A founder signs a term sheet, proud of landing a $20 million valuation. Six months later, she realizes the deal needs a $100 million exit just to match what she would have earned from a $15 million valuation with cleaner terms.

Scenarios like this happen in startup boardrooms every quarter. Founders often chase big headline numbers and overlook how that valuation affects every other part of their term sheet.

The valuation you negotiate influences your leverage on liquidation preferences, anti dilution protections, board control, and more. Understanding these connections within your term sheet determines whether you build wealth or give it away.

This guide will show you how the valuation you secure transforms your entire funding agreement, highlights the key terms, and explains how to negotiate for your best outcome. Most importantly, it will help you keep more equity where it truly belongs: with you.

More Than Just One Number

Valuation is more than a figure on your term sheet. It shapes your negotiating position for every clause that follows and influences how investors view your company’s potential.

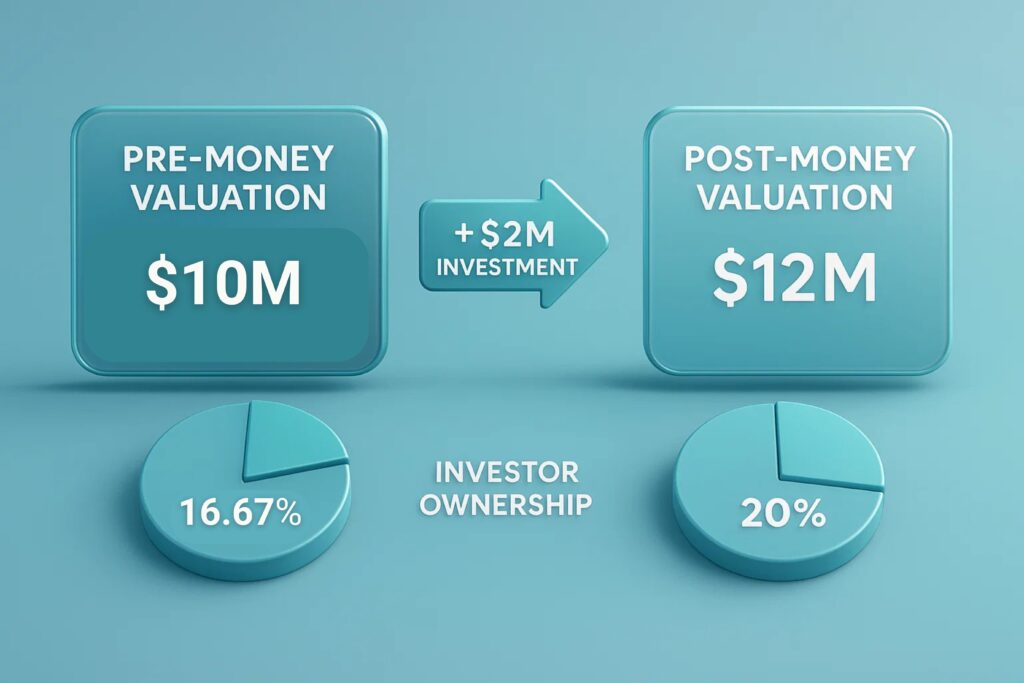

Pre money valuation is your company’s value before a new investment. Post money is pre money valuation plus investment. A $5 million pre money valuation and a $1 million investment create a $6 million post money valuation. Investors then own 16.67 percent of the company.

In 2024, AI startups raised Series A rounds at a median valuation of $45.7 million, while traditional SaaS companies typically saw lower numbers. These figures guide your future term sheet negotiations.

A higher valuation means founders give away less ownership per dollar raised. Retained equity becomes valuable leverage for every negotiation with investors. However, it is always a trade. Investors who offer higher valuations often want stronger protections, while those investing at lower numbers may accept founder friendly terms to balance things out. Finding the right balance is key.

Why the Math Matters: Pre-Money vs Post-Money

The difference between pre-money and post-money valuation directly impacts dilution. Investors calculate their ownership based on one of these numbers, significantly affecting founder equity.

For example, if investors seek a 20% stake, basing it on pre-money lets founders retain more equity. If calculated post-money, you give up more. With a $10 million pre-money valuation and a $2 million investment, you have a $12 million post-money valuation. Pre-money calculation gives investors 16.67%; post-money gives them a full 20%.

This difference compounds over multiple rounds. Most term sheets use post-money for clarity, but always check which number applies before signing.

The Hidden Costs in Your Term Sheet

The term sheet valuation only reveals part of the story. Many provisions can erode the true value founders receive.

One tactic is the so-called “option pool shuffle.” Investors might require you to set aside a 10 to 20 percent employee option pool. When you create this pool matters for who bears the dilution. If your pre-money valuation includes a 10 percent option pool, the founders absorb the dilution, so your real business value is $9 million despite a $10 million headline. Investors still get their percentage, but founders own less.

Next, there are liquidation preferences, which set the payout order at exit. Most recent deals used a simple 1x non-participating liquidation preference, meaning investors get their money back first and the rest is split by ownership.

Participating preferences favor investors further: they get their cash back, then still share what remains.

For example, if you raise $5 million for 25% of a $20 million post-money valuation and exit for $50 million, 1x non-participating preference delivers $12.5 million to investors, $37.5 million to founders. If investors have a participating preference, they get $5 million back plus 25% of the remaining $45 million ($11.25 million), totaling $16.25 million, while founders get $33.75 million.

Anti-dilution rights, especially full ratchet, protect investors if you raise later at a lower valuation. Full ratchet is harsh, adjusting their share price to the new low. Weighted average is fairer, adjusting more gently in down rounds.

These terms can quickly stack up. High valuations with bad provisions can do more damage than lower valuations with clean ones.

Turning Valuation Into Negotiating Power

A strong valuation strengthens your ability to negotiate founder favorable term sheet terms, not just price.

The best way to maximize your position is by creating competition. Keep conversations with multiple investors going. Having several offers means you can push for a better term sheet and walk away from bad deals.

Exclusivity periods for Series A usually span 30 to 45 days, allowing due diligence but preventing indefinite deal lock. If asked for 60 days or more, be cautious.

Support high valuations with evidence such as revenue growth, customer wins, and product progress. Investors pay more for visible momentum.

Negotiating board seats also depends on leverage. Premium investors are more open to observer roles, while bargain investors often request board seats.

Never hesitate to walk away from unfavorable terms. Bad deals tend to get worse with each round as investors seek the same or stronger protections.

Six Term Sheet Traps to Avoid

- Participating liquidation preferences above 1x: Nearly all market deals stick to 1x non-participating. More only helps investors.

- Full ratchet anti-dilution: The market standard is weighted average. Full ratchet punishes founders in down rounds.

- Immediate investor board control: Early investors shouldn’t rule your board before product-market fit. That’s for you.

- Excessive option pools over 20%: Normal pools are 10 to 15%. Anything higher just dilutes founders.

- Veto rights on future rounds: Don’t let investors block necessary capital if you disagree on valuation or terms.

- Pay-to-play clauses that penalize founders: Beware conversion of your shares if you can’t participate in future funding. These provisions can hurt founders disproportionately.

When Market Timing Is Everything

The environment in 2024 and 2025 shifted valuation dramatically. Q3 2024 data showed AI startups getting up to 40 percent higher multiples than non-AI companies.

Median AI pre-money valuations: Pre-seed $3.6M, Seed $10M, Series A $45.7M, Series B $366.5M. This premium signals investor confidence in AI.

Valuation drivers: More focus now goes to capital efficiency, clear profit paths, and unit economics like CAC, lifetime value, and margin.

| Stage | AI Startups | SaaS | Fintech | Health Tech |

| Pre-Seed | $3.6M | $5M | $4M | $4.5M |

| Seed | $10M | $12M | $10M | $11M |

| Series A | $45.7M | $30M | $35M | $40M |

| Series B | $366.5M | $100M | $120M | $150M |

Your specific valuation depends on your revenue, traction, team, and edge. Outliers need clear evidence.

As of early 2025, the SaaS Capital Index was 7.0x annualized revenue. Bootstrapped SaaS companies saw a median of 4.8x, equity-backed 5.3x. Software sales multiples averaged 3.0x; EBITDA multiples averaged 15.2x.

Technical leadership and unique technology boost valuations, especially in AI. Companies with defensive IP and special datasets gain more leverage.

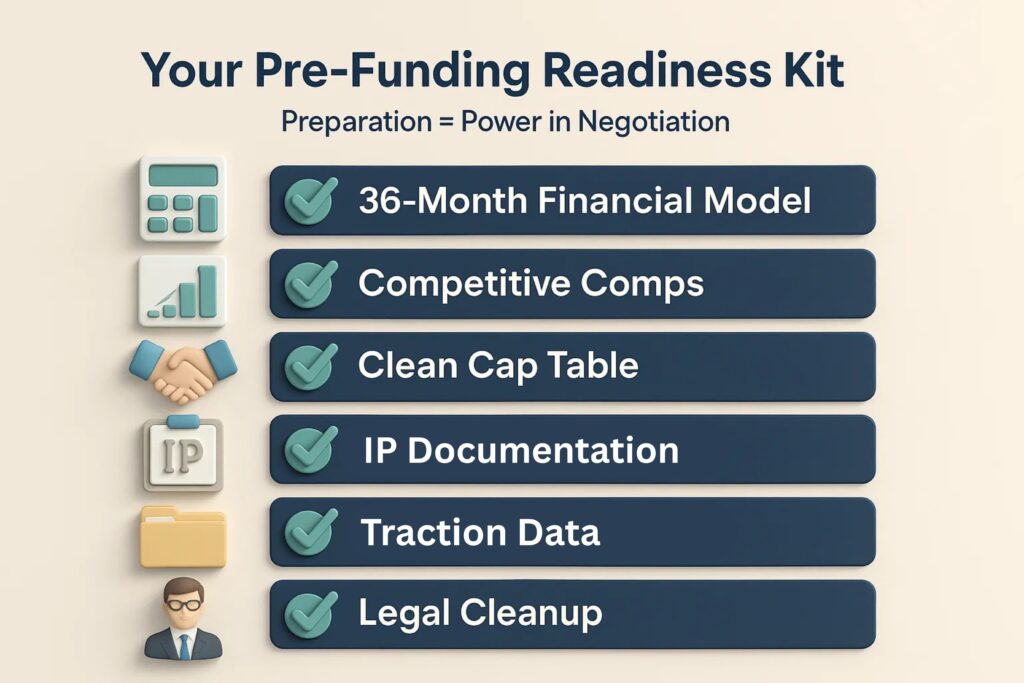

Preparing to Win Before You Start

Success in fundraising rests on preparation. Before negotiating, get these ready:

- 36-month financial model: Forecast revenue, expenses, cash, unit economics.

- Competitive comps: Find similar companies and deals to benchmark your valuation.

- Clean, current cap table: Accurate share records and vesting details.

- Traction data: Growth, customer metrics, and usage, especially key for SaaS.

- IP documentation: Patents and unique data can boost your negotiating power.

- Legal cleanup: Vesting and IP assignments must be in order.

Having expert advisors is essential. Experienced mentors and startup attorneys can help you spot risky terms before they become problems. Bookman Capital experts provide founders with tailored insights and guidance to ensure every term works in your favor.

Why Early Term Sheets Shape Your Future

Early funding terms often haunt later rounds. Clean seed terms ease Series A negotiations, while early bad provisions usually persist or worsen as new investors demand the same protections.

Future investors will scrutinize your prior terms. You protect flexibility by keeping both economic and control provisions founder-friendly. For example, with a fair board structure and strong voting rights.

You can recover from a low valuation if you maintain control. But if you lose control, even a high valuation won’t save you. Optimize for the best overall package, not just the top-line number.

The Bottom Line

Imagine you have three term sheets for $28M, $31M, and $35M. Rather than jumping at the biggest offer, pick the $31 million deal if it has clean 1x non-participating liquidation, standard weighted average anti-dilution, and just a board observer seat.

If you exit in two years for $120 million, you could walk away with $67 million. The founder who took the biggest offer but accepted poor terms might end up with just $51 million.

That difference? It comes from partnering with advisors who know how to read the fine print.

Be prepared, understand the details, and negotiate a deal that builds your future.

Ready for your next negotiation? Bookman Capital can translate every term sheet before you sign. We’ve helped hundreds of founders make smarter funding decisions.

Book your free term sheet review at bookmancapital.io/ and ensure your next funding round works for you, not just the headline.

Sources: