Most founders treat their 409A valuations as a mysterious black box. You send documents, wait three weeks, and receive a number you’re supposed to trust. But understanding the financial mechanics behind that number helps you anticipate changes, explain valuations to employees, and make better equity decisions.

Let’s break down exactly how appraisers determine your 409A valuations. We’ll cover the methods they use, the calculations they perform, and why your common stock is always worth less than what investors pay.

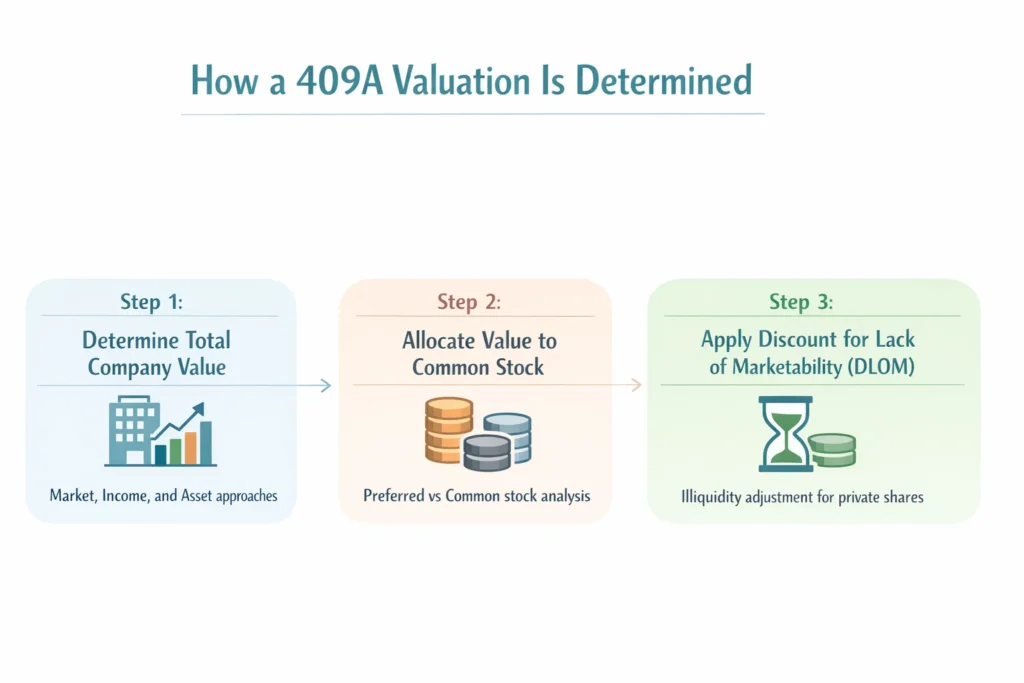

The Three Steps Appraisers Follow

The 409A valuations follow the same basic process. First, appraisers calculate your total company value (enterprise value). Second, they figure out what common stock is worth versus preferred stock. Third, they apply a discount because private stock can’t be easily sold.

Each step uses specific methods that the IRS accepts as valid.

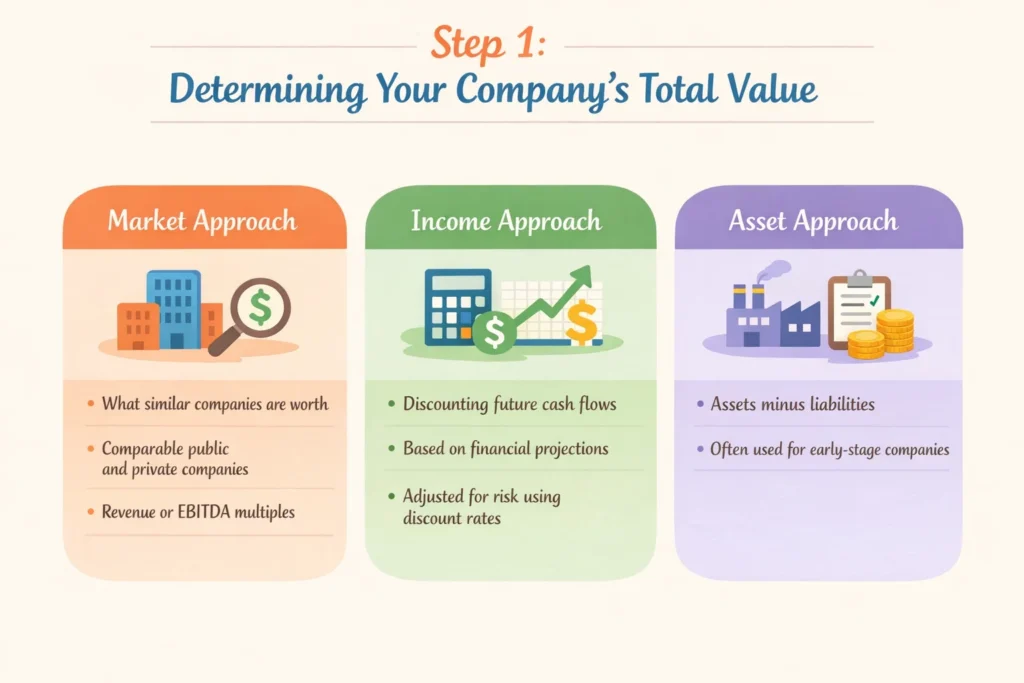

Step 1: Determining Your Company’s Total Value

The IRS recognizes three main approaches to calculate what your company is worth. Most appraisers use a combination of these methods.

The Market Approach: What Similar Companies Are Worth

This method for 409A valuations looks at comparable companies. Appraisers find businesses similar to yours that recently sold or are publicly traded. They examine what prices these companies fetched.

Then they apply the same math to your company for the 409A valuations. If SaaS companies in your space trade at 10x revenue, and you have $5M in revenue, this suggests a $50M valuation.

The challenge is finding truly similar companies. They need to match your business model, size, growth rate, and market. Good comparables make this method reliable. No comparables mean less weight on this approach.

The Income Approach: Discounting Future Cash Flows

This method says your company is worth the money it will generate in the future. But future money is worth less than money today. Appraisers must “discount” those future cash flows back to present value.

This requires detailed financial projections. You forecast revenue, expenses, and cash generation for 5-10 years. The appraiser reviews these numbers carefully.

The most critical input is the discount rate. This number reflects how risky your business is. Higher risk means a higher discount rate, which lowers your value.

How discount rates get built:

Start with the risk-free rate. This is what you’d earn on Treasury bonds, currently around 4-5%.

Add the market risk premium. Investors demand extra returns for stock market risk. This adds 6-8 percentage points.

Multiply by beta. This measures your volatility versus the overall market. Tech startups often use 1.2 to 1.5.

Add the size premium. Small companies are riskier than large ones. This adds another 3-7 percentage points.

Add company-specific risks. Customer concentration, unproven technology, and key person dependence all increase risk. This adds 5-10 more percentage points.

Example calculation:

- Risk-free rate: 4.5%

- Market premium times beta: 1.3 × 7% = 9.1%

- Size premium: 5%

- Company-specific risk: 7%

- Total discount rate: 25.6%

Early-stage startups typically see discount rates of 25-50%. Later-stage companies get 15-25%.

The Asset Approach: Adding Up What You Own

This is the simplest method for 409A valuations. Calculate the fair value of all your assets. Subtract your liabilities. The result is net asset value.

This works for early-stage companies or those with significant physical assets. But most tech startups get little weight here. Their value lies in future growth, not current assets.

Step 2: Allocating Value to Common Stock

You now have a total company value. But you need to know what one share of common stock is worth. This requires understanding your cap table structure.

Why Preferred Stock Is Worth More

Investors don’t buy common stock. They buy preferred stock with special rights.

Liquidation preferences guarantee they get paid first. A 1x preference means investors get their money back before common shareholders receive anything.

Participation rights let some investors double-dip. They get their preference plus a share of remaining value.

These rights are valuable. They make preferred stock worth more than common stock.

The Option Pricing Method (OPM)

For early-stage companies, appraisers often use OPM. This treats each share class as a call option on company value.

Think of it this way. Common shareholders only get paid if the company sells for more than the liquidation preferences. That’s like holding a call option.

The math uses Black-Scholes option pricing. It requires your enterprise value, expected volatility, time until exit, and liquidation preference amounts.

OPM typically values common stock at 10-30% of preferred stock prices for early companies.

The Probability-Weighted Method (PWERM)

Later-stage companies often use PWERM instead. This method is more straightforward.

Appraisers identify possible outcomes. Maybe 30% chance of IPO, 60% chance of acquisition, 10% chance of failure.

They calculate what each share class receives in each scenario. Then they are weighted by probability and discounted to present value.

Example:

IPO scenario (30% probability): Common gets $2.50 per share

Acquisition scenario (60% probability): Common gets $1.20 per share after preferences

Failure scenario (10% probability): Common gets $0

Weighted value: (0.30 × $2.50) + (0.60 × $1.20) + (0.10 × $0) = $1.47 per share

This 70% discount from preferred prices is normal for early-stage companies. The gap narrows as you approach the exit.

Step 3: The DLOM Discount (Why Private Stock Gets Slashed)

You’ve calculated what common stock should be worth. But there’s one more crucial adjustment.

Private company stock is illiquid. You can’t sell it tomorrow. You might not be able to sell it for 3-5 years.

This creates the Discount for Lack of Marketability (DLOM). The IRS expects this discount on all private company valuations.

What Determines Your DLOM

Several factors affect how large the discount is:

Time to liquidity. Companies six months from IPO see lower discounts (20-25%). Companies with no clear exit see higher discounts (30-40%).

Company volatility. Unstable businesses with unpredictable revenue get higher discounts.

Financial performance. Profitable companies approaching exit get lower DLOMs.

Market conditions. During hot IPO markets, discounts compress. During downturns, they expand.

Academic studies consistently show DLOM ranges of 20-35% for private companies. The IRS recognizes this research.

How DLOM Gets Applied

Let’s say your allocation analysis determined common stock should be worth $3.50 per share. Your company expects to go public in 2-3 years. Your DLOM is 30%.

Final calculation:

- Value before DLOM: $3.50

- DLOM adjustment: $3.50 × 30% = $1.05

- Final value: $2.45 per share

This is the number that appears in your 409A report.

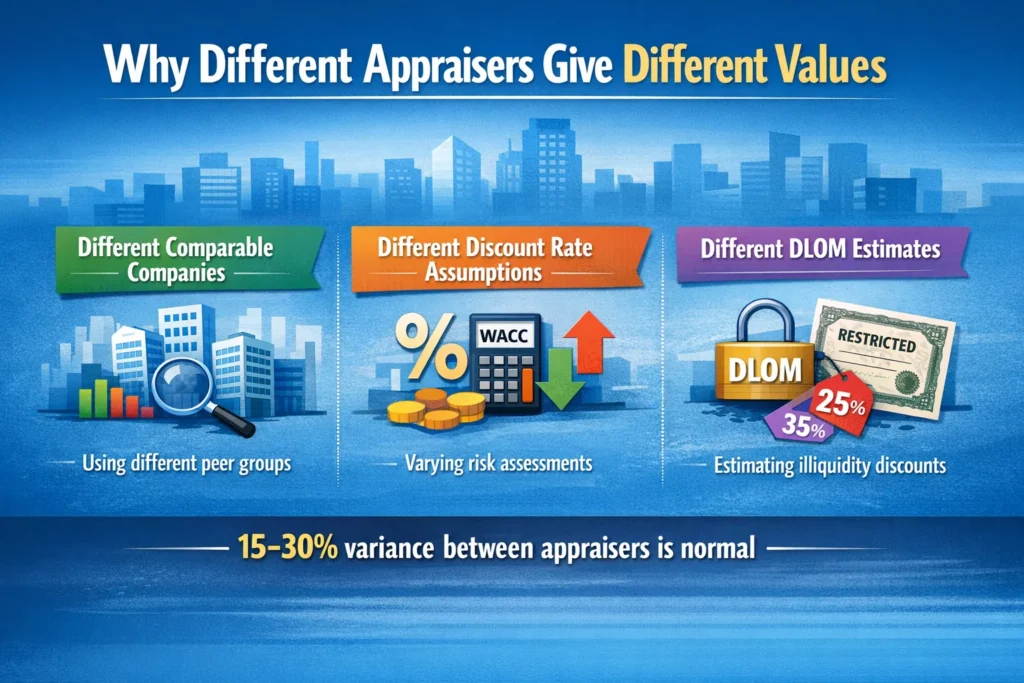

Why Different Appraisers Give Different Values

Professional judgment varies. Two qualified appraisers might differ on:

- Which comparable companies are most similar (affects market approach)

- What discount rate components to use (affects income approach)

- What DLOM percentage applies (affects final value)

These differences compound. Final valuations might vary by 15-30% between appraisers. This range is normal and acceptable.

The goal isn’t the highest number. It’s a defensible number that survives IRS scrutiny.

Common Questions About 409A Valuations Determination

Why did my value barely change after a major contract?

Appraisers discount future revenue heavily when conducting 409A valuations. A $2M contract might only add $1M to value after discounting. If it’s replacing churned customers rather than net-new growth, it might not increase value at all during the 409A valuations process.

Can I influence the methodology?

Not really. Appraisers conducting 409A valuations must follow professional standards. You can provide data supporting different assumptions, but they verify everything independently to ensure your 409A valuations are compliant.

Why is my value so much lower than what investors paid?

Preferred stock has downside protection through liquidation preferences. Common stock has none. The 60-70% gap reflected in 409A valuations is mathematically accurate, not a mistake. This differential is a standard feature of 409A valuations that accounts for the structural differences between preferred and common equity.

Getting Accurate Results From Your Appraiser

The quality of your valuation depends on the data you provide.

Send complete, organized documentation. Your cap table, financial statements, and business plan should be clean and detailed.

Be transparent about risks. Customer concentration, technical challenges, and competitive threats all matter. Hiding problems creates inaccurate valuations.

Explain your financial projections. Don’t just send a spreadsheet. Include the assumptions behind your numbers.

Ask questions during the process. Good appraisers welcome informed discussion about their methodology.

Using Your Valuation Strategically

Understanding the methodology helps you make better decisions.

Time option grants carefully. Your 409A jumps after raising money. Grant options to key hires before closing if possible.

Manage employee expectations. Explain why common stock is worth less than preferred. The math is defensible, not arbitrary.

Plan for exit. As you approach IPO, the gap between preferred and common narrows. Your 409A might increase 3-5x in the final year.

How This Comes Together

The determination process is rigorous and methodical. Appraisers use IRS-approved methods, established financial models, and professional judgment to arrive at your number.

That $2.47 per share isn’t random. It reflects market data, discounted cash flows, allocation mechanics, and illiquidity adjustments. Every component has mathematical support.

Understanding this process helps you see your 409A as more than a compliance requirement. It’s a financial analysis that protects your company and fairly values your team’s equity.

Partner With Valuation Experts Who Know Startup Finance

Understanding how Are 409A valuations determined is crucial for making informed equity decisions. While the methodology is complex, working with qualified appraisers ensures your valuation holds up to IRS scrutiny.

When you’re ready to take the next step beyond equity compensation and explore exit strategies or business valuations, Bookman Capital specializes in SaaS company valuations and strategic advisory. Our team understands startup finance and can help you navigate valuation questions as your company grows.

Need guidance on startup valuations and exit planning? Contact Bookman Capital at https://bookmancapital.io/contact/ for a consultation about your company’s strategic financial needs.

Sources: