pricing optimization is becoming standard practice. Companies analyze customer behavior, churn patterns, and revenue data to refine their SaaS pricing models continuously.

Value-based positioning is replacing feature-based differentiation. Companies focus on customer outcomes and business impact rather than listing technical capabilities.

What Metrics Should You Track for Pricing Success?

Effective pricing with SaaS pricing models requires continuous monitoring and optimization. Key metrics reveal how well your pricing model serves both customer needs and business objectives.

Customer Acquisition Cost (CAC) shows how efficiently you convert prospects to customers. CAC varies widely by segment and channel; mid-to-enterprise motions often run in the high hundreds or more. Your SaaS pricing models directly influence this through conversion, payback, and expansion.

Lifetime Value (LTV) measures the total revenue generated per customer. The LTV to CAC ratio should exceed 3:1 for sustainable growth. Pricing changes significantly impact this ratio.

Monthly Recurring Revenue (MRR) provides the foundation for SaaS financial planning. Track MRR growth rates, churn impact, and expansion revenue to understand pricing effectiveness.

Advanced Metrics for Pricing Optimization

Average Revenue Per User (ARPU) reveals pricing power and customer value. Increasing ARPU indicates successful upselling or pricing improvements.

Net Revenue Retention (NRR) shows how well you expand revenue within existing accounts. NRR above 100% indicates customers increase their spending over time, reflecting net expansion.

Churn rate by pricing tier reveals which segments are most price-sensitive. Early-stage churn is often mid- to high-single-digit monthly, improving as product-market fit and ARPA increase. Analyzing churn patterns helps optimize pricing for retention.

How Can You Implement Pricing Changes Successfully?

Pricing changes to your SaaS pricing models require careful planning and execution. Poorly managed transitions can damage customer relationships and revenue growth.

Grandfathering existing customers often makes sense for major pricing increases. This approach maintains goodwill while capturing higher prices from new customers. However, it can create long-term revenue complexity.

Clear communication prevents customer surprise and backlash. Explain the reasons for changes and highlight new value being delivered. Focus on customer benefits rather than company needs.

A/B testing helps validate adjustments to SaaS pricing models before full implementation. Test new prices with small customer segments to measure impact on conversion and retention rates.

Common Pricing Change Mistakes to Avoid

Avoid implementing pricing changes without adequate notice. Customers need time to adjust budgets and evaluate alternatives. Sudden changes create negative sentiment that persists long-term.

Don’t change pricing without improving value proposition. Customers accept price increases when they see corresponding value improvements. Pure price increases without added benefits generate resentment.

Never neglect competitive analysis before pricing changes. Understanding market pricing helps position changes appropriately and avoid competitive disadvantages.

Ready to Optimize Your SaaS Pricing Strategy?

The SaaS pricing landscape continues evolving rapidly. Success requires continuous adaptation and optimization based on customer feedback and market dynamics.

Your pricing model shapes every aspect of your business growth. It influences customer acquisition, retention, and expansion revenue. Getting it right accelerates growth while getting it wrong limits potential.

The most successful SaaS companies in 2025 will be those that master flexible, data-driven pricing approaches. They’ll align pricing with customer value while maintaining operational efficiency.

Ready to optimize your SaaS pricing strategy for maximum growth? Bookman Capital specializes in helping SaaS companies scale through strategic pricing optimization and growth capital. Contact us today to discover how we can accelerate your revenue growth.

Sources:

- Worldwide public-cloud spend (SaaS category) 2025 forecast

- State of Usage-Based Pricing (2nd ed.)

- Net Revenue Retention (NRR) definition & usage