Someone just offered to buy your SaaS company. The number seems good. But you have no idea if it’s actually fair value or way too low.

Valuing subscription software isn’t guesswork. Miss one calculation and the difference shows up in your bank account.

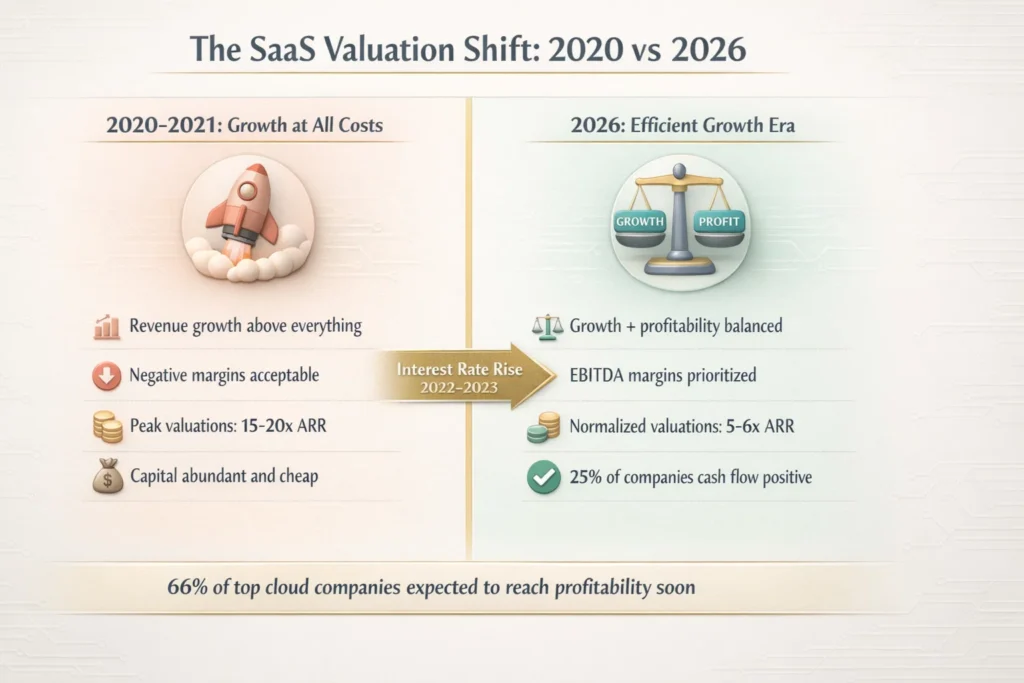

This year, the math changed. Investors stopped chasing growth alone. They want companies that can actually make money while expanding. Understanding this shift affects every founder planning an exit or fundraise.

We’ll show you exactly what buyers measure and why those numbers matter for your specific situation.

What Financial Metrics Determine SaaS Valuation?

Revenue predictability sits at the center of every valuation discussion. Buyers pay for consistency because it reduces their risk.

Annual Recurring Revenue Sets Your Baseline

ARR represents your predictable yearly subscription income. A company with $5 million in ARR generates roughly that amount next year without finding new customers.

Buyers multiply this number by an industry factor to get your starting valuation. According to KeyBanc’s 2024 survey, public software companies trade around 5 to 6 times their next twelve months’ revenue. Private companies with strong metrics often get higher multiples.

Your ARR growth rate changes everything. SaaS Capital’s 2025 research shows median private SaaS growth hit 25 percent. Companies growing above 40 percent annually command serious attention. Those below 20 percent face tough questions about their ceiling.

Gross Margin Shows Operational Efficiency

This metric reveals your profit after delivering the service. Strong SaaS businesses maintain gross margins above 75 percent. Some reach close to 90 percent.

Software scales beautifully when built right. Low margins below 60 percent signal problems. Maybe you rely too heavily on professional services. Maybe infrastructure costs eat your revenue.

Three Numbers That Separate Winners

Net Revenue Retention measures existing customer spending over time. The benchmark target sits at 111 percent according to industry data.

NRR above 100 percent means current customers spend more each year without new sales. Companies hitting 120 percent or higher get premium valuations because they grow efficiently.

CAC Payback Period tells buyers how fast you recover acquisition costs. Companies with average contract values over $100,000 show median payback periods around 24 months. Businesses with contracts under $5,000 recover costs in about 9 months.

Faster payback means better cash flow. Top performers aim for payback under 18 months regardless of deal size.

Rule of 40 combines your growth rate with profit margin. Add these two percentages together. Hitting 40 percent or above signals health.

A company growing 50 percent with negative 10 percent margins passes. So does one growing 25 percent with 15 percent margins. This metric forces the tradeoff between growth investment and profitability.

How Do Qualitative Factors Affect Valuation?

Numbers open doors. But softer elements determine whether buyers offer baseline multiples or premium prices.

Technology Stack Quality

Your codebase becomes the buyer’s inheritance. Modern, documented, secure code reduces their risk and future costs.

Proprietary technology creates barriers that competitors can’t easily cross. Patents and unique data assets add defensive value. Legacy systems built on outdated frameworks raise red flags.

Customer Base Composition

Revenue concentration kills deals fast. When 40 percent of income comes from two clients, buyers see massive risk.

Spread across industries and company sizes reduces vulnerability. Industry data shows 90 percent annual customer retention is now standard. Your retention story directly shapes perceived stability.

Contract terms matter too. Multi-year agreements provide more security than month to month arrangements. Enterprise customers with annual contracts signal predictable revenue streams.

Market Size and Position

The total addressable market determines your growth ceiling. Bessemer’s Cloud 100 research found AI companies now reach $100 million ARR in just 5.7 years on average. Large expanding markets accelerate valuations.

Small market cap limits your potential even with a great product. A company holding 2 percent of a billion dollar market looks different than one with 20 percent of $50 million.

Competitive moats protect your margins. Exclusive data, network effects, or complex integrations take years to replicate. Weak differentiation leads straight to price wars.

Team and Operational Independence

Buyers ask a brutal question: Can this business run without the founder?

If you’re the only person who understands customer relationships or key systems, that’s a problem. Buyers structure deals to keep founders involved, but they need operational continuity.

Specialized domain knowledge and a skilled team represent hard-to-replace assets. Buyers pay for institutional knowledge that ensures smooth transitions.

What Valuation Methods Do Buyers Use?

Theory meets reality through specific calculation approaches. Buyers blend multiple methods to arrive at their number.

Revenue Multiple Approach

Take your ARR and multiply by an industry factor. That factor ranges from 3x to 15x based on your metrics and market.

A $10 million ARR company growing slowly with weak margins might get 4x for a $40 million valuation. Strong growth with excellent retention could command 10x for $100 million. Same revenue, totally different outcomes.

Comparable Transaction Analysis

Investment bankers research recent deals for similar companies. They examine what other SaaS businesses in your sector sold for relative to their ARR.

This grounds valuations in actual market prices rather than theoretical models. Real transactions provide powerful negotiating evidence.

Performance Benchmarks Impact

| Metric | Strong | Weak |

| ARR Growth | Above 40% yearly | Below 10% yearly |

| Net Revenue Retention | Above 120% | Below 90% |

| Gross Margin | Above 80% | Below 60% |

| CAC Payback | Under 12 months | Over 24 months |

Why 2026 Valuations Look Different

The market matured substantially. Growth at all costs died when interest rates climbed in 2022 and 2023.

KeyBanc’s 2024 survey confirms companies now focus on operational efficiency and EBITDA margin improvement instead of chasing top line growth alone. Nearly 25 percent of top private cloud companies already generate positive cash flow. Two-thirds expect to reach breakeven or profitability soon.

Buyers want efficient growth. They seek companies that expand revenue while moving toward profitability. The bar for impressive metrics rose significantly. What looked great in 2020 is baseline today.

Public market valuations stabilized around 5 to 6 times revenue but remain below 2021 peaks. Private buyers stay active but run disciplined due diligence. They expect clean financials and clear unit economics from day one.

What Should You Prepare for Valuation Discussions?

Clean financial records going back three years minimum. No surprises. No unusual quarters requiring lengthy explanations.

Documented tracking for every metric we discussed. Buyers shouldn’t need to calculate basic information themselves. Having this ready shows operational maturity.

Your preparation checklist:

- ARR broken down by customer segment and contract type

- Monthly cohort retention analysis showing NRR trends

- Detailed CAC calculations with payback by channel

- Gross margin analysis with infrastructure cost breakdown

- Customer concentration report showing revenue distribution

- Growth projections with realistic assumptions

- Technology architecture documentation

- Team org chart with key personnel identified

A clear story about competitive advantages and market position. Numbers show what happened. Narrative explains why it matters and where you’re headed.

Honest weakness assessment. Every business has vulnerabilities. Addressing them upfront builds trust. Hiding problems destroys deals during due diligence.

The final valuation falls within a range that becomes negotiable. You negotiate from strength when you’ve done thorough preparation work.

What Questions Should You Ask Potential Buyers?

Valuation discussions go both ways. Smart founders evaluate buyers as carefully as buyers evaluate companies.

Ask about their portfolio and experience with similar businesses. Do they understand your market? Have they successfully grown companies like yours?

Understand their value creation plan. How will they accelerate growth? What resources can they provide? What changes do they envision for operations or the team?

Clarify deal structure expectations. All cash? Earnouts? Equity rollover? Payment terms significantly affect the real value you receive.

Discuss transition expectations. How long do they need founder involvement? What role would you play? These answers shape your next few years.

How is a SaaS Company Valued? Getting to Your Final Number

Valuation isn’t guessing. It’s a systematic analysis of financial performance, market position, and growth potential.

Strong metrics command premium multiples. Weak numbers limit your options. The difference between good and great performance translates directly into millions of dollars.

Understanding how buyers think changes your preparation strategy. You can optimize the right metrics and build the story that justifies top valuations.

This knowledge matters whether you’re selling next month or in three years. The decisions you make today about growth, margins, and customer retention shape tomorrow’s valuation.

Work With Valuation Experts

Maximizing your company’s value requires specialized knowledge and market relationships. You need advisors who see hundreds of deals and understand what drives premium outcomes.

Bookman Capital helps SaaS founders translate operational success into maximum valuation. We analyze your metrics, strengthen your positioning, and connect you with serious buyers or investors.

Stop guessing what your business is worth. Get a valuation based on current market realities and your specific performance.

Visit Bookman Capital at bookmancapital.io/ to start the conversation.

Sources: