Most SaaS buyers focus on revenue, growth rates, and churn percentages. They miss something just as critical: how the business actually keeps customers around.

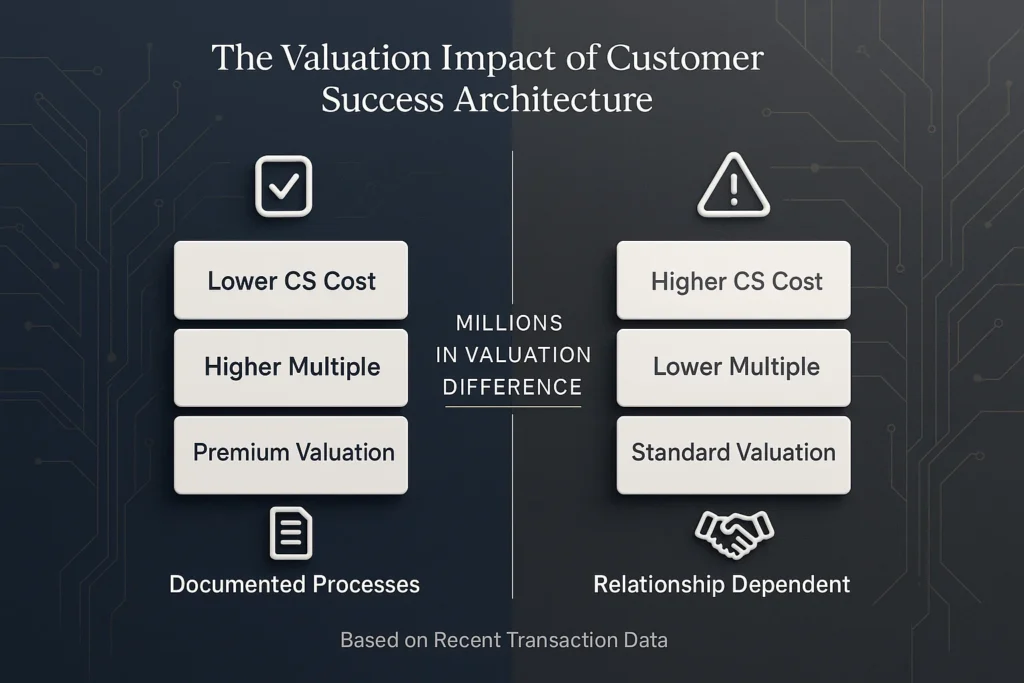

You can find two companies with identical revenue and similar retention rates. One might be worth millions more than the other. The difference? Customer success architecture.

This guide shows you what to look for, what to avoid, and how to spot the difference between real value and operational debt.

What Is Customer Success Architecture and Why Does It Matter?

Customer success architecture is how a company keeps customers happy, engaged, and paying. It includes team structure, processes, tools, and systems working together.

Some businesses achieve strong retention through solid systems. Others hit the same numbers through personal relationships and constant hustle. Both look identical on paper. The real difference only shows up during due diligence.

The Numbers Tell the Story

Flippa facilitated 795 SaaS business sales in 2024. Profit multiples ranged from 2x to 6.13x in the fourth quartile. That massive spread often comes down to customer success architecture quality.

According to Software Equity Group, companies with gross margins above 80% had median multiples of 7.6x in Q4 2024, while those below 80% earned 5.5x. Companies with Net Revenue Retention above 120% achieved median multiples of 11.7x.

Here’s a real example from market data. Two businesses both generate $3 million in annual recurring revenue with similar growth. Business A has documented processes and runs lean operations at higher margins. Business B operates in a relationship-dependent manner with lower margins despite similar retention.

Based on 2024-2025 market data, Business A commands 5-7x multiples. Business B struggles to reach 3-4x. That’s $6 million to $12 million difference in purchase price.

How Strong Customer Success Architecture Actually Works

The best customer success architecture uses specialized roles instead of generalists handling everything. Each person focuses on specific tasks they do well. This creates systems that survive personnel changes.

Four Core Functions That Scale

Dedicated Support Teams

- Handle technical issues through clear processes and service agreements

- Use ticketing systems, knowledge bases, and escalation protocols

- Track response times, satisfaction scores, and ticket patterns

- Deliver faster answers and more consistent quality

Implementation Specialists

- Own the first 90 days of each customer relationship

- Follow proven frameworks from contract to full product value

- Track milestones, engagement signals, and time to results

- Create predictable activation and retention outcomes

Renewal Managers

- Focus on contract negotiations and commercial terms

- Maintain clear pipelines and accurate forecasts

- Track expansion opportunities systematically

- Create clear accountability for retention results

Scaled Engagement Programs

- Deliver value through content libraries and educational webinars

- Build customer communities for peer-to-peer learning

- Use automated health monitoring and interventions

- Create leverage that grows with the business

Here’s why customer communities matter: they create retention advantages that survive acquisitions while cutting costs.

What Smart Buyers Check During Due Diligence

According to Windsor Drake’s analysis of SaaS M&A, buyers dig deep into how resources get distributed among support, implementation, and retention. As Bookman Capital’s comprehensive M&A guide emphasizes, success in SaaS acquisitions hinges on rigorous preparation and disciplined execution, particularly when evaluating customer success architecture transferability. Customer success architecture assessment reveals whether retention will transfer post-acquisition.

Here’s what buyers look for to evaluate customer success architecture quality.

The Due Diligence Checklist

Map Every Customer Touchpoint

- Document who owns each stage from contract to renewal

- Identify what triggers handoffs between stages

- Look for manual processes and undocumented workflows

- Spot single points of failure in the customer journey

- Strong architecture shows clear ownership and written procedures

Interview the Customer Success Team

- Ask how they prioritize accounts and spot at-risk customers

- Request their methods for measuring success

- Teams with systems describe specific frameworks

- Teams without systems struggle to explain clear methods

- Watch for data-driven triggers versus gut feelings

Examine Health Scoring Systems

- Request documentation on score calculations

- Check what thresholds trigger interventions

- Review the historical accuracy of predictions

- Strong systems track multiple usage signals and outcomes

- Weak systems rely on single metrics or subjective assessments

Analyze Retention by Segment

- Break down churn by acquisition channel and product tier

- Review expansion rates by company size and use case

- Wide variance suggests inefficient resource distribution

- Consistent performance indicates systematic approaches

- Look for patterns that reveal architectural strengths

The Metrics Driving Premium Valuations

Current market conditions reward efficiency and sustainability. Private SaaS companies in Q2 2025 traded at median multiples of 4.2x EV/TTM revenue, with top-tier assets averaging 6.1x. Companies above 80% gross margins and high NRR command premium multiples.

According to SaaS Capital’s 2025 survey, median private B2B SaaS companies spend 8% of ARR on customer support and success combined. However, this varies significantly by company stage and customer success architecture maturity.

Gainsight’s benchmarking data shows that companies over $100M ARR typically have customer success teams costing 10% of ARR or less, with 39% achieving less than 5% of ARR. Companies between $10M-$100M ARR should target under 20% as they scale.

Customer Success Cost Benchmarks by Stage

| Company Stage | Typical CS Cost as % of ARR | Target Performance |

| >$100M ARR | 5-10% | >105% NRR |

| $10M-$100M ARR | 10-20% | >100% NRR |

| <$10M ARR | Variable | Building foundation |

Source: Gainsight Customer Success Team Planning & Cost Benchmarks

SaaS Capital reports median Net Revenue Retention of 104% for bootstrapped SaaS companies with $3M-$20M ARR, with 90th percentile reaching 118%. ChartMogul’s data shows top-quartile companies with $15M-30M ARR achieving NRR between 115-120%.

Churn Expectations by Segment

Market data from multiple sources consistently shows buyers strongly prefer:

- Enterprise SaaS: Annual churn below 10%, with sub-6% commanding premium valuations

- Mid-Market SaaS: Annual churn in the 10-15% range acceptable if offset by expansion

- SMB-focused SaaS: Higher churn acceptable only with scaled programs and strong expansion economics

Five Investments That Maximize Exit Value

Planning to sell your SaaS business? These customer success architecture investments pay off both operationally and in deal value.

1. Create a Dedicated Renewal Role Early

Most businesses wait until $5 million ARR. Consider starting at $2-3 million if your contract values support it. Early specialization establishes commercial discipline and reduces founder dependency. It demonstrates systematic retention management that buyers value.

2. Document Every Process as You Go

Every written process adds intellectual property value. Buyers pay more for comprehensive playbooks because they reduce integration risk. Documentation reveals gaps you can fix before listing. As Windsor Drake emphasizes, thorough documentation shapes deal terms and integration plans.

3. Build Programs That Scale Without Headcount

Content libraries, automated onboarding, and customer communities create leverage. Every dollar of retention through programs instead of high-touch time improves margins. This differentiates your customer success architecture from competitors.

4. Implement Quantitative Health Scoring

Research shows that Gainsight’s customer health scoring platform helped a SaaS company achieve 15% reduction in churn within a year. HubSpot reduced churn by 20% by implementing machine learning-based health scoring.

Data-driven scoring shows analytical sophistication that buyers value. It enables proactive problem-solving that improves retention outcomes.

5. Track Efficiency Metrics Buyers Analyze

Go beyond churn and Net Revenue Retention. Measure:

- Customer success manager ratios by segment

- Cost per customer retained

- Percentage of zero-touch renewals

- Health score prediction accuracy

- Expansion revenue rate by cohort

These metrics prove customer success architecture excellence during due diligence.

Four Red Flags That Kill Deals

Watch for these warning signs because they often lead to price cuts or deal restructuring.

Revenue Tied to Departing Personnel

When key team members hold critical customer relationships, their exit creates immediate revenue risk. As highlighted in GLC Advisors’ 2025 analysis, management teams face extended interview processes during acquisitions, and key-person risk often results in valuation haircuts and structural protections like escrows and earnouts.

Test whether relationships transfer or evaporate with personnel changes.

Missing Onboarding Documentation

No current playbooks means implementation quality varies by who handles it. This inconsistency creates unpredictable activation and retention. It extends integration timelines and increases post-close resource needs.

Customer Success Costs Above Industry Benchmarks

According to Gainsight data, if your customer success team costs exceed 20% of ARR for companies under $100M, you’re operating above industry benchmarks. Calculate true, fully loaded costs including salaries, benefits, tools, and overhead.

Customer success architecture significantly above benchmarks indicates efficiency issues. Factor remediation costs and timeline into your valuation expectations.

No Customer Health Monitoring System

Businesses lacking health scoring operate reactively. This allows preventable churn and misses expansion opportunities. It suggests the customer success architecture lacks analytical sophistication.

Your Competitive Edge in Acquisitions

Understanding customer success architecture creates three clear advantages.

You avoid overpaying for unsustainable businesses. A 95% retention rate from heroic efforts isn’t worth the same as 95% from systematic customer success architecture.

You spot opportunities where strong product-market fit hides behind inefficient customer success architecture. These businesses trade at discounts but transform through architectural improvements.

You accelerate post-acquisition value creation. Instead of broadly adding resources, you strategically build specialized functions in the right order for maximum impact.

For sellers, professionalizing customer success architecture before engaging buyers directly impacts exit valuations. According to The SaaS Barometer, PE buyers now place higher priority on EBITDA, while strategic buyers prioritize customer retention, cross-sell opportunities, and operational readiness.

Questions Buyers and Sellers Ask

How much should customer success really cost?

According to SaaS Capital, efficient private B2B SaaS companies spend 8% of ARR median on customer support and success combined. Gainsight benchmarks show companies over $100M ARR typically operate at 10% or less, with best-in-class under 5%. Smaller companies ($10M-$100M ARR) should target under 20% as they scale. The key metric is cost per customer retained relative to their lifetime value.

When should I create specialized roles?

Start considering dedicated support and onboarding roles at $2-3 million in annual recurring revenue if your contract values support it. Add a renewal manager once you have sufficient contract volume to justify the role. Gainsight data shows that over-investing early is key to ensure success later in the company’s lifecycle. Waiting too long creates operational debt that reduces acquisition value.

What churn rate do buyers expect?

Flippa marketplace data shows buyers strongly prefer SaaS businesses with churn below 6% for premium valuations. For enterprise SaaS, annual churn of 6-10% is acceptable. Mid-market SaaS can operate in the 10-15% range if offset by strong expansion revenue. SMB-focused SaaS faces higher churn expectations but must demonstrate scaled programs to compensate.

What valuation multiples should I expect in 2025?

According to Software Equity Group, the median EV/TTM Revenue multiple for Q4 2024 was 4.1x, with averages reaching 6.0x. Flippa’s H1 2025 data shows profit multiples for smaller businesses ranging from 2x-4x for owner-operated businesses, with top-quartile performance driving premiums up to 6.13x. Companies with strong customer success architecture, high margins, and efficient operations command the highest multiples.

Work With M&A Experts Who Understand Customer Success Architecture

You can’t evaluate customer success architecture with standard financial reviews alone. The architectural reality behind retention metrics determines whether acquisitions create or destroy value.

At Bookman Capital, we help SaaS buyers and sellers understand customer success architecture dynamics. Whether evaluating targets or preparing for exit, we provide specialized insights that maximize transaction value.

Our team brings deep experience in SaaS operations, customer success architecture evaluation, and middle-market mergers and acquisitions. We help buyers spot hidden architectural risks and find efficiency opportunities. For sellers, we position customer success architecture to command premium valuations and accelerate exit timelines.

The SaaS businesses getting the highest multiples in 2025 prove their results come from scalable, efficient, transferable customer success architecture.Contact Bookman Capital to discuss your next SaaS transaction. Our expertise in customer success architecture evaluation protects and enhances deal value.

Other source(s):