What if the same SaaS company with five million in revenue could sell for forty percent more just because of how it charges customers?

It sounds almost too simple to be true. Yet in 2025, the numbers tell the story. Companies using usage-based pricing are getting premium offers, while traditional subscription models are settling for less.

Investors are no longer just looking at top-line revenue. They are looking at predictable, scalable, and usage-driven growth. How you price your product can change what someone is willing to pay for your business.

In this article, we will break down why usage-based pricing is reshaping valuations and what it means for your next raise or exit.

What Exactly Is Usage-Based Pricing?

Usage-based pricing is pretty straightforward: customers pay based on how much they actually use your product. Think about your electric bill or cloud storage. The more you consume, the more you pay.

In the SaaS world, this might mean charging per API call, per gigabyte processed, per user active in a given month, or per transaction completed. It’s flexible and scales naturally with how valuable your product is to each customer.

Compare that to traditional subscription pricing, where everyone pays a flat monthly or annual fee regardless of whether they use your product once a day or a hundred times.

Both models work, but they create very different business dynamics.

The consumption model has exploded in popularity. Recent industry studies show that about one-half to a little over one-half of SaaS companies now use some form of usage-based or hybrid pricing. This is a clear increase from the levels seen in 2020.

Companies like Snowflake, AWS, and Twilio have proven it works at a massive scale, and investors have taken notice.

Why Does Usage-Based Pricing Matter So Much for Valuation?

Here’s where things get interesting for your bottom line. Private market reports show that revenue multiples vary from year to year, but companies with strong usage-driven metrics often receive higher offers than subscription-only businesses. Many buyers are willing to pay noticeably more when a company shows healthy and consistent usage growth.

The premium can be meaningful because buyers place strong value on dependable expansion and predictable customer behavior.

If you’re selling a $10 million revenue business, that’s the difference between a $45 million offer and a $70 million offer.

But why do investors care so much about how you bill customers? It comes down to three things they obsess over: predictable growth, customer retention, and efficiency.

Usage-based pricing builds growth into your business automatically. When your customers’ businesses grow, they use more of your product. They pay more.

No sales team needed to convince them to upgrade. No awkward pricing conversations. It just happens.

The data backs this up. Public SaaS companies using usage-based pricing showed Net Revenue Retention rates averaging 125%. Subscription-only models hovered around 110%.

That 15-point gap is huge when you’re projecting future revenue.

What Makes Investors Pay a Premium?

Let me break down the specific advantages that boost what buyers are willing to pay:

- Expansion revenue happens naturally. The more they use, the more they pay. Companies with usage-based pricing regularly achieve Net Revenue Retention above 120% without aggressive upselling. The product essentially sells itself through increased consumption.

- Customers stick around longer. This is subtle but important. With traditional subscriptions, customers either stay or cancel. With usage based pricing, they can reduce usage during slow periods instead of leaving entirely.

Annual churn rates typically run 5 to 8% for usage-based models versus 8 to 12% for subscriptions.

- You acquire customers more efficiently. Usage-based pricing lets customers start small and scale up. There’s less friction in the sales process.

The typical payback period for customer acquisition costs drops from 15 months to 10 months with consumption models.

- Operating leverage improves over time. Adding usage capacity costs less than acquiring new subscription customers. Your margins expand as the customer base grows, creating valuable operating leverage that buyers love.

- Product-led growth accelerates. Lower barriers to entry mean customers can start free or cheaply and expand naturally.

Your customer acquisition engine runs more efficiently without heavy sales involvement.

All of these factors make your revenue more predictable and your growth more sustainable.

That’s exactly what someone buying your company wants to see.

How Does Consumption Pricing Transform Your Metrics?

Switching to usage-based pricing doesn’t just change when you send invoices.

It fundamentally alters the numbers investors care about most.

Net Revenue Retention becomes your superpower. NRR measures how much revenue you keep and grow from existing customers. This metric becomes incredibly powerful with usage-based pricing.

Snowflake and Datadog have both reported very high net revenue retention in recent years. Exact numbers change from quarter to quarter, but both companies are known for strong expansion from existing customers.

Why does this matter so much? Because SaaS valuation multiples increase exponentially once you’re consistently above 120% NRR. Companies showing this kind of retention command multiples of 10x revenue or higher.

Below 120%, multiples compress to 4x to 6x regardless of how fast you’re growing.

Your costs go down while outcomes improve. Traditional subscriptions require constant manual work to prevent churn and drive expansion.

Customer success teams spend their days identifying upsell opportunities and scheduling quarterly business reviews.

Usage-based pricing eliminates most of this friction. Customers expand their spending automatically as they use more. Your system handles the billing increases without human intervention.

The typical usage-based company spends 15 to 20% of revenue on customer success. Subscription businesses spend 20 to 25% for similar retention rates.

The Rule of 40 becomes easier to hit. Investors evaluate software companies using something called the Rule of 40. You add your growth rate to your profit margin, and if it’s above 40%, you’re considered healthy and valuable.

Usage-based pricing helps you score well through both components. Growth accelerates from natural expansion. Margins improve from reduced sales and customer success costs.

Many companies that adopt usage-based models find it easier to raise their Rule of 40 scores because they experience natural expansion and more efficient operations. The actual improvement depends on the industry and customer base.

What Do Real Exit Numbers Tell Us?

Let’s look at actual market data from recent sales. Marketplace data shows that many SaaS deals with strong usage-based revenue received higher offers than those relying only on fixed subscriptions. The exact premium depends on the size and quality of the business.

The premium jumped to 40% for businesses showing quarterly usage growth above 15%.

AI-powered SaaS companies using usage-based pricing commanded the highest multiples of all. These businesses sold for 10 to 20 times annual revenue when demonstrating strong retention and expansion.

Subscription based AI tools averaged 6 to 8 times revenue.

The public markets tell the same story. Snowflake reached a $50 billion market cap using pure usage-based pricing. The company grew revenue 50% annually while maintaining gross margins above 70%.

Investors rewarded this combination with premium valuations.

Twilio took a hybrid approach, combining base subscriptions with consumption billing. This model drove consistent expansion revenue while providing a predictable baseline income.

The company maintained valuations about 30% above traditional communication software providers.

In the private markets, overall SaaS valuation multiples dropped from 2021 peaks but stabilized around 4x revenue by late 2024. Companies with usage-based pricing and strong metrics maintained multiples of 6x to 8x throughout this correction.

Strategic corporate buyers paid even higher premiums, valuing consumption revenue 50% higher than subscription revenue in comparable deals.

How Can You Maximize Your Valuation?

If you’re considering implementing usage-based pricing to boost your valuation, here are the critical steps:

- Get your usage tracking right. Build dashboards showing customers exactly what they’re consuming in real time. Transparency prevents billing surprises and builds trust.

Companies with clear usage visibility maintain churn rates 30% lower than those without.

- Invest in metering infrastructure. Your systems need to measure and charge for consumption accurately. Billing errors destroy customer confidence fast.

The typical infrastructure investment pays back within 8 months through improved retention.

- Communicate clearly about costs. Create pricing pages that explain exactly how charges work. Show examples at different usage levels.

Clear pricing documentation increases conversion rates by about 25% and reduces support tickets by 40%.

- Monitor your expansion metrics monthly. Track cohort behavior to identify usage growth patterns early. Spot problems before they impact retention.

This lets you fix issues while maintaining the high NRR scores that drive valuations.

- Prepare comprehensive documentation. Build detailed usage analytics, customer success playbooks, and infrastructure scalability documentation.

Complete packages can add 10 to 20% to final purchase prices.

What Do the Numbers Really Show?

Here’s a side-by-side comparison of how usage-based pricing stacks up against traditional subscriptions across the metrics that matter most to buyers:

| Metric | Traditional Subscriptions | Usage-Based Pricing | Valuation Impact |

| Median Revenue Multiple | 4.5x | 7x | 55% premium |

| Net Revenue Retention | 105-110% | 120-125% | Drives 40% higher multiples |

| Annual Churn Rate | 8-12% | 5-8% | Better revenue predictability |

| CAC Payback Period | 15 months | 10 months | Faster cash generation |

| Customer Success Costs | 20-25% of revenue | 15-20% of revenue | Improved profit margins |

What Should You Know Before an Exit?

When you’re preparing to sell a usage-based pricing business, buyers will evaluate some specific things:

Your data infrastructure quality determines buyer confidence. Metering systems need to handle scale and provide audit trails.

Buyers typically discount valuations by 15 to 25% when they find technical debt in billing systems.

Customer concentration by usage matters. If ten customers represent 60% of your consumption, that creates concern.

Buyers prefer seeing usage distributed across many customers.

Predictability of consumption growth drives final offers. You need to demonstrate consistent quarterly expansion across customer cohorts.

Show at least four quarters of stable or improving usage trends.

Complete documentation accelerates deals and preserves value. Prepare detailed usage analytics, customer success playbooks, and infrastructure scalability documentation.

Complete packages can add 10 to 20% to final purchase prices.

Capture Every Dollar Your Business Is Worth

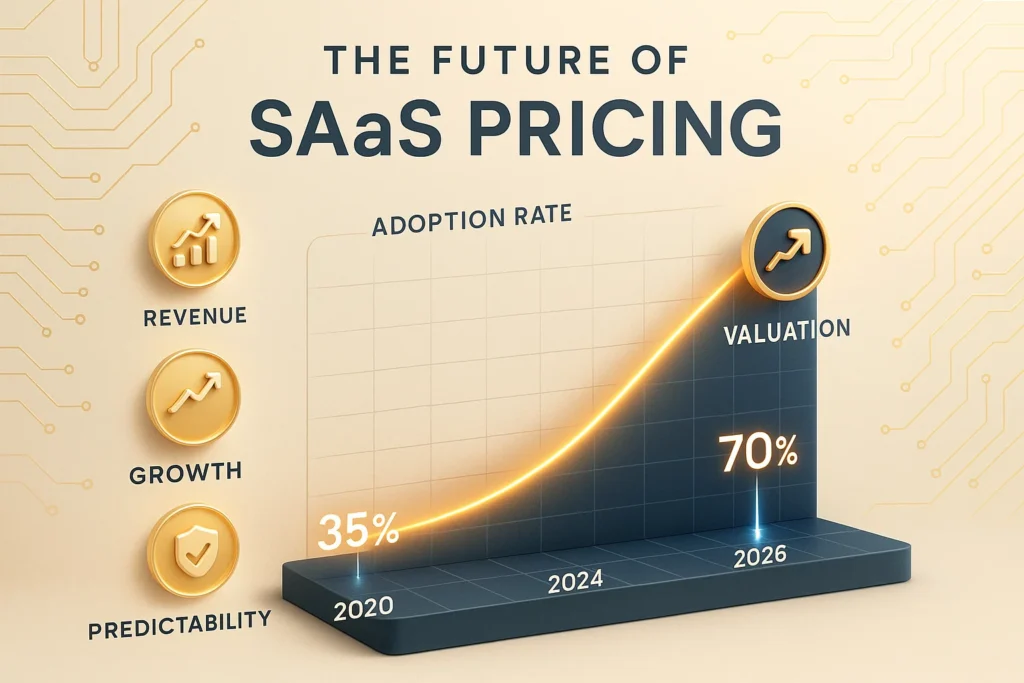

The market has moved decisively toward consumption models, and that shift directly impacts what your business is worth.

This isn’t a temporary trend. Adoption continues to rise each year as more companies experiment with usage based and hybrid pricing approaches.

Your pricing model directly affects what buyers will pay for your company.

Bookman Capital specializes in helping SaaS founders achieve premium exits through strategic pricing optimization and metric improvement.

Our team understands exactly how investors evaluate usage based pricing companies and what drives the highest multiples in today’s market.

If you’re building toward an exit, understanding these dynamics isn’t optional anymore. The difference between traditional subscriptions and consumption models can mean millions of dollars in your final sale price.

Contact Bookman Capital today to schedule your confidential SaaS valuation consultation. Visit bookmancapital.io/ and discover what your business is truly worth.

Note: The numbers in this article are based on public company filings and industry studies. Specific metrics can vary by year, customer base and company size. What matters most to buyers is steady usage growth, strong customer retention and reliable expansion revenue.

Sources:

- OpenView / Kyle Poyar – The Usage-Based Pricing Playbook

- Chargebee – “Demystifying Usage-Based Pricing”

- M3ter – “Net Revenue Retention Impact on SaaS Company Valuations”

- Ordway / Public SaaS Companies Net Revenue Retention Report

- Oxx VC – “Use It or Lose It: Why Usage-Based Pricing Drives High Net Revenue Retention”