If you’re thinking about selling your SaaS business, interest rates matter more than you might realize. They quietly influence every part of the M&A process, from how buyers calculate your value to the terms they’re willing to offer.

This guide breaks down the connection between interest rates and your exit value. You’ll see exactly why valuations change when rates move, and more importantly, you’ll learn six practical ways to maximize what buyers will pay for your business regardless of the rate environment.

Where Interest Rates Stand Today

The Federal Reserve held interest rates between 5.25% and 5.5% throughout most of 2023 and early 2024. They began cutting rates in late 2024, bringing the current range to 4.25% to 4.5% as of December 2024.

This marks a dramatic shift from the near-zero rates of 2020 and 2021. The Fed raised them aggressively to combat inflation, and we’re now seeing the beginning of a rate-cutting cycle.

When interest rates affect SaaS M&A markets, the changes show up immediately in deal terms. Public SaaS companies traded at 18.4x revenue multiples in September 2021. By early 2025, public SaaS companies trade in the 6x to 7x revenue range, with specific indices showing between 6.1x and 7.5x depending on the cohort tracked.

Private SaaS companies saw similar compression. Average businesses now trade around 4.1x to 4.8x revenue, while equity-backed and top-tier assets command 5.3x to 8x multiples. The difference between low and high rate environments can mean millions in valuation for the same business.

The Capital Cost Reality

Buyers typically finance 50% to 70% of acquisitions with borrowed money. A buyer purchasing a $5M revenue business at a 5x multiple pays $25M total, borrowing $15M and investing $10M from their fund.

At 2% interest rate, that $15M loan costs $300K yearly. At 8% interest, the same loan costs $1.2M annually. That extra $900K comes directly from your business profits, forcing buyers to lower their purchase offers.

Private equity firms hold approximately $2.0 to $2.5 trillion in dry powder waiting to be deployed. They want to deploy this capital, but higher borrowing costs make them extremely selective. Due diligence periods stretched from four to six weeks in 2021 to six to twelve weeks in 2024.

Six Ways Interest Rates Shape Your Valuation

1. Deal Structures Get More Creative

Approximately one-third of private SaaS deals included earnouts during 2024, representing an increase from historical averages. Smart sellers recognize that earnouts can bridge valuation gaps while potentially delivering higher total proceeds.

Request earnout periods of 12 to 18 months maximum. Define milestones using objective metrics like ARR or EBITDA. Maintain operational control protections that prevent buyers from undermining earnout achievements.

Seller financing also became more common. Buyers ask sellers to finance 10% to 20% of the purchase price, demonstrating your confidence while reducing buyer financing needs.

2. Profitability Beats Growth Rate

The Rule of 40 became the definitive metric for SaaS valuations. This rule states that your growth rate plus profit margin should exceed 40%. Companies meeting this threshold command significantly higher multiples.

Companies with gross margins above 80% receive substantially higher offers than those with margins below 80%. The valuation gap can exceed 30%.

Quick ways to improve your metrics: eliminate the bottom 20% of customers by profitability, switch monthly customers to annual contracts, automate customer onboarding, renegotiate vendor contracts, and add usage-based pricing tiers.

3. Retention Metrics Drive Premium Valuations

Companies with Net Revenue Retention above 120% command significantly higher valuation multiples. Buyers obsess over retention because it determines cash flow predictability. A business with 110% NRR grows organically from existing customers without requiring massive acquisition spending.

Document your Gross Revenue Retention and NRR monthly. If your NRR exceeds 110%, make it the centerpiece of all acquisition materials. Implement quarterly business reviews with top accounts and create customer health scores that identify at-risk accounts before they churn.

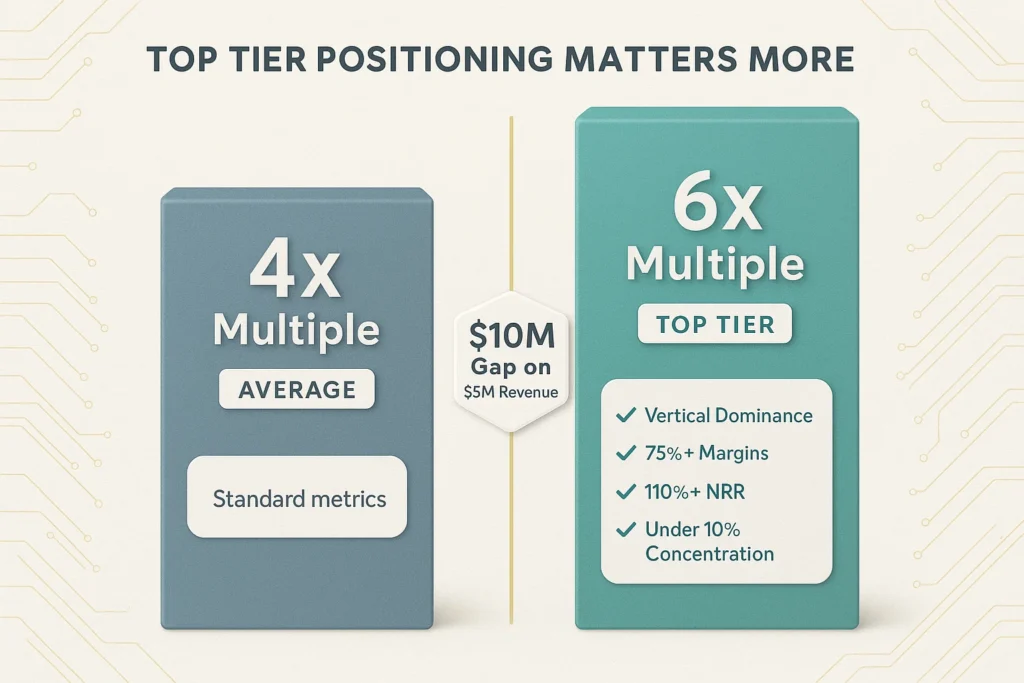

4. Top-Tier Positioning Matters More

Public SaaS multiples fell from 18.4x to the 6x to 7x range. Private company multiples settled around 4.1x to 4.8x median for average companies and 5.3x to 8x for top-tier assets.

The difference between a 4x and 6x multiple on $5M revenue equals $10M in proceeds. Exceptional businesses still command exceptional prices.

Position your business in the top tier by emphasizing vertical market dominance, gross margins above 75%, Net Revenue Retention above 110%, and minimal customer concentration with your top customer representing less than 10% of revenue.

5. Buyer Type Determines What Matters

Private equity involvement jumped to 61% of all SaaS deals in 2024. PE-backed strategic buyers became the most active category at 51% of transactions. Different buyer types evaluate deals using completely different frameworks.

PE buyers prioritize cash flow predictability and debt serviceability. They focus intensely on EBITDA, payback periods, and the Rule of 40 because they need to prove your business generates enough cash to service acquisition debt.

Strategic acquirers value product synergies and market expansion opportunities. They care about customer overlap, technology integration, and competitive positioning. They often pay premium multiples for businesses that accelerate their strategic roadmap.

6. Exit Timing Creates Strategic Advantage

The Federal Reserve signaled continued rate cuts through 2025 and into 2026. Many analysts predict strong M&A activity levels ahead.

Industry trackers reported 2,107 SaaS M&A transactions in 2024, representing the second-highest year on record and an 18% increase over 2021 levels. Q4 2024 marked the most active fourth quarter on record. Additionally, 57% of SaaS CEOs expect improved market conditions in 2025.

If interest rates are falling and your metrics are improving, consider waiting six to twelve months. Buyers pay higher multiples when they feel confident rates will stay low. However, if rates might rise again or your growth is plateauing, move quickly.

Never let market timing override fundamental business readiness. A business with strong metrics in a challenging market gets better offers than a business with declining metrics in a great market.

What’s Selling in Today’s Market

Vertical SaaS remained the hottest category throughout 2024, with vertically-focused companies representing 44% of all deal activity. Buyers pay premium multiples for businesses dominating specific industry niches.

Categories commanding premium valuations include healthcare and telemedicine platforms, financial services and fintech tools, analytics and data management solutions, security and compliance software, AI-enhanced workflow automation, and marketing and customer experience platforms.

The ServiceTitan IPO in December 2024 at a $5.16B valuation signaled renewed market confidence, showing institutional investors are ready to back quality SaaS businesses again.

Common Questions About Interest Rates and SaaS Sales

How do rising interest rates affect SaaS M&A valuations?

Higher interest rates directly increase borrowing costs for buyers, which reduces purchase prices. When interest rates jumped from 0.25% to 5.25% between 2021 and 2023, median SaaS multiples fell from 18.4x to the 6x to 7x range. Buyers finance 50% to 70% of acquisitions with debt, so when interest rates rise from 2% to 8%, the annual cost on a $15M loan increases from $300K to $1.2M, forcing buyers to lower their offers proportionally.

Should I wait to sell my SaaS business until interest rates drop?

Your decision depends on your business fundamentals rather than interest rates alone. The Fed began cutting interest rates in late 2024 to the current 4.25%-4.5% range, with further cuts expected through 2025-2026. However, a business with strong metrics in a high interest rate environment will receive better offers than a business with declining metrics when interest rates are favorable.

How have deal structures changed with higher interest rates?

Earnouts now appear in 39% to 60% of private SaaS transactions, compared to lower historical averages. Buyers also request seller financing for 10% to 20% of the purchase price more frequently. Due diligence periods extended from four to six weeks in 2021 to six to twelve weeks today as buyers scrutinize metrics more carefully when interest rates increase their capital costs.

Partner With SaaS M&A Specialists

Understanding how interest rates affect SaaS M&A represents just your starting point. Executing a successful exit requires deep expertise in valuation optimization, buyer identification, and deal negotiation.

Bookman Capital specializes in SaaS M&A transactions across all market conditions. Our team helps founders achieve premium valuations by positioning businesses for maximum buyer appeal. We closed deals at 6x multiples and higher, even when median market multiples sat at 4x.

Interest rates will fluctuate. Your business fundamentals create lasting value. The combination of strong metrics and expert representation produces outstanding exits regardless of macro conditions.

Ready to explore your exit options? Get a confidential valuation and market positioning assessment from the SaaS M&A specialists at Bookman Capital today.

Sources: