Selling your AI SaaS business to buyers requires a different approach than traditional software exits. Recent venture rounds for AI companies have shown median revenue multiples in the mid-20s, but sale/M&A multiples are usually lower. Smart founders create competitive bidding situations to capture this value.

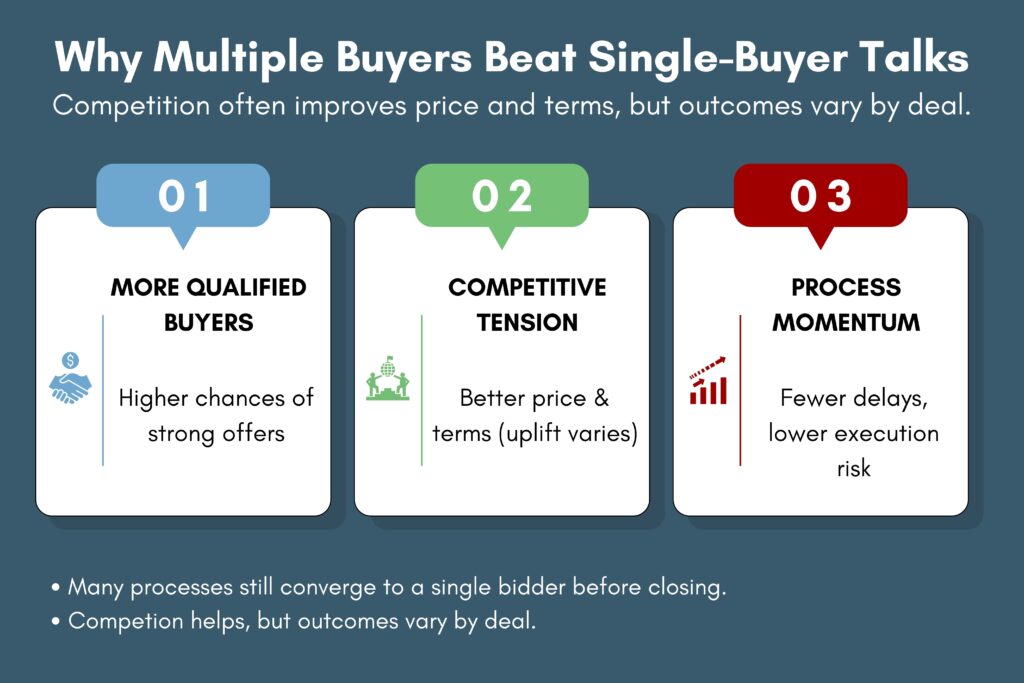

Multiple buyers can improve outcomes versus single-buyer negotiations. Creating real competition often improves price and terms, but the size of the uplift varies; many processes still converge to a single bidder before closing. This strategy also improves deal terms and reduces execution risk.

The AI market continues expanding rapidly in 2025. Buyers actively seek differentiated artificial intelligence solutions. Your timing matters for maximizing buyer interest and valuation multiples.

Why Multiple Buyers Are Critical for AI SaaS Exits

Strategic buyers and financial buyers compete aggressively for quality AI assets. This competition creates natural price discovery mechanisms. Single-buyer negotiations limit your negotiation leverage significantly.

AI can command premiums (especially with defensible data/IP), but 2025 public comps show caution. This premium exists because buyers recognize artificial intelligence’s transformative potential. Competition among buyers protects this premium during negotiations.

The AI Premium Effect on Valuations

In 2025, public SaaS traded roughly 4-7x forward revenue; private mid-market SaaS often cleared ~5x with wide bands for growth/NRR/profitability. Select AI deals price higher, but venture fundraising multiples (e.g., ~25.8x for AI) shouldn’t be used as M&A comps.

Median public SaaS growth slowed to ~13% YoY in Q1-2025. AI businesses maintain higher growth trajectories than traditional software. Buyers pay premiums for sustainable competitive advantages.

Market Competition Benefits Beyond Price

Multiple offers improve deal terms beyond purchase price increases. Competing buyers offer better earnout structures and employment packages. They also provide faster closing timelines and reduced due diligence requirements.

Buyer competition creates urgency that prevents deal delays. Single buyers often extend negotiations to gain leverage. Multiple interested parties maintain momentum throughout the sales process.

Market Positioning That Attracts Strategic Buyers

Market positioning determines which buyer types pursue your business actively. Different buyer categories evaluate AI companies using distinct criteria. Understanding these differences shapes your marketing strategy.

Strategic buyers include enterprise software companies, technology giants, and industry specialists. These buyers seek synergies with existing product portfolios. They often pay the highest multiples for strategic value.

Understanding Your Buyer Universe

Enterprise buyers acquire AI solutions to enhance existing software platforms. They evaluate integration capabilities and customer overlap potential. These buyers focus on recurring revenue stability and growth rates.

Technology giants pursue AI companies for talent and intellectual property. They assess technical differentiation and competitive positioning. These acquisitions often include significant talent retention packages.

Financial buyers evaluate AI businesses using traditional software metrics. They focus on cash flow generation and scalability potential. These buyers typically require lower growth rates than strategics.

Crafting Your Unique AI Value Proposition

Technical differentiation drives premium valuations. Document your proprietary algorithms and data advantages clearly. Highlight barriers to entry that protect market position.

Customer concentration affects buyer interest levels significantly. Diversified customer bases attract more buyer types. Enterprise customers provide higher valuations than SMB-focused businesses.

Data moats create sustainable competitive advantages in artificial intelligence. Buyers evaluate data quality, volume, and exclusivity carefully. These assets often justify premium acquisition multiples.

Timing Your Market Entry for Maximum Interest

Time your go-to-market to buyer budget cycles you can confirm; 2025 dealmaking showed mixed momentum amid policy/market uncertainty. Strategic planning aligns your sales process with buyer budget cycles. Corporate buyers typically complete acquisitions before year-end.

Market conditions in 2025 favor AI business sellers significantly. Interest rates stabilized while buyer confidence increased. This environment supports higher valuation multiples and competitive bidding.

Financial Optimization Strategies

Financial metrics determine initial buyer interest and valuation ranges. AI businesses require different KPIs than traditional software companies. Optimizing these metrics before marketing increases buyer competition.

Revenue quality matters more than absolute revenue growth rates. Predictable recurring revenue attracts premium valuations consistently. High gross margins demonstrate scalable business models effectively.

AI SaaS Metrics That Matter Most to Buyers

Annual recurring revenue provides the foundation for valuation calculations. Monthly recurring revenue offers insufficient stability for acquisition modeling. Buyers prefer annual contracts over month-to-month arrangements.

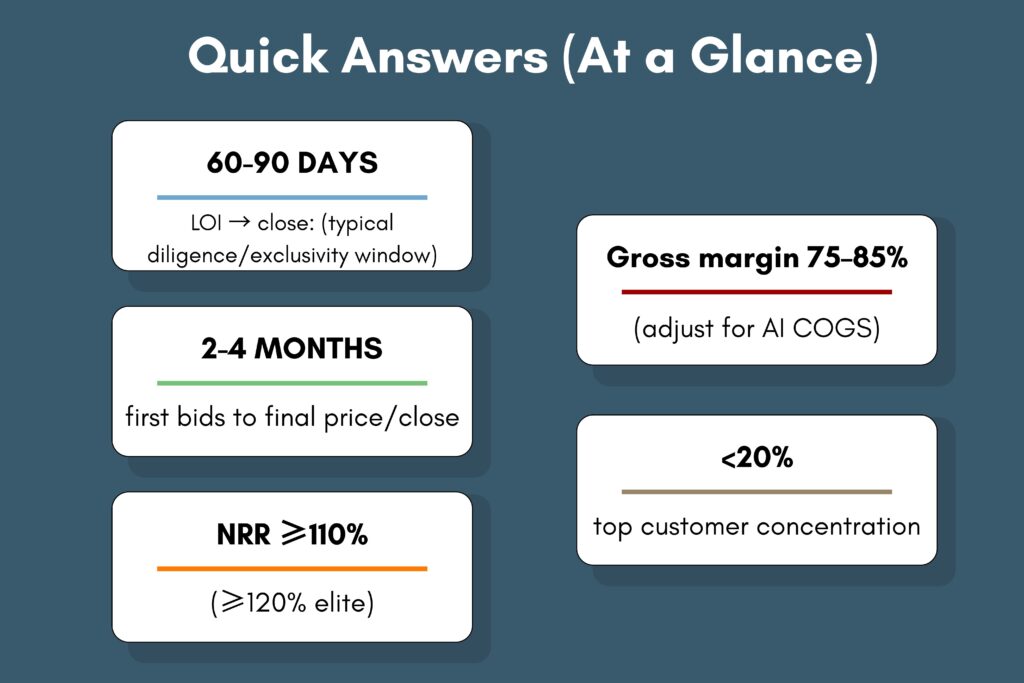

Aim for NRR ≥110% (≥120% elite) for successful AI businesses. This metric demonstrates product stickiness and expansion potential. Clients evaluate churn rates and expansion revenue carefully.

Keep software GM ~75–85%; AI workloads may run lower due to inference costs—price accordingly. Lower margins suggest services components that reduce valuations. Software-driven AI solutions command higher multiples than consulting-heavy models.

| AI SaaS Metric | Target Range | Buyer Priority |

| Revenue Multiple | 3-6x (varies by growth/quality) | Critical |

| Net Revenue Retention | 110-120%+ | High |

| Gross Margin | 75-85% (adjust for AI COGS) | High |

| Growth Rate | Scale-dependent | Medium |

| Customer Concentration | <20% top client | Medium |

(Benchmarks informed by public comps medians and sector ranges in 2025.)

Revenue Quality Enhancement

Customer diversification reduces buyer concerns about revenue concentration. No single customer should represent more than 20% of revenue. Diverse customer bases support higher valuation multiples consistently.

Contract length affects revenue predictability and buyer confidence. Annual contracts provide better visibility than monthly arrangements. Multi-year agreements command premium valuations from strategic buyers.

Payment terms influence cash flow quality and buyer interest. Annual prepaid contracts generate higher valuations than quarterly billing. Upfront payments demonstrate strong customer commitment levels.

Profitability Positioning for Premium Multiples

EBITDA margins demonstrate operational efficiency to financial buyers. Positive EBITDA businesses attract broader buyer interest than loss-making companies. Profitability provides negotiation leverage during acquisition discussions.

Unit economics prove business model scalability for long-term growth. Customer acquisition cost should remain below annual contract value. Lifetime value calculations justify marketing investment levels effectively.

Building a Competitive Sales Process

Sales process design determines buyer engagement levels and final outcomes. Structured processes create competitive tension while maintaining professional relationships. Poor execution wastes marketing efforts and reduces valuations.

Run a structured, competitive process; auctions don’t guarantee higher prices. Many ‘auctions’ morph into one-on-one negotiations, and failed auctions can lower premiums. These processes require significant preparation and professional management. Investment bankers typically manage complex auction processes effectively.

Designing Your Sales Process for Competition

Information rooms provide controlled access to business information systematically. Cloud-based platforms track buyer engagement levels and interest areas. Well-organized materials demonstrate professional management capabilities.

Buyer qualification prevents wasting time on unqualified prospects. They require proof of funds or committed capital. Strategic buyers need internal approval processes and integration capabilities.

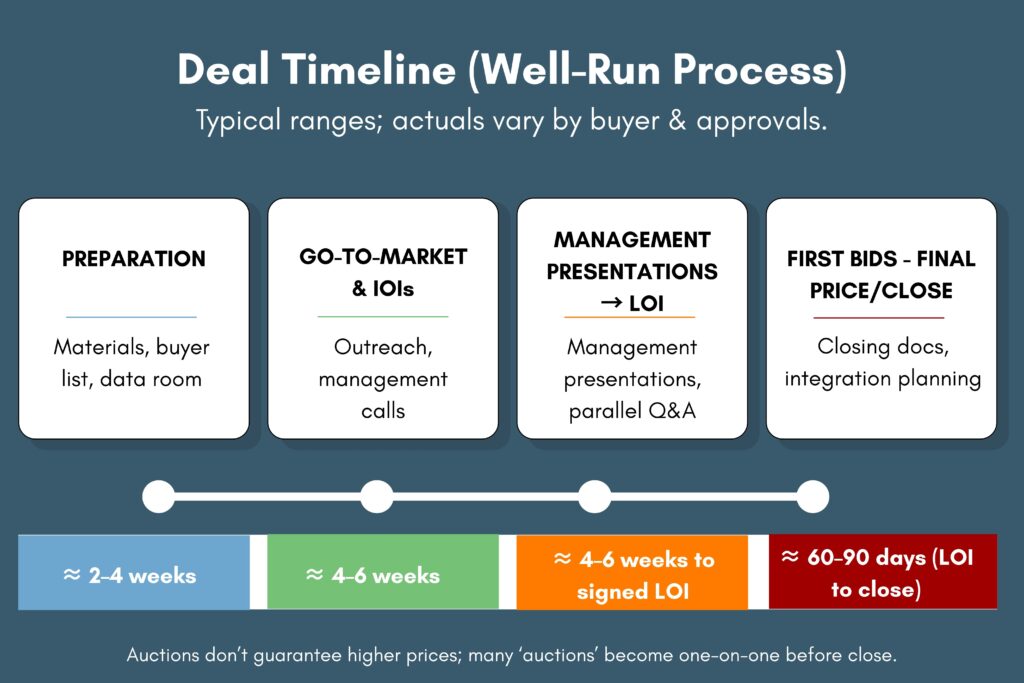

Timeline management creates urgency while allowing sufficient due diligence time. 60-90 day processes balance thoroughness with competitive pressure. Extended timelines often result in buyer fatigue and reduced offers.

Managing Multiple Due Diligence Processes

Due diligence coordination requires significant management attention and resources. Legal, financial, and technical reviews occur simultaneously across buyers. Professional advisors help manage multiple streams efficiently.

Document preparation streamlines buyer review processes and reduces delays. Financial statements, customer contracts, and technical documentation require organization. Complete materials demonstrate transparency and professional operations.

Creating Urgency Without Desperation

Market deadlines provide natural urgency for buyer decision-making. Budget cycles and strategic planning periods create legitimate time pressure. Artificial deadlines often backfire and damage seller credibility.

Competitive dynamics emerge naturally from well-managed processes. Buyers understand competitive situations without explicit pressure tactics. Professional communication maintains relationships while encouraging prompt decisions.

Platform and Marketing Strategies

Marketing channels reach different buyer types through targeted approaches. Online marketplaces connect with individual and small financial buyers. Investment networks access institutional and strategic buyer audiences.

Digital platforms like Flippa successfully facilitate AI business sales regularly. AI Boost achieved a $450K exit through marketplace exposure — a single case that shows marketplaces can work, not a baseline outcome. These platforms provide built-in buyer qualification and marketing tools.

Marketplace Optimization for AI SaaS

Listing optimization attracts qualified buyers through compelling business descriptions. Keywords like “artificial intelligence” and “machine learning” improve search visibility. Detailed financial metrics demonstrate business quality effectively.

Photography and branding create professional impressions for potential buyers. Screenshots of dashboards and customer interfaces showcase product sophistication. Professional presentation materials increase perceived business value.

Direct Outreach to Strategic Buyers

Industry research identifies potential strategic buyers within your market segment. Competitors, suppliers, and customers often represent acquisition candidates. Technology companies seek bolt-on acquisitions for growth strategies.

Professional networks provide warm introductions to strategic buyer organizations. Industry events and conferences offer direct access to corporate development teams. LinkedIn outreach generates initial interest from qualified prospects.

Professional Intermediary Benefits

Investment bankers access institutional buyer networks unavailable to individual sellers. These professionals manage complex negotiations and transaction structures. Their involvement often increases final purchase prices significantly.

Business brokers serve smaller transactions with retail investor buyers. They provide marketing services and transaction management capabilities. Broker networks reach thousands of qualified individual investors regularly.

Negotiation and Deal Management

Offer management requires balancing multiple competing proposals simultaneously. Each buyer presents different structures, timelines, and terms. Professional evaluation ensures optimal outcome selection.

Term sheets extend beyond purchase price to include employment, earnouts, and warranties. Strategic buyers often provide better employment terms than financial buyers. Earnout structures can increase total consideration significantly.

Offer Evaluation Beyond Price

Deal structure affects net proceeds and risk profiles substantially. All-cash offers provide certainty while earnouts offer upside potential. Stock considerations require evaluation of buyer company prospects.

Employment terms matter for founders planning post-acquisition involvement. Strategic buyers typically offer better packages than financial buyers. Integration roles provide career advancement opportunities beyond cash proceeds.

Closing conditions affect deal execution risk and timeline certainty. Financing contingencies create uncertainty while strategic buyers offer committed capital. Regulatory approvals may delay certain transaction types.

Managing Buyer Expectations and Timeline

Communication protocols maintain professional relationships throughout competitive processes. Regular updates prevent buyer frustration while protecting process integrity. Transparent communication builds trust and encourages best offers.

Milestone tracking ensures process momentum and prevents delays. Due diligence completion, legal documentation, and financing approval require coordination. Professional project management maintains competitive tension effectively.

Final Negotiations and Closing Strategy

Best and final offers conclude competitive processes decisively. Clear deadlines prevent extended negotiations that damage relationships. Professional presentation of final terms ensures optimal buyer responses.

Winner selection considers multiple factors beyond highest purchase price offers. Strategic fit, execution certainty, and employment terms influence final decisions. Professional advisors provide objective evaluation frameworks.

Frequently Asked Questions

How long does it typically take to attract multiple buyers for an AI SaaS business?

Expect ~60–90 days to reach a signed LOI in well-run processes, with 2–4 months common from first bids to final price. The process includes buyer qualification, due diligence, and negotiation phases. Professional marketing accelerates buyer identification and interest development significantly.

What valuation multiple difference can I expect with multiple buyers versus single buyer negotiations?

Creating real competition often improves price and terms, but the size of the uplift varies; many processes still converge to a single bidder before closing. The AI premium requires competitive tension to maintain. Single buyers often discount offers knowing no competition exists.

What AI-specific metrics do buyers focus on most during evaluation?

Buyers prioritize revenue multiples, net revenue retention, and gross margins primarily. Technical differentiation and data advantages drive premium valuations significantly. Customer concentration below 20% reduces buyer concerns substantially.

How do I manage multiple due diligence processes without overwhelming my team?

Professional advisors coordinate multiple buyer streams while protecting team productivity. Virtual data rooms provide controlled information access across buyers. Structured processes prevent duplicated efforts and resource conflicts.

Ready to Maximize Your AI SaaS Exit Value?

Creating competitive bidding for your AI SaaS business requires strategic preparation and professional execution. The artificial intelligence market offers unprecedented valuation opportunities for prepared sellers.

Multiple buyers drive better outcomes through natural competitive dynamics. Your business deserves the premium that AI companies command in today’s market. Professional guidance ensures you capture maximum value from this opportunity.

The experts at Bookman Capital have helped dozens of AI founders maximize their valuations through strategic buyer competition. Their proven process attracts qualified buyers and manages complex negotiations effectively.

Contact Bookman Capital today for your free consultation and valuation assessment. Transform your AI SaaS exit into a competitive bidding war that delivers maximum value.

Sources: