In today’s rapidly evolving digital landscape, artificial intelligence (AI) software as a service (SaaS) has emerged as a game-changing model for businesses across various sectors. As more entrepreneurs and business owners explore the potential of AI SaaS, understanding the intricacies of selling or scaling such a venture becomes paramount. This blog post delves into the critical insights that founders need to consider when embarking on the journey of scaling an AI SaaS business or preparing it for sale. By unlocking the value inherent in AI-driven solutions, stakeholders can position themselves for sustainable growth and success in a competitive marketplace. Whether you’re an investor seeking lucrative opportunities or a founder looking to maximize your company’s potential, grasping these essential strategies will be key to navigating the complexities of the AI SaaS landscape.

For AI SaaS founders, the strategic question has evolved beyond simple growth metrics. Today’s market rewards companies that demonstrate sustainable competitive advantages in an AI-native world—whether through proprietary data moats, unique model architectures, or distribution advantages that compound over time. Acquirer appetite has shifted dramatically toward companies with defensible AI capabilities and proven unit economics. The founders who master this new playbook won’t just maximize their exit multiples; they’ll define the next generation of enterprise software leaders.

The Current AI SaaS Market Landscape

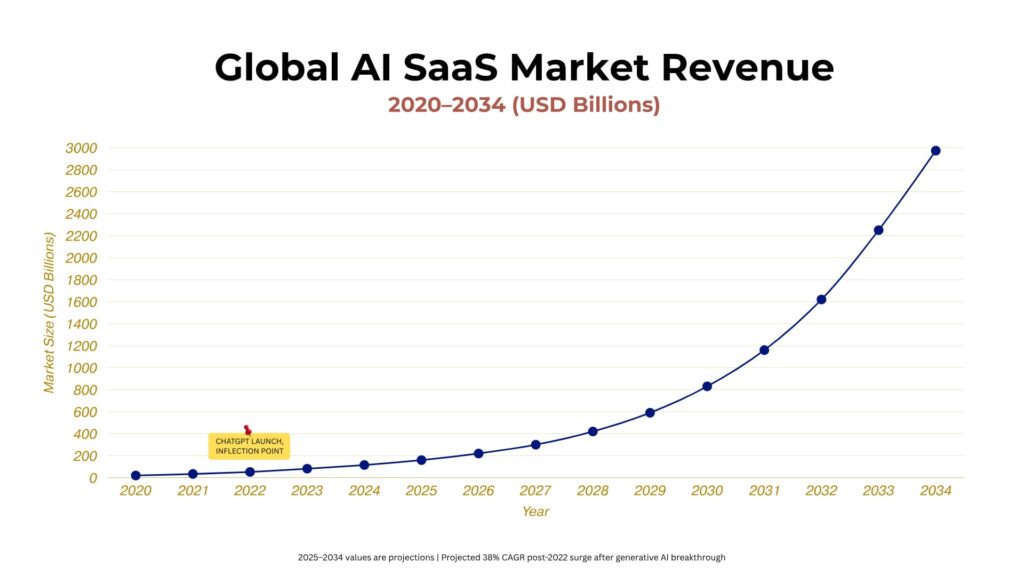

Market Size and Growth Trajectory

The global AI SaaS market reached $115.22 billion in 2024. Machine learning integration accelerates software adoption across industries. Enterprise customers increase artificial intelligence spending by70% annually according to recent surveys.

Generative AI solutions drive significant market growth. Companies integrate AI features into existing software platforms. This integration creates new revenue streams and competitive advantages for established providers.

ChatGPT catalyzed widespread AI adoption across business sectors, reaching 1 million users within five days of its November 2022 launch. Organizations recognize AI’s potential for operational efficiency. Investment in AI-powered business software reaches record levels.

Market research projects growth to $2,973.14 billion by 2034. B2B software companies leverage AI for customer acquisition. Subscription models prove particularly effective for AI-enhanced services.

Investment Climate and Funding Trends

Venture capital funding maintains robust levels for AI startups. AI startups received 53% of all global VC dollars in H1 2025. Private equity firms actively seek profitable AI companies.

Global GenAI VC investment reached $49.2 billion in H1 2025. AI represents 20% of all VC deals worldwide. Revenue growth rates influence funding availability significantly.

Series A funding emphasizes product-market fit verification. Early-stage companies demonstrate clear customer demand. Revenue growth rates influence funding availability significantly.

Late-stage funding targets scalable business models. Companies show predictable recurring revenue patterns. Enterprise customers provide validation for larger funding rounds.

Key Market Dynamics Shaping 2025

Economic conditions affect M&A activity across technology sectors. Interest rates between 4.5-4.75% influence deal structures. Strategic acquisitions focus on profitable growth companies.

IPO markets demonstrate strong recovery for profitable companies. IPO offerings increased 62.5% in 2025 versus 2024. Public valuations improve with 59% of 2025 IPOs profitable at debut.

Competition intensifies among AI software providers. Market consolidation accelerates through strategic acquisitions. Technology differentiation becomes increasingly important for sustained growth.

Understanding AI SaaS Valuations in 2025

Current Valuation Multiple Ranges

Private companies achieve valuation multiples with median ranges around 3.3x revenue. Bootstrapped businesses command premium multiples due to profitability. Venture-backed companies trade at varying multiples based on growth and profitability profiles.

Public SaaS companies achieve median multiples of 6.0x revenue as of 2025. Market conditions improve investor confidence in SaaS valuations. Profitable companies achieve multiples above market averages.

EBITDA multiples apply to companies with positive earnings. Cash flow positive businesses use earnings-based valuations. Growth rates influence which multiple method applies.

B2B companies typically achieve higher multiples than B2C platforms. Enterprise software commands premium valuations due to customer retention. Recurring revenue models support higher multiple ranges.

Factors That Drive Premium Valuations

| Factor | Why It Matters | Impact | Risk/Edge |

| Revenue Growth | Shows momentum | Higher valuation | Signals sustainability |

| Churn Rate <5% | Indicates retention | Premium pricing | Low customer loss |

| Gross Margin >80% | Demonstrates scalability | Drives profitability | Strong unit economics |

| Technology Moat | Competitive advantage | Defensibility | Enhances valuation |

Industry-Specific Multiple Variations

Vertical SaaS companies achieve higher multiples than horizontal solutions. Industry expertise creates barriers to entry. Domain knowledge provides sustainable competitive advantages.

Healthcare AI commands premium valuations due to regulatory barriers. Financial services AI benefits from compliance requirements. Manufacturing AI leverages operational efficiency improvements.

Developer tools achieve consistent valuation premiums. API businesses demonstrate network effects at scale. Infrastructure software benefits from switching costs.

Valuation Multiple Recovery Trends

Market multiples peaked at 6.0x revenue in 2021 for many companies. Economic uncertainty drove multiples lower in 2023. Current recovery brings public SaaS multiples to 6.0x median levels.

Interest rate stabilization supports multiple expansion. Investor confidence returns to growth technology companies. Public market performance influences private valuations.

Quality companies outperform market averages consistently. Profitability focus drives multiple expansion for efficient businesses. Sustainable growth rates support valuation recovery.

Strategic Decision Framework: Scale vs. Sell

When Scaling Makes Strategic Sense

Revenue growth above 40% annually indicates scaling potential. Market opportunity size supports continued expansion. Competitive position provides sustainable advantages.

Customer acquisition costs remain below lifetime value thresholds. Product-market fit enables predictable growth patterns. Team capabilities match scaling requirements.

Capital availability supports growth investments. Technology infrastructure scales with user demand. Operational processes handle increased business volume.

Market timing favors continued business expansion. Industry trends support long-term growth. Competitive dynamics allow market share gains.

Optimal Exit Timing Indicators

Market conditions favor strategic transactions. Buyer interest increases in profitable AI companies. Valuation multiples reach acceptable levels for founders.

Business maturity provides predictable cash flows. Growth rates stabilize at sustainable levels. Operational efficiency maximizes profit margins.

Founder readiness for life transitions influences timing decisions. Personal financial goals align with exit proceeds. Team succession planning ensures business continuity.

Strategic buyers actively seek technology acquisitions. Industry consolidation creates acquisition opportunities. Synergy potential drives premium valuations.

Hybrid Approaches and Partial Exits

Strategic partnerships provide growth capital without full exits. Joint ventures access new market segments. Technology licensing generates additional revenue streams.

Minority investments offer partial liquidity for founders. Growth equity partners provide scaling resources. Management retention maintains operational continuity.

Earnout structures align buyer and seller interests. Performance metrics determine additional payments. Risk sharing benefits both transaction parties.

Risk Assessment Matrix

Market risks include economic downturns and demand changes. Technology risks involve obsolescence and competitive threats. Operational risks encompass key person dependencies.

Financial risks affect cash flow and funding availability. Regulatory risks impact compliance requirements. Customer risks involve concentration and churn rates.

Mitigation strategies reduce business vulnerabilities. Diversification lowers concentration risks. Process documentation reduces operational dependencies.

Preparing Your AI SaaS for Maximum Value

Financial Health Optimization

Monthly recurring revenue trends demonstrate business momentum. Annual recurring revenue provides valuation foundations. Revenue predictability increases buyer confidence.

Customer churn rates below 5% annually indicate strong retention. Average B2B SaaS churn rate sits at 3.5% in 2025. Net revenue retention above 110% shows account expansion. Gross revenue retention measures customer satisfaction.

Gross margins above 80% demonstrate scalable economics. Contribution margins per customer show unit profitability. Operating margins indicate business efficiency.

Cash flow management ensures operational stability. Working capital requirements stay minimal for SaaS businesses. Cash conversion cycles optimize financial efficiency.

Financial reporting systems provide real-time visibility. Accounting practices follow GAAP standards. Audit trails support due diligence processes.

Operational Excellence Standards

Process documentation reduces key person risks. Standard operating procedures ensure consistent execution. Knowledge management systems preserve institutional memory.

Team structure supports business scalability. Key personnel retention programs maintain operational continuity. Succession planning identifies leadership development opportunities.

Technology infrastructure handles increased user demand. System architecture supports horizontal scaling. Performance monitoring prevents service degradation.

Security frameworks protect customer data and intellectual property. Compliance programs meet industry standards. Risk management procedures address operational vulnerabilities.

Market Position Strengthening

Customer acquisition strategies diversify lead generation channels. Sales processes convert prospects efficiently. Customer success programs maximize account value.

Product differentiation creates competitive moats. Feature development addresses customer pain points. Innovation cycles maintain technology leadership.

Brand recognition improves market positioning. Thought leadership establishes industry expertise. Customer testimonials provide social proof.

Partnership networks expand market reach. Integration ecosystems increase customer stickiness. Channel relationships accelerate growth rates.

Due Diligence Preparation

Legal documentation organizes corporate records. Intellectual property audits catalog technology assets. Contract reviews identify key agreements.

Financial records demonstrate business performance. Tax compliance ensures regulatory adherence. Insurance coverage protects business assets.

Operational documentation explains business processes. Technology architecture diagrams show system design. Data governance policies protect customer information.

Employee records document team capabilities. Compensation plans outline retention strategies. Benefits programs support talent acquisition.

Execution Strategies for Scaling AI SaaS Businesses

Growth Strategy Implementation

Customer acquisition channels diversify lead sources. Digital marketing generates qualified prospects. Sales team expansion supports revenue growth.

Product development roadmaps align with customer needs. Feature prioritization maximizes user value. Release cycles maintain development momentum.

Market expansion strategies target new segments. Geographic expansion accesses international markets. Vertical expansion leverages domain expertise.

Team scaling matches business growth requirements. Hiring plans address skill gaps. Culture development maintains organizational values.

Funding and Capital Strategy

Series A preparation requires product-market fit demonstration. Financial metrics show scalable growth patterns. Customer traction validates market demand.

Series B funding supports market expansion initiatives. International growth requires additional capital. Team scaling needs funding support.

Alternative funding includes revenue-based financing. Debt financing preserves equity ownership. Government grants support R&D investments.

Investor selection aligns with strategic goals. Board composition provides industry expertise. Valuation negotiations balance growth and dilution.

Operational Scaling Challenges

Infrastructure scaling handles AI workload demands. Cloud computing provides elastic capacity. Performance optimization maintains user experience.

Customer support scaling matches user growth. Support ticket volume increases with customer base. Self-service options reduce support costs.

Regulatory compliance becomes complex with geographic expansion. Data privacy laws vary by jurisdiction. Legal counsel ensures compliance adherence.

International expansion requires localization efforts. Currency management affects financial reporting. Cultural adaptation improves market acceptance.

Exit Strategy Execution for AI SaaS Founders

Exit Option Evaluation

Strategic buyers seek technology acquisitions for competitive advantages. Industry consolidation drives acquisition activity. Synergy potential justifies premium valuations.

Financial buyers focus on cash flow generation. Private equity firms target profitable businesses. Growth potential influences investment decisions.

Management buyouts preserve company culture. Employee ownership maintains team motivation. Financing structures enable management control.

IPO readiness requires substantial revenue scale. Public markets demand transparent reporting. Regulatory compliance increases operational complexity.

Sale Process Management

Investment bankers manage transaction processes. Industry expertise improves buyer identification. Valuation analysis supports pricing decisions.

Marketing materials highlight business strengths. Financial projections demonstrate growth potential. Competitive positioning emphasizes market advantages.

Negotiation strategy balances price and terms. Deal structure affects tax implications. Closing conditions ensure transaction certainty.

Due diligence management requires organized documentation. Data room preparation facilitates buyer review. Management presentations address buyer questions.

Post-Exit Considerations

Earnout structures tie additional payments to performance metrics. Revenue targets align buyer and seller interests. Integration success affects earnout achievement.

Non-compete agreements restrict future business activities. Geographic limitations define restricted markets. Time restrictions specify agreement duration.

Tax optimization strategies minimize transaction costs. Installment sales defer tax obligations. Professional advice ensures optimal structures.

Next venture planning leverages exit experience. Industry knowledge provides competitive advantages. Network relationships facilitate future opportunities.

Frequently Asked Questions

What are the typical valuation multiples for AI SaaS businesses in 2025? Private AI SaaS companies achieve median valuation multiples around 3.3x annual recurring revenue. Public SaaS companies trade at higher multiples around 6.0x revenue. Profitable businesses command higher multiples than growth-stage companies. Company stage, profitability, and growth rates significantly influence multiple ranges.

How do I know if my AI SaaS business is ready to scale vs. sell? Revenue growth above 40% annually indicates scaling potential. Market opportunity size determines expansion viability. Capital availability and team capabilities influence scaling decisions. Market conditions and personal goals affect exit timing.

What specific metrics do buyers focus on when evaluating AI SaaS businesses? Monthly recurring revenue growth demonstrates business momentum. Customer churn rates below 5% annually indicate strong retention. Gross margins above 80% show scalable economics. Net revenue retention above 110% proves account expansion capabilities.

How long does the typical AI SaaS business sale process take? Strategic transactions typically require 6-9 months for completion. Due diligence periods last 60-90 days on average. Negotiation phases extend 30-60 days depending on deal complexity. Regulatory approvals may add additional time for larger transactions.

What are the biggest mistakes AI SaaS founders make when preparing for exit? Financial record disorganization delays due diligence processes. Key person dependencies create buyer concerns. Customer concentration reduces business value. Technology debt affects integration feasibility for strategic buyers.

Maximize Your AI SaaS Business Value

Strategic decisions require expert guidance for optimal outcomes. Market timing significantly affects business valuations. Professional advice helps navigate complex transaction processes.

Ready to unlock your AI SaaS business’s maximum value? Whether you’re planning to scale or exploring exit opportunities, the experts at Bookman Capital provide specialized guidance for technology founders. Our team understands the unique dynamics of AI SaaS valuations and can help you navigate critical strategic decisions. Contact Bookman Capital today to discuss your specific situation and explore your options.

Business preparation determines value maximization success. Financial optimization improves buyer interest. Operational excellence reduces transaction risks.

Don’t leave money on the table. Connect with Bookman Capital’s experienced advisors to develop a customized strategy for your AI SaaS business. Get your free consultation and discover how to maximize your business value in today’s market.

Sources: