Something interesting is happening in the micro SaaS world right now. Buyers are showing up in record numbers, especially for businesses making under $1 million in annual recurring revenue.

Here’s what makes micro SaaS exits different: you don’t need years of preparation as traditional software companies do. These smaller, focused businesses can reach exit-ready status much faster.

In this guide, we’ll walk through the strategies that actually work when you’re ready to sell. Everything here is based on real market data and what buyers are actually looking for.

What Exactly Is Micro SaaS?

Micro SaaS is a small-scale software-as-a-service business typically operated by one founder or a small team, focused on solving a specific niche problem. Unlike traditional SaaS companies that chase broad markets with venture funding and large teams, micro SaaS businesses are lean, bootstrapped operations generating under $1 million in annual recurring revenue.

These businesses succeed by targeting narrow market segments with specialized solutions. Think tools built for Shopify store owners, Chrome extensions for specific workflows, or productivity apps for particular professions.

The “micro” isn’t just about size. It is a business model emphasizing profitability over growth at all costs, minimal overhead, and sustainable operations that don’t require constant fundraising.

Most micro SaaS founders run their businesses with little to no outside investment, often as solo operators or with small remote teams. This lean structure creates attractive margins and makes these businesses particularly appealing to individual buyers and small acquisition funds.

What Makes Your Micro SaaS Valuable

Let’s start with what buyers actually care about when they’re evaluating your business.

The Revenue That Matters Most

MRR and ARR are your foundation. Buyers want to see predictable, recurring revenue. A business pulling in $10,000 monthly from 100 loyal customers is more attractive than the same revenue coming from one-off sales, even if the total dollars match.

Your Churn Rate Tells a Story

Here’s a number that can make or break your deal: monthly churn below 5% is what buyers consider healthy. When it creeps above 7-8%, alarm bells start ringing. High churn suggests something’s off with your product fit or service quality.

The LTV: CAC Balance

This ratio shows buyers whether your growth is sustainable. The sweet spot is 3:1 or better, which means each customer generates three times what you spent to acquire them. Anything less, and buyers start questioning whether you’re burning too much cash to grow.

Your Profit Margins

Micro SaaS businesses should be hitting 70-85% gross margins. Software naturally enjoys high margins. If yours are lower, buyers will dig into why. Maybe you’re spending too much on infrastructure or support.

Growth from Existing Customers

Net Revenue Retention above 100% is gold. This means your current customers are spending more over time through upgrades and add-ons. You’re growing without needing to constantly find new customers, which buyers love.

The Rule of 40 Quick Check

Add your growth rate and profit margin together. A business growing at 30% with 15% margins hits 45, and that’s strong. While this started with bigger SaaS companies, buyers now use it for micro SaaS, too.

Want to dive deeper into these numbers? Check out our complete guide on SaaS valuation metrics.

Your Path to Exit

You’ve got three main routes when you’re ready to sell. Each works differently depending on where your business stands.

Selling Through Marketplaces

Some founders choose to sell their micro SaaS through online acquisition marketplaces where buyers and sellers connect. These platforms typically include a mix of independent operators, small funds, and acquisition entrepreneurs.

The process is generally standardized: listings are reviewed, metrics are verified, and interested buyers conduct due diligence. Based on publicly shared industry timelines, many micro SaaS deals listed on these marketplaces tend to close within 60–120 days, depending on documentation quality and financial clarity.

This route works best when a business has clean metrics, low churn, and clear documentation, since buyers in these environments typically evaluate SaaS businesses using established benchmarks such as ARR stability, customer retention, and margin health.

Strategic Buyers

Sometimes a bigger SaaS company wants what you’ve built. They’re buying the features, the customers, or the market position you’ve created. These buyers often pay premium prices because they see value beyond just the numbers.

Think about it: a project management tool might pay extra for your time-tracking micro SaaS because it completes their product suite.

Financial Buyers

These are investors treating your business as a portfolio addition. They focus on cash flow and growth potential. Expect them to run detailed financial models and want professional-level reporting.

What to Expect Price-Wise

Your ARR size matters a lot here. Under $50K ARR? You’re looking at 2-4x multiples. Between $100K and $500K with strong metrics? That jumps to 4-6x. Exceptional businesses with great growth and low churn sometimes hit 6-8x, but that’s rare.

Boosting Your Sale Price

Let’s talk about the moves that actually increase what buyers will pay.

Cut Your Personal Involvement

This is huge. When you’re the only one who can handle support, development, or sales, buyers discount heavily. Document your processes. Train your team. Automate what you can. Show that the business runs without you.

Get Your Books Clean

Use proper bookkeeping software. Separate personal and business expenses completely. Organize those tax returns. Clean financials speed up deals because buyers need confidence in your numbers.

Fix Your Churn Problem

Find out where customers are dropping off. Improve your onboarding. Add retention campaigns. Even reducing churn by 20-30% significantly boosts your valuation and proves your product has staying power.

Document Everything Technical

Buyers fear what they can’t understand. Write clear technical docs. Comment your code. Create architecture diagrams. Undocumented code equals risk, which equals lower offers.

Optimize Your Pricing

Many founders underprice at launch and never revisit it. Look at competitor pricing. Tests increase with new customers. Add pricing tiers. You can often boost MRR 15-30% without adding a single feature.

Track the Right Metrics

Build dashboards for MRR, churn, LTV, CAC, and retention. Use tools like ChartMogul or Baremetrics. This shows buyers you run a data-driven business, not a hobby project.

Timing Your Exit Right

Knowing when to sell is almost as important as building something worth buying.

Market Conditions Matter

Buyer activity peaks when the economy is strong and financing is easy. During uncertain times, expect longer timelines as buyers get pickier. Micro SaaS is steadier than big tech, but timing still counts.

Check Your Retention Health

Don’t try selling when churn is spiking. Fix retention issues first. Then approach buyers when your metrics show stability or improvement.

Milestone Moments

Hitting $10K MRR, $100K ARR, or profitability creates momentum. Exit right after a milestone because buyers love that forward energy.

Your Personal Situation

Burnout, new opportunities, and lifestyle changes are all valid reasons to exit. But selling from strength (growing business, engaged founder) almost always gets better valuations than a distressed sale.

Watch for Demand Signals

Are you getting more acquisition inquiries? Seeing competitors sell? Strategic buyers reaching out? These suggest good exit timing.

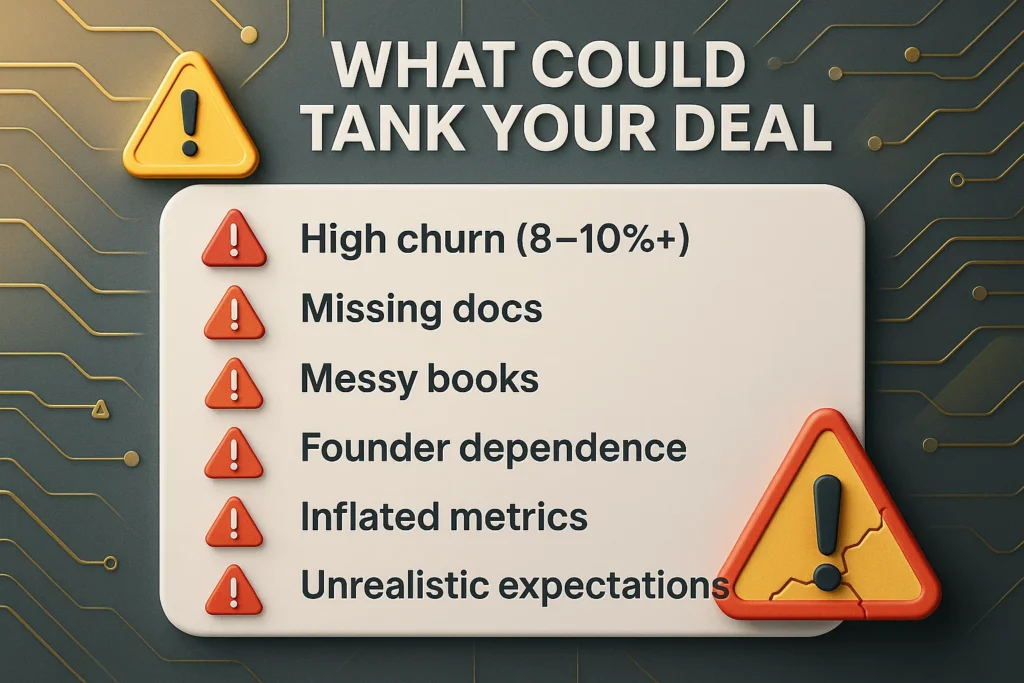

What Could Tank Your Deal

Let’s be honest about what kills sales or crushes valuations.

- High churn above 8-10%? Deal killer. Buyers see dying revenue.

- Missing documentation? They’ll assume the worst and drop their offer.

- Messy books? Due diligence drags on, buyers lose confidence, and deals collapse.

- Everything depends on you? Limited buyer pool. They can’t see themselves running it.

- Inflated metrics? Due diligence will uncover this. Trust evaporates. Deal dies.

- Unrealistic pricing expectations? Wanting 10x multiples with high churn and no growth? Buyers will pass.

How We Help at Bookman Capital

We work with micro SaaS founders through the entire exit process.

Our pre-exit assessment looks at your business through the buyer’s eyes. We identify what needs improvement and develop realistic valuation ranges based on current market conditions.

Metric cleanup means organizing financials, validating your SaaS metrics, and creating the professional dashboards buyers expect. Clean data means faster deals and better prices.

Buyer mapping leverages our relationships with marketplace buyers, strategic acquirers, and financial buyers. We connect you with buyers whose criteria actually match your business.

Throughout negotiations, we’re there with deal structure advice, valuation support, and due diligence coordination. Dozens of transactions’ worth of experience help you navigate the complex parts confidently.

We focus on transparent, data-backed valuations. No inflated expectations. Just honest assessments based on comparable deals and real buyer appetite. That builds trust and closes deals.

Common Questions

What multiple should I expect?

Most micro SaaS businesses sell for 3-6x ARR depending on your growth, churn, and profitability. Smaller businesses under $50K ARR trend toward 2-4x. Mid-size ($100K-500K ARR) with strong metrics can reach 4-6x.

Exceptional businesses with low churn, high growth, and strategic value occasionally hit 6-8x. But expect lower multiples if your churn is above 7-8%, growth is flat, or you’re too involved in daily operations.

How critical is churn?

Extremely. It’s one of the top factors buyers examine. Monthly churn below 5% signals health and commands premium pricing. Between 5 and 7%? Acceptable, but you’ll see 10-20% valuation cuts.

Above 8%? You’ve got serious product-market fit concerns. Many buyers will simply pass. They’re looking at churn because it predicts future revenue and customer satisfaction.

Do I need a broker or marketplace?

Neither is required, but both have advantages. Marketplaces can give you buyer access, standard processes, and speed and they will charge fees.

Advisory firms like ours offer personalized buyer matching and negotiation support. Often, we secure higher valuations through strategic buyer relationships.

Direct sales to strategic acquirers skip the fees but require strong networks and negotiation skills. Choose based on your business size, timeline, and comfort level with sales.

Ready to explore your exit options? Contact Bookman Capital today for a confidential assessment of your micro SaaS business and discover what buyers in your market are willing to pay.

Sources: