You need a 409A valuation. That much is clear, but the next question trips up many founders: who can perform a 409A valuation?

You can’t simply ask your accountant for a quick number. The IRS expects the valuation to be independent and reasonable to provide protection. Choosing the wrong valuation providers risks severe tax penalties for your team.

This guide cuts through the confusion. We explain the exact qualifications a provider must have. You will learn about the different types of firms in this space.

We also cover what you should expect from the process. Let’s identify who can legally determine your company’s stock value.

The IRS Rulebook: What the Law Actually Says

The rules come from Section 409A of the Internal Revenue Code. The law requires a reasonable valuation method.

The IRS provides a safe harbor for valuations that meet specific standards. A key standard involves using an independent, qualified appraiser.

An internal calculation by your CFO often fails this test. A guess from your lead investor is also a problem.

This independent appraisal helps create a strong safe harbor position. A compliant valuation protects your company from IRS penalties. It also protects your employees from unexpected tax bills.

The goal is a valuation that is defensible and not grossly unreasonable.

The Core Principle: Independence Isn’t Optional

The IRS safe harbor strongly favors independent appraisals. This means the appraiser cannot have a financial stake in your outcome. They must be a true third party.

This principle is what disqualifies internal teams and investors.

The Safe Harbor: Your Shield Against Penalties

Meeting the IRS standards gives you “safe harbor” status. This is your legal protection. It means the IRS presumes your valuation is correct.

Without it, your valuation faces much higher scrutiny. The burden of proof shifts to your company.

The Valuation Providers Landscape: From Specialists to Solo Acts

Not all valuation providers are the same. The market has different players, each with pros and cons. Your company’s stage and complexity determine the best fit.

Specialist firms do this work every single day. Big accounting firms have dedicated valuation practices.

Boutique firms and independent appraisers offer more personal service. You must understand the differences to choose wisely.

The Heavy Hitters: Specialist & Big Four Firms

These are the go-to for venture-backed startups. They offer deep expertise and brand credibility.

Specialist Valuation Firms: Their entire business is valuation. They are experts in startup cap tables and preferred stock.

Big Four Valuation Practices: Major accounting firms like PwC or Deloitte have separate valuation arms. They are preferred for late-stage, pre-IPO companies.

The Agile Players: Boutiques & Independent Appraisers

These valuation providers can be excellent for early-stage or bootstrapped companies. Due diligence is critical.

Boutique Valuation Firms: Smaller firms that often provide more hands-on service and competitive pricing.

Solo Practitioners: Independent, credentialed appraisers. Always verify their specific 409A experience and insurance.

Quick-Reference Provider Comparison

| Provider Type | Typical Cost | Best For | Key Verification Step |

| Specialist Valuation Firm | Higher | VC-backed startups, complex cap tables | Credentials (ASA, CFA, CVA, ABV) of lead appraiser |

| Big Four Accounting Firm | Highest | Late-stage, pre-IPO, global structures | Confirm that the valuation group (not audit) does the work |

| Boutique/Independent | Lower | Bootstrapped, simple structures, early-stage | 409A-specific experience and E&O insurance |

The Credential Check: Decoding the Alphabet Soup

Credentials matter. They are shorthand for formal training and ethical standards. You should look for specific letters after a name.

The right credentials mean the appraiser has passed rigorous exams. It means they follow professional valuation standards.

It is your first filter for quality and expertise.

Gold-Standard Designations to Look For

Four credentials stand out in the business valuation field:

- Accredited Senior Appraiser (ASA): From the American Society of Appraisers. Considered a premier valuation credential.

- Chartered Financial Analyst (CFA): Granted by the CFA Institute. Signals mastery of advanced financial analysis.

- Certified Valuation Analyst (CVA): Granted by the National Association of Certified Valuators and Analysts. Recognized credential for business valuation.

- CPA/ABV: A CPA who is also accredited in business valuation by the AICPA. Combines accounting expertise with valuation specialization.

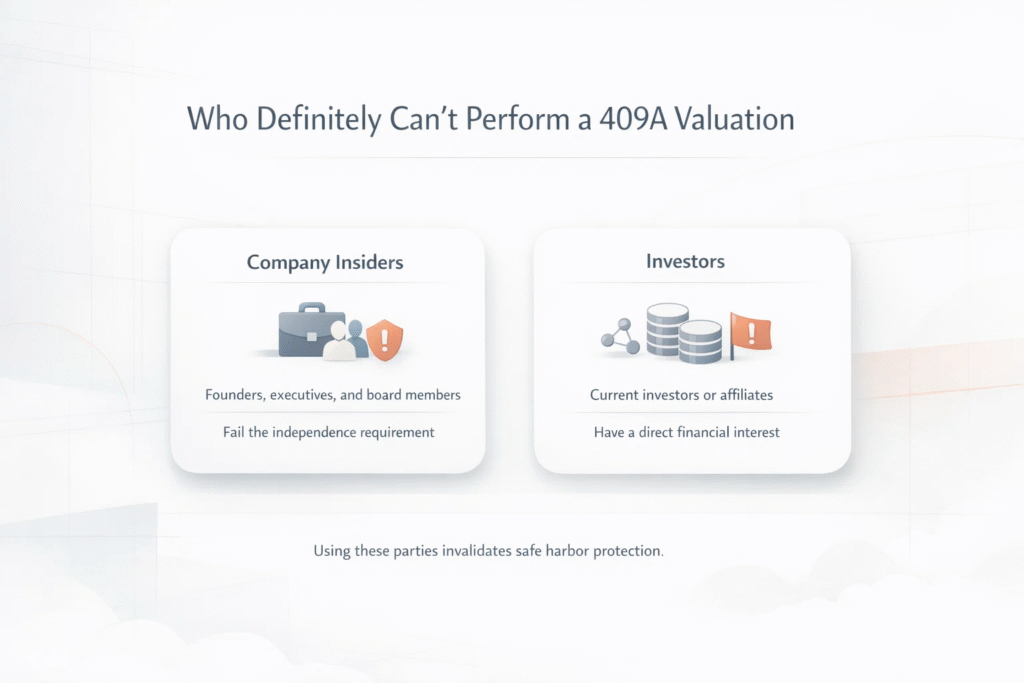

The Red Flag Department: Who Definitely Can’t Do It

Some parties are clearly disqualified. Using them invalidates the safe harbor. It puts your company and employees at immediate risk.

The Obviously Conflicted Parties

These groups have a direct financial interest. Their involvement fails the independence test completely.

- Company Insiders: Founders, executives, and board members cannot perform the valuation.

- Investors: Any current investor, their firm, or their affiliate has a stake in the outcome.

The Complex Independence Case: Your Audit Firm

If your company undergoes financial statement audits, there are important independence considerations regarding your audit firm.

SEC and professional rules prohibit audit firms from providing valuation services to audit clients when the valuation results will be subject to audit procedures. However, these rules provide exceptions for valuations performed for tax purposes or non-financial reporting purposes.

The key question: Will your 409A valuation results be incorporated into your audited financial statements?

For many early-stage companies that don’t yet have audited financials, this isn’t an issue. For companies with audited financial statements, the treatment depends on whether the 409A impacts financial reporting.

To avoid any potential complications, many companies use a separate, independent firm for their 409A valuation, ensuring clear separation between audit and valuation services.

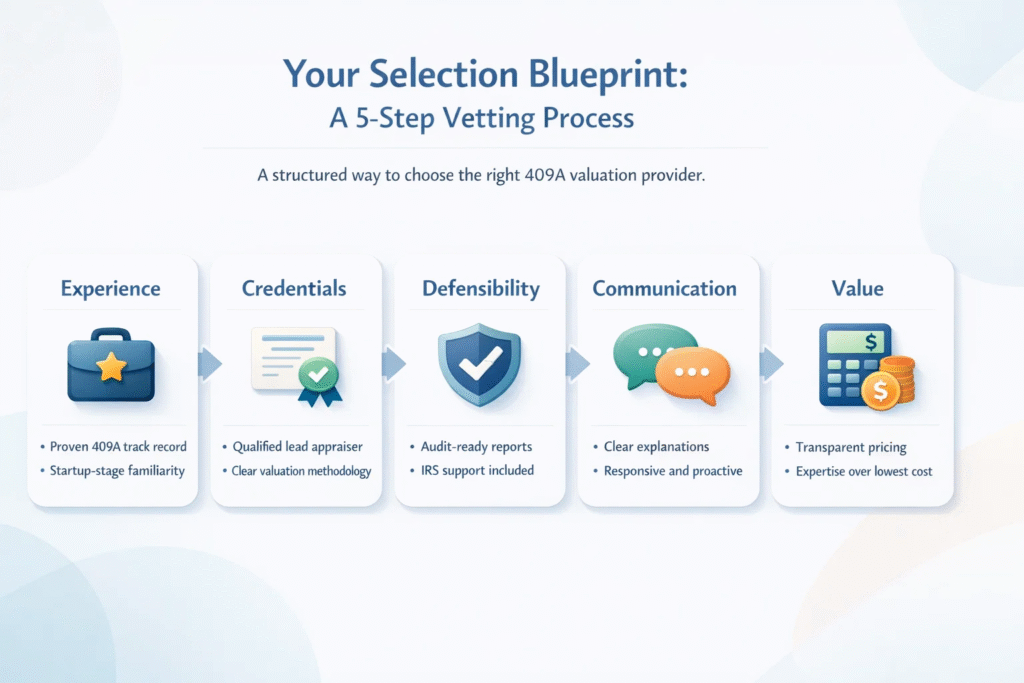

Your Selection Blueprint: A 5-Step Vetting Process

Choosing a valuation provider is a strategic decision. Follow this structured process to make a confident choice.

Step 1: Interrogate Their Experience

Ask pointed questions about their 409A work. Request a redacted sample report.

Gauge their familiarity with your industry and stage.

Step 2: Verify Credentials and Process

Confirm the lead appraiser’s professional designations. Understand their methodology.

Get a clear timeline and data request list.

Step 3: Confirm Defensibility and Support

The report must be audit-ready. Ensure their service includes support if the IRS has questions.

This is non-negotiable.

Step 4: Evaluate Communication and Responsiveness

Schedule a discovery call to assess how they explain complex concepts. A good provider educates you throughout the process.

Test their responsiveness during initial outreach. This previews your ongoing working relationship.

Step 5: Compare Pricing and Value

Get detailed quotes from at least two valuation providers. Understand what’s included beyond the base report.

The cheapest option often costs more later. Balance price with expertise and support quality.

The Founder’s Vetting Checklist

- Number of 409A valuations completed in the last year?

- Can I see a sample report?

- What are the lead appraiser’s credentials?

- What is your specific methodology for startups?

- Do you provide full audit support?

- How responsive are you during the valuation process?

- What’s included in your pricing?

The Cost of Getting It Wrong: Why This Choice Matters

A faulty valuation is not a paperwork error. It triggers serious financial penalties.

The consequences fall on your employees and your company’s reputation.

The Immediate Tax Blow to Your Team

The IRS can reclassify “discounted” options as immediate taxable income. Employees owe income tax on the value they haven’t realized.

They also get hit with a 20% additional penalty and interest.

The Lasting Damage to Your Company

Morale and trust evaporate overnight. Recruiting becomes incredibly hard.

Future investors will spot this governance failure in due diligence. It creates a stain that is difficult to remove.

The Final Decision: Who Can Perform a 409A Valuation?

Selecting your 409A valuation providers is about more than compliance. It is an investment in your team’s trust and your company’s credibility.

Prioritize independence and proven expertise. A defensible valuation provides peace of mind and solidifies your foundation for growth.

This article provides general guidance on 409A valuation requirements. For specific situations, consult with your legal and tax advisors.

You need a partner who knows who can perform a 409A valuation and understands startup finance and IRS rigor. Bookman Capital delivers precisely that.

Our experts create defensible, audit-ready 409A reports that founders and their teams can trust.

Stop gambling with your equity compliance. Contact Bookman Capital at https://bookmancapital.io/contact/ for a direct consultation with our valuation specialists. Let’s secure your foundation.

Sources:

Treasury Regulation § 1.409A-1

Internal Revenue Code 26 U.S.C. § 409A

SEC Final Rule on Auditor Independence (2003)