Your SaaS company needs consistent revenue growth to survive and thrive. Monthly recurring revenue (MRR) stands as the heartbeat of every successful software business because it captures how well you attract the right users, activate them quickly, keep them engaged, and expand accounts over time.

The difference between companies that scale and those that stagnate lies in treating MRR as a system you improve week after week. Most SaaS founders still focus heavily on acquiring new customers, which can burn cash and deliver weak payback if retention and expansion are ignored. The smartest companies in 2025 use systematic MRR growth strategies that compound over time through clear pricing, strong onboarding, proactive retention, and well-timed expansion.

What Makes MRR the Ultimate SaaS Success Metric?

MRR represents predictable monthly revenue from all active subscriptions. This metric reduces noise from seasonal variations and one-time payments so you can see true recurring performance. SaaS companies use MRR to measure business health, plan cash flow, and forecast future performance with more confidence.

The calculation involves three components: new MRR from fresh customers, expansion MRR from upgrades and add-ons, and churned MRR from downgrades and cancellations. Successful SaaS companies track each component separately to identify growth opportunities and remove bottlenecks.

Current MRR Benchmarks Tell a Clear Story

Benchmarks are most useful on an annual basis rather than as fixed monthly targets. Across private B2B SaaS, recent industry surveys show a median annual revenue growth rate around the mid-20s year over year, with higher growth at smaller ARR levels and tighter ranges as companies scale. Use annual growth benchmarks and compare yourself to peers at a similar ARR band and motion instead of assuming a universal monthly MRR target. This approach gives you a more realistic baseline for setting goals and evaluating momentum.

How Smart Pricing Strategies Unlock Hidden MRR Growth

Pricing optimization is often the fastest path to MRR growth for established SaaS companies because small improvements can create immediate revenue gains without additional acquisition spend. Many teams leave meaningful revenue on the table by anchoring price to costs or competitors rather than value.

Value-based pricing tends to outperform cost-plus and simple competitor benchmarking because customers are willing to pay in proportion to the outcomes your product delivers. Done well, value-based pricing increases average revenue per account and reduces price sensitivity, which strengthens unit economics and cash flow.

The Science Behind Psychological Pricing Tactics

Price anchoring influences decision making by shaping how customers perceive value and trade-offs. Presenting a higher-value plan first can make mid-tier options feel more reasonable by comparison and can shift plan mix when validated through testing.

Decoy pricing guides customers toward your preferred plan by placing a slightly less attractive option at a similar price point. When customers compare side by side, they tend to select the option with clearer value. These techniques should be validated with experiments since effects vary by audience and product.

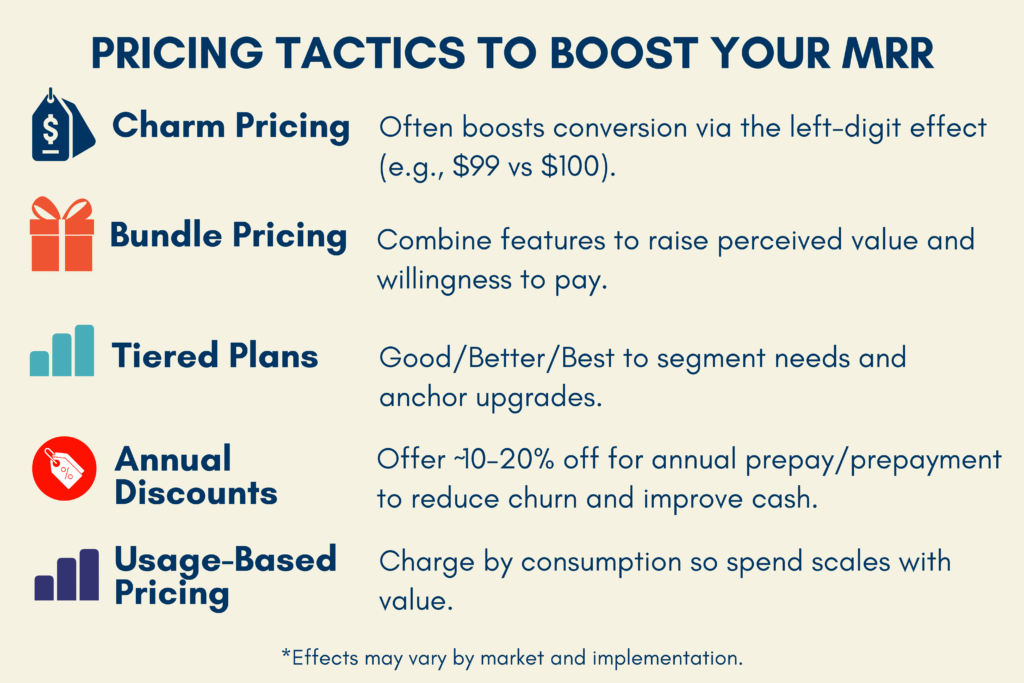

5 Psychological Pricing Tactics That Boost SaaS MRR

• Charm pricing with 9s: for example, $99 can feel more approachable than $100 to many buyers when positioned clearly

• Bundle pricing: combine features that deliver a complete outcome to increase perceived value and reduce churn

• Tiered good-better-best: three clear options simplify choice architecture and can raise conversions when tiers map to outcomes

• Annual discount incentives: starting in the 15–20% range is common, then tune to CAC payback, cash needs, and churn profile

• Usage-based triggers: align price with value consumption so increases feel fair as customers grow

Testing Price Changes Without Customer Backlash

Price testing requires a careful plan to protect trust. New customers are the best population for pricing experiments, while existing customers typically need grandfathering and clear advance communication.

Run tests until you reach sufficient statistical power for the metric you care about, such as revenue per visitor, conversion to paid, or average contract value. Test one pricing element at a time to isolate impact, start with modest adjustments, and review results by segment so you learn where price elasticity differs.

Why Customer Retention Delivers Better MRR Returns Than Acquisition

It is widely cited that acquiring a new customer can cost several times more than retaining an existing one, and even small improvements in retention are associated with meaningful profit gains in many industries. Retention improvements compound over time as customer lifetime value grows, which strengthens cash flow and reduces the pressure on acquisition.

In B2B SaaS, strong teams often aim for roughly 1–3.5% monthly logo churn depending on segment and average revenue per customer, while enterprise motions can be closer to 1–2% monthly. Calibrate your targets by price point and sales motion, and focus on the levers that reduce early-life churn and improve long-term engagement.

Spotting Churn Signals Before Customers Cancel

Declines in feature usage, lower login frequency, and stalled activation milestones are reliable early indicators of potential churn. Support-related signals such as rising ticket volume, unresolved issues, and negative sentiment also point to risk.

Use these signals to prioritize proactive outreach. Campaigns that re-engage users on stalled steps, clarify value for underused features, and resolve friction early can lift save rates and protect MRR, especially when paired with success-led conversations and in-product nudges.

Churn Reduction Strategies

| Strategy | Implementation Time | Potential Churn Reduction | Cost Level |

| Onboarding optimization | 2–4 weeks | 10–20% reduction | Low |

| Usage monitoring alerts | 1–2 weeks | 10–25% reduction | Medium |

| Customer success outreach | 4–6 weeks | 15–30% reduction | High |

| Feature adoption campaigns | 3–5 weeks | 5–15% reduction | Medium |

| Renewal prediction models | 6–8 weeks | 15–30% reduction | High |

Onboarding Excellence Prevents First Month Disasters

Early churn can spike when onboarding is unclear or time to first value is slow. Help customers achieve a meaningful result quickly, ideally within the first 7 to 14 days, so they feel progress and confidence. Clear progress indicators, milestone celebrations, and short educational moments keep users moving forward during setup.

Progressive disclosure prevents overwhelming new users. Introduce one core feature at a time in the order that leads to value. This approach shortens time to value and supports better long-term retention.

How Revenue Expansion from Existing Customers Multiplies MRR

Expansion revenue from current customers typically converts at a much higher rate than net-new acquisition because those customers already understand your product and trust your brand. It is also lower risk and capital efficient.

Many successful SaaS companies generate a significant share of new revenue from existing customers, often 20–40% depending on segment and motion. This includes upgrades to higher tiers, add-on features, and increased usage limits. Expansion MRR often carries higher margins than new customer MRR because acquisition costs are lower.

Perfect Timing Transforms Upselling Success Rates

Usage threshold triggers help identify customers who are ready for plan upgrades. When customers approach plan limits, present clear upgrade options before they hit restrictions. This proactive moment is when the value of upgrading is most obvious.

Contract renewal periods also create natural opportunities to discuss additional value with minimal friction. Customers expect commercial conversations at renewal, so you can bundle relevant upgrades or services to increase average contract value without disrupting the relationship.

Cross-Selling Strategies That Feel Natural to Customers

Use feature adoption data to spot power users who gain strong value from your core product. These customers are ideal candidates for complementary features and add-ons because they are more likely to succeed with additional capabilities.

Integration partnerships open cross-sell opportunities without channel conflict. Customers who connect multiple tools tend to expand usage to maximize the value of your ecosystem, which deepens stickiness and lifts MRR.

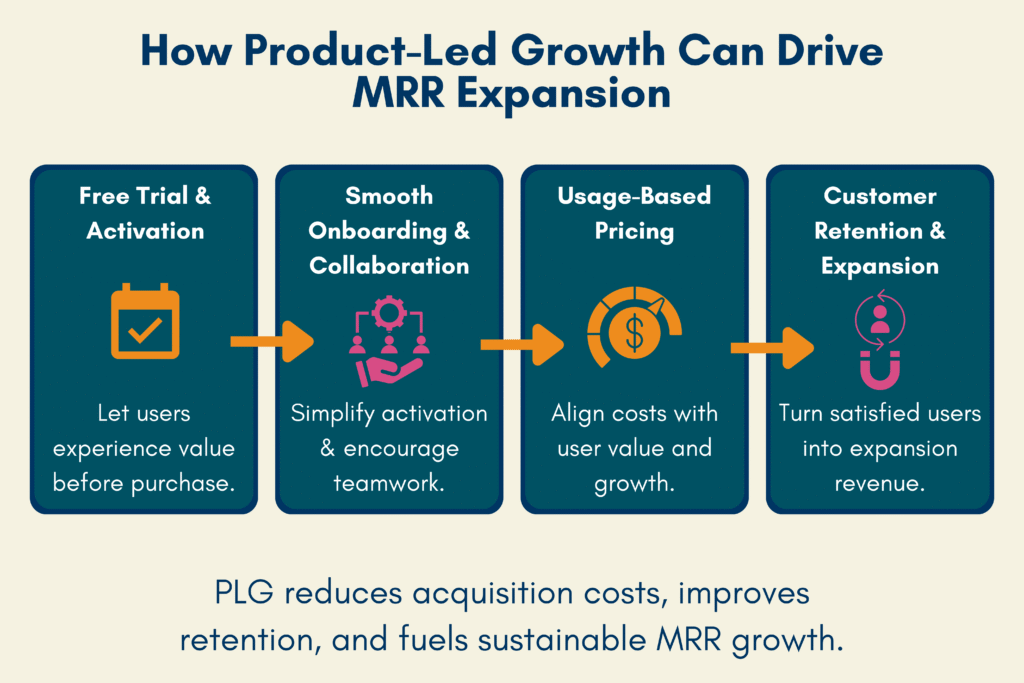

Product Led Growth Strategies That Generate Efficient MRR Expansion

Product-led growth lowers acquisition costs by letting users experience value before purchase. When activation is smooth and value is clear inside the product, conversion quality improves and retention strengthens.

Strong PLG companies often emphasize efficiency and net revenue retention rather than chasing headline growth alone. With well-designed activation, collaboration surfaces, and usage-based value, PLG can scale faster and more profitably than a pure sales-driven approach in the right markets.

Building Viral Loops Into Your SaaS Architecture

Collaborative features encourage invitations and organic account expansion. Team workspaces, shared documents, and project management tools gain value as more users join, which encourages growth inside customer organizations.

Data sharing and reporting features such as dashboards, client portals, and automated reports create external touchpoints that expose your product to adjacent stakeholders. These touchpoints generate qualified interest while delivering value to current customers.

Referral Programs That Actually Drive MRR Growth

Successful referral programs deliver value to both referrers and new customers. Account credits, feature unlocks, and service upgrades tend to motivate participation more consistently than one-off cash rewards.

Ask for referrals when customers have just experienced a clear win or shared positive feedback. Monitoring satisfaction and usage helps you time the request for higher participation and better lead quality.

Advanced Analytics Transform MRR Optimization Into Science

Revenue analytics give you granular visibility into MRR performance by segment, plan, channel, and cohort. Use these insights to identify which customers and features drive the highest-value growth and to spot underperforming areas that need improvement. Data-driven decisions consistently outperform intuition when you are deciding where to invest time and budget.

Cohort analysis shows how behavior changes over time. By tracking retention and expansion for each signup month, you can see which acquisition sources and onboarding paths produce the strongest long-term outcomes and redirect resources accordingly.

Essential MRR Metrics Beyond Basic Monthly Calculations

Net MRR or ARR Growth combines new revenue, expansion, and churn to reveal true momentum. Track it on an annual basis and by customer segment so you can see whether growth is healthy and sustainable.

Customer Lifetime Value to Customer Acquisition Cost ratios help guide how aggressively you can scale. A 3:1 LTV to CAC ratio is a common rule of thumb for healthy unit economics, while ratios below 2:1 suggest you should improve pricing, retention, or targeting before stepping on the gas.

Automation Tools That Scale MRR Growth Efforts

Marketing automation can nurture leads and customers with personalized messages based on behavior and usage. This helps surface expansion opportunities and delivers targeted upgrade prompts at the right time, which typically outperforms one-off manual outreach.

Customer success platforms monitor account health, consolidate signals such as usage and support tickets, and trigger intervention workflows automatically. This makes your team more efficient while improving save rates and customer outcomes across a larger book of business.

Your MRR Growth Action Plan Starts Today

Sustained MRR growth comes from executing a balanced system across pricing, retention, expansion, and acquisition. Companies that work multiple levers at the same time tend to see compounding effects, provided they measure impact and double down on what works.

Start with pricing optimization for quick wins and clearer unit economics. Move next to retention improvements that protect existing MRR. Then focus on expansion strategies that grow revenue from current customers. With this foundation in place, acquisition spend works harder and scales more predictably.

Schedule Your Free Consultation with Bookman Capital for Valuation and M&A Advisory

Ready to implement these proven MRR growth strategies for your SaaS business? For valuation or potential exit planning, Bookman Capital provides SaaS M&A and valuation advisory that prepares founders for strategic outcomes and surfaces the metrics buyers and investors prioritize. Contact Bookman Capital today at bookmancapital.io/.

Sources: